We’re now into the final weeks of 2023. Christmas is right around the corner.

How many of you are over the Christmas shopping?

I know I am. So much so that our family hasn’t done it for years. In fact, I’ve forgotten when we last bought Christmas presents for each other!

Now, you don’t have to go to such extremes.

But if you’re like me, there comes a point where buying a gift for birthdays, special occasions or weddings becomes increasingly difficult.

This is especially true if it’s someone close to you —a family member or a close friend.

There are only so many gift ideas you can think of before you feel you’ve given them everything they need (and then even things they don’t).

Some then resort to buying an experience — a ticket to a special show, a macaron making course or a photoshoot.

Those are fun and memorable. But after a while, even that novelty will wear off.

So, if you’re running out of ideas, how about a gift that keeps on giving?

Who knows? It could be a most memorable present!

I can remember around 20 years ago when a close family friend gave me a Chinese zodiac silver coin issued by The Perth Mint for my birthday.

At the time, my reaction was that it was a thoughtful gift, a commemorative coin that allows me to remember when I received it.

But I wasn’t familiar about the value of silver. So that was about it.

At least, until I started to appreciate the truth behind gold and silver as money.

Now why is money important?

I’ll come to that later.

Beating the rising cost of living

Most households are feeling the overwhelming burden from the rising cost of living, especially in the last three years.

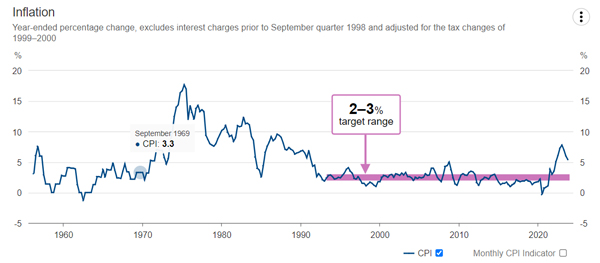

I’ll show you how our Consumer Price Index has changed over the last 70 years, according to the Reserve Bank of Australia:

|

|

| Source: Reserve Bank of Australia |

Notice how our price levels have increased every quarter except for just two quarters? The most recent was in June 2020. Prior to that, we’d have to go back to 1962.

While inflation appears relatively low in the last 30 years, the cumulative effects add up.

To put into context, the average income of a Sydney worker in the 1990s was between $37,000–45,000.

Nowadays, it’s almost $100,000.

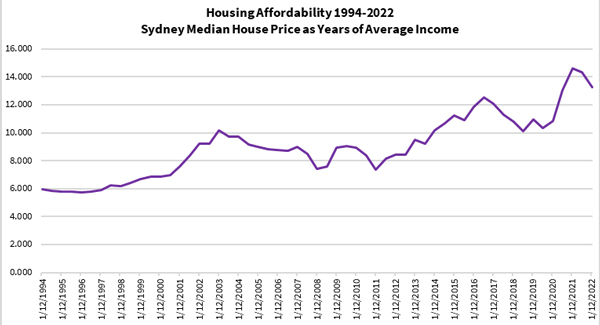

Income may’ve increased, but what the pay cheque buys today is much less than what it used to. Let me show you the relative affordability of a Sydney home below:

|

|

| Source: Refinitiv Eikon, Australian Bureau of Statistics |

You can see how the average Sydney worker needed only six years of income to buy a home back in the 1990s. Today, it’s more than 12 years.

This is why many households are finding it hard to make ends meet. They’ve resorted to having two people work full-time, applying for government benefits to supplement their income and borrowing more.

Those who are under 30 are likely to forget about ever owning their own home before they retire. That’s unless they get a job paying $200,000 a year or they bear much greater risk speculating in the markets.

Put simply, we’ve lost our way.

That’s why it’s important to get back to basics.

A gift that keeps giving

Knowing money from currency will help you stay on course.

Those who have followed my work for some time are aware there’s a distinct difference between money and currency. The notes and coins we hold in our wallet are currency, not money. They gradually lose purchasing power over time.

Not so with money.

By which, of course, I’m talking about gold and silver.

