Let me start by wishing you a happy financial year! May this year be rewarding for you in more ways than one.

Many of you would’ve ridden the financial rollercoaster during the last financial year. It started amid what might’ve been the most aggressive rate rise cycle in the last 50 years — at least in Australia, the Eurozone, and the US.

While most stock market indices rose over the past year, looking at individual company performance, that wasn’t the case. For a few months this year, the indices only rose because the biggest companies dragged them up. The vast majority of the constituents fell by the wayside.

Those invested in commodity stocks had it tough as they were all over the place. Almost every commodity went through some turbulence — gold, copper, coal, iron ore, crude oil, uranium, etc. Even lithium and rare earth elements (REE), promoted as hot commodities for the Green Agenda, didn’t escape this.

I’m sure over the course of the year, you’d wonder why the Green Agenda — which, ironically, will cause mining activity to ramp up — didn’t result in a mining boom and deliver easy profits to those who participated.

Let me try to shed some light on this puzzle.

Unprecedented challenges for mining operations in the past year

The past year saw many mining companies slowly emerge from what may have been the most challenging operating environment for many decades, thanks to government restrictions in light of the lockdowns implemented worldwide. As that happened, the price of oil surged off the back of sanctions by many of the G7 nations against Russia in the wake of the Russia-Ukraine conflict that started last February.

It was like having a rough night, only to get out of bed and smash your face into the bedside cabinet as you try to nurse your stubbed toe.

That’s what many mining companies experienced. I read many quarterly reports where management spoke of how production levels fell as costs rose, caused by mining disruptions, various delays in achieving planned output, or budget blowouts in light of inflation and labour shortages.

It was a case of whoever faced the least disruptions were the winners.

Weak stock performance and sentiment spells opportunities

I hope this has placated any doubts you may’ve had about your investment ability if your investment returns last year were disappointing.

Let me focus on gold stocks, in particular, as they had a rough ride.

On the bright side, the ASX Gold Index [ASX:XGD] delivered 37% and completely shot the lights out relative to the US counterparts, VanEck Vectors Gold Miners Index [NYSE:GDX], which rose 8.6% over the same period, while the VanEck Vectors Junior Gold Miners Index [NYSE:GDXJ] rose just 7.9%.

Unfortunately, however, those invested in the more speculative end of town — such as explorers and early-stage developers — endured losses as market sentiment dried up in May 2023.

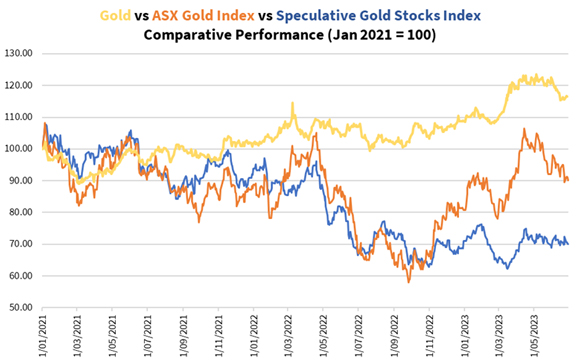

Let me show you how the relative performance of gold, the larger gold producers (represented by the ASX Gold Index) and the smaller gold explorers (represented by my own Speculative Gold Stocks Index) have performed since 2021:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

The bull market for gold producers that started in late September 2022 is still in play — make no mistake about that.

But the correction we’ve experienced since mid-April has taken the wind out of the sails and may have left a sour note for many.

And those who decided to go full contrarian buying the smaller explorers are currently likely to be in a state of despair.

However, this is just the type of market that is the author of the biggest winners. That’s if one chooses to take the risk.

If history is any indicator…

In fact, I woke up last Friday morning to find that the price of gold dipped from US$1,910 to US$1,892 an ounce as the market opened over in the US and quickly jumped back to around US$1,910 within an hour. Let me show you the figure below:

|

|

| Source: Kitco.com |

In trader’s terms, this was a doji pattern, implying a market capitulation. What could follow from this is a solid rally.

When I first embarked on my journey with investing in gold stocks in mid-2013, I did so during one of the most brutal bear markets.

I remember the final week of June 2013 saw some heavy selling of gold stocks. The setup for the price of gold looked horrendous.

But on the final trading day of June, there was a similar doji pattern with the price of gold. One of my friends, who is well-versed in technical analysis, told me gold was likely primed for a bounce after this.

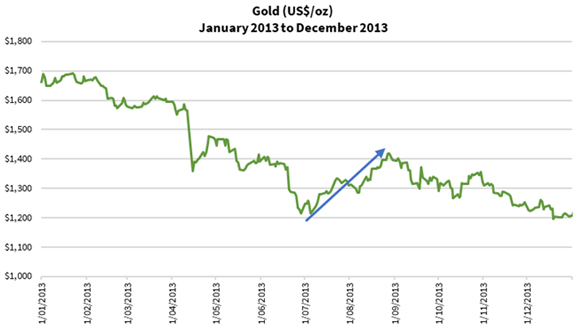

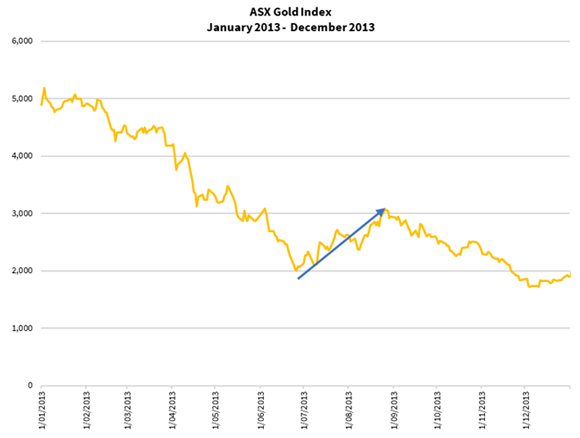

Let me show you what happened with the price of gold and the ASX Gold Index in the next two months:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

|

|

| Source: Thomson Reuters Refinitiv Datastream |

The price of gold recovered by 15% in two months, and the ASX Gold Index rose by 50%.

Sure, that recovery didn’t last long, and the bear market dragged on until December 2014.

It was different then because the Federal Reserve had more headroom to control the economy and inflation, thereby holding gold down. This time, the world is weighed down by more debt, so it’s harder to repeat this feat.

Could this provide us with another period of gold rising and the price of crude oil falling due to a global recession?

Should that happen, the tide will float all the boats in this space, especially the gold explorers that have been unloved for so long.

If you share this sentiment with me, then it’s time to act.

Should you be interested in the more established gold producers and buying bullion to protect your wealth, let me help you via my investment service, The Australian Gold Report.

Those who want to try their luck speculating in gold explorers, head over to my premium service Gold Stock Pro for a chance to make life-changing gains in the coming gold bull market.

Alternatively, if you’re willing to broaden your investments beyond the commodities sector — for it’s always good to diversify — read on below for Fat Tail’s latest take on steady-income stocks. Enjoy!

God bless,

|

Brian Chu,

Editor, Fat Tail Commodities

Comments