What just happened…?

April 2020 was a blur of spreading infections, rising fatalities, personal lockdowns, and an utterly devastating economic collapse.

It’s one thing to follow the headlines and keep up with the news. It’s quite another to comprehend what just happened and the implications for all of us in the months and years to come.

Even the savviest analysts cannot yet internalise what happened. Wall Street predictions have never been so divergent. Everyday people cannot be blamed for struggling to understand what’s going on.

If the situation makes your head spin, don’t worry — it should. Nothing like what we’re witnessing has ever happened before. Welcome to a new world.

Comparisons to the 2008 crisis or even the 1929 stock market crash that started the Great Depression fail to capture the magnitude of the economic damage of COVID-19.

As Jim Rickards explains below, what we are witnessing is a cascade of complex systems. A pandemic is one complex dynamic system. The economy is another. So, what does it all mean — for investors in particular?

| Until next time, |

| Shae Russell, |

Welcome to the New Depression

|

The impact of COVID-19 on the global economy is unprecedented.

In the US, it’s safe to say the economy will not return to normal for years. Some businesses will never return to normal because they’ll be bankrupt before they are even allowed to reopen.

Before exploring why the economy will take so long to recover (and what this means for investors), allow me to highlight the extent of the economic damage so far.

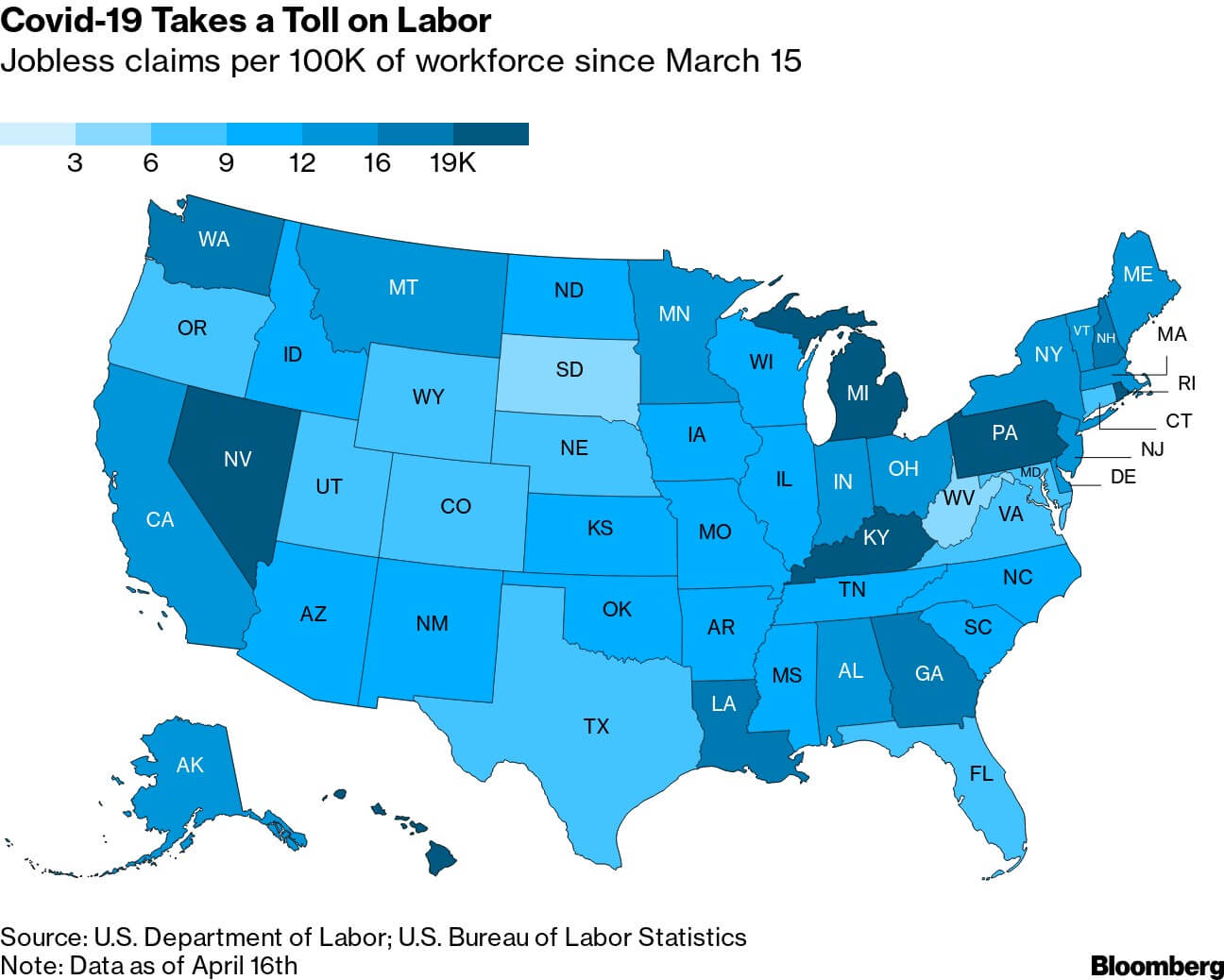

The chart below shows the number of jobless claims since 15 March on a state-by-state basis.