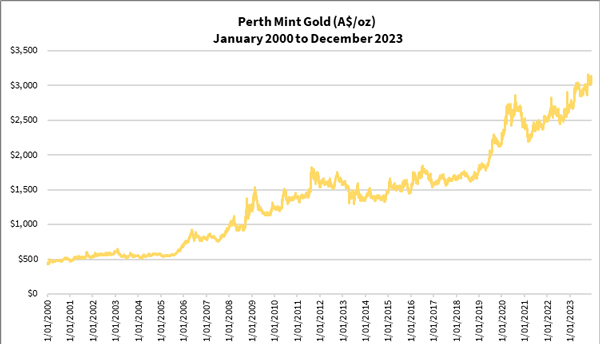

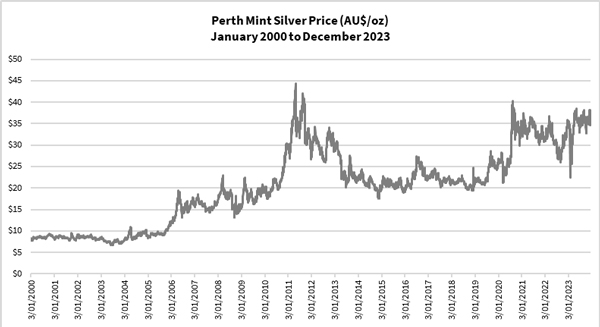

Let’s have a look at how that’s changed since 2000:

|

|

| Source: Refinitiv Eikon |

|

|

| Source: Refinitiv Eikon |

Notice how gold and silver gradually increases in price over time?

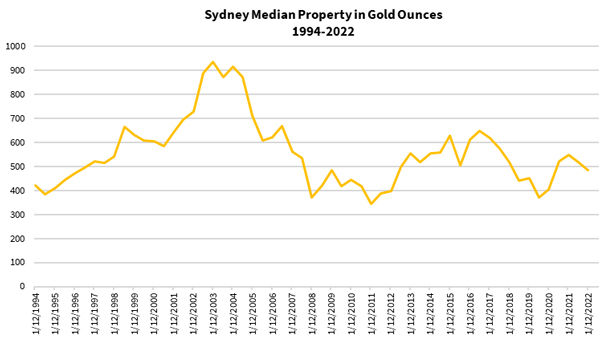

Here’s how gold stacks up with real estate:

|

|

| Source: Refinitiv Eikon, Australian Bureau of Statistics |

If you own gold, home ownership isn’t as out of reach anymore!

Why is this so?

Our currency loses value over time through unrestricted currency creation from decades of financial mismanagement and corruption.

The rate of currency creation has far outpaced the creation of various assets. That’s the power of supply and demand!

So do you expect that governments and those in authority will suddenly change course and steer us back to sanity?

If they do, wake me up. I might look for the sun to rise in the west!

So this Christmas, why not consider giving someone a gift that builds wealth?

Consider a gold or silver coin to introduce your loved ones to the true value of money.

And start them on an educational journey of true wealth building.

My precious metals investment newsletter, The Australian Gold Report, might help with this.

It contains a guide to help you understand the power of precious metals in preserving purchasing power and an introduction to mining stocks to help find opportunities to benefit. It comes with a game plan to help you start a precious metals investment portfolio.

Not only that, I provide regular updates and a quarterly summary report to keep you informed on how our gold mining companies are performing.

Recently, I’ve added an article sharing how I started my journey in building my family wealth with precious metals and mining stocks over 10 years ago.

This happened during one of the most brutal bear markets in gold in recent history. My experience with these challenging times hopefully helps me to better prepare my readers in dealing with the ups and downs of investing in this space.

If you’re already on board with me and like my work, why not share it with someone special who you believe can benefit?

Let this year’s Christmas hopefully change their life for the better.

Click here to find out more.

So let me sign off by wishing you all a Merry Christmas. May you all enjoy this time and be of good cheer!

God bless,

|

Brian Chu,

Editor, Australian Gold Report and Gold Stock Pro