As you can see, no part of the country was spared. Even those states with relatively few unemployment claims still had a significant increase. A nationwide pandemic has played out in the form of a nationwide wave of unemployment.

|

|

| Source: Bloomberg |

I also want to highlight the importance of small- and medium-sized enterprises (SMEs) to the US economy. Many of these businesses are those we visit every day. They include restaurants, bars, pizza parlours, dry cleaners, hair salons, gift shops, and many others.

In an economy focused on large, publicly traded corporations and the stock market, the SMEs are often overlooked as economic contributors. That’s a mistake. SMEs make up 44% of total US GDP and 47% of all jobs. In short, SMEs are almost half the US economy.

This is where many of the job losses, shutdowns, and lost revenues are sourced. This is also the part of the economy that was intended to benefit from the Paycheck Protection Program (PPP) loans.

US debt now in the same category as Greece

The US government response to the economic collapse has been unprecedented in size and scope.

The US has a baseline budget deficit of about US$1 trillion for fiscal year 2020. Congress recently added US$2.2 trillion to that in its first economic bailout bill. A second bailout bill was just passed with an additional US$500 billion in assistance. Another bill is expected in the coming weeks that may add another US$2 trillion to the deficit.

Combining the baseline deficit, enacted legislation, and anticipated legislation brings the fiscal 2020 deficit to US$5.7 trillion. That’s equal to more than 25% of GDP and will push the US debt-to-GDP ratio to as high as 130% once the lost output ($6 trillion annualised) is taken into account.

This puts the US in the same category as Greece, Lebanon, and Japan when it comes to the most heavily indebted countries in the world. The previous record debt for the US was about 120% of GDP at the end of the Second World War.

The Federal Reserve is also printing money at an unprecedented rate. The Fed’s balance sheet is already $6.3 trillion, up from about US$4.5 trillion at the end of QE3 in 2015. The first rescue bill for US$2.2 trillion included $454 billion from a special purpose vehicle (SPV) managed by the US Treasury Department and the Fed.

Plans have already been announced to use that Fed capacity to buy corporate debt, junk bonds, mortgages, US Treasury notes and municipal bonds, and to make direct corporate loans.

Once the Fed is done leveraging up its new capital, its balance sheet will reach US$10 trillion.

So, US$5.7 trillion of new deficit spending and US$5 trillion of new money printing are being thrown at the crisis by the Congress and the Fed.

When investors should jump back in

So far we’ve reviewed what is known. What is not known is how quickly the economy will recover.

Answering that question will determine whether investors should look at jumping back into the stock market or whether they should remain on the sidelines in expectation that the stock market has much further to fall.

The best evidence indicates that the economy will not recover quickly, and an age of low output, high unemployment, and deflation is upon us.

Here’s why the economic recovery will not exhibit the ‘pent-up demand’ and other happy talk traits you hear about on TV.

Jim Rickards warns that a total financial collapse is imminent. Learn how to protect your savings and investments…before it’s too late. Click here now.

The first reason the economic downturn will persist is the lost income for individuals.

Unemployment compensation and PPP loans will only scratch the surface of total lost income from layoffs, pay cuts, reduced hours, business failures, and individuals who are not only unemployed but drop out of the workforce entirely.

In addition to lost wages through layoffs and pay cuts, many other workers will lose contingent pay in the form of tips, bonuses, and commissions.

Even a fully employed waitress or salesperson cannot collect tips or sales commissions if there are no customers to buy meals, goods and services. This illustrates how the economy is tightly linked, so that problems in one sector quickly spread to other sectors.

This lost income will eventually spread to the stock market. Individuals who are unemployed or facing reduced incomes are not inclined to buy stocks. They will be too busy just trying to pay the rent, mortgage, car loans, and credit card bills.

In addition to lost individual income, there is a massive loss of business income. Earnings per share of publicly traded companies will not only decline in the second quarter (and likely the third quarter), but they will be negative.

Lost business income will be another source of lower stock valuations and a source of dividend cuts. Reduced dividends are also a source of lost income for individual stockholders who rely on dividends to pay for their retirements or medical expenses.

Unfortunately, this is just the start…stay tuned for more thoughts on the economic fallout of COVID-19 — and what it means for investors. I’ll explain more this Friday.

| All the best, |

|

| Jim Rickards, |

PS: There’s a reason why financial experts and risk managers use the word ‘contagion’ to describe a financial panic. Remember the 2008 crisis?

That was triggered by some credit swap dealers by a subsidiary of AIG in a dingy office in London…yet those decisions impacted the global banking system…until the entire world is in the grip of a financial panic, as happened in 2008. Could coronavirus be the final tipping point?

Comments