How much has changed in a week!

Prior to the SVB (Silicon Valley Bank) collapse a few days ago, the road ahead seemed pretty clear.

More rate rises to combat inflation, and more pain for property owners and purchasers.

Every buyer I’ve had on the books since the RBA started its rate hiking cycle mid last year has been a cautious one — budgeting carefully for future increases.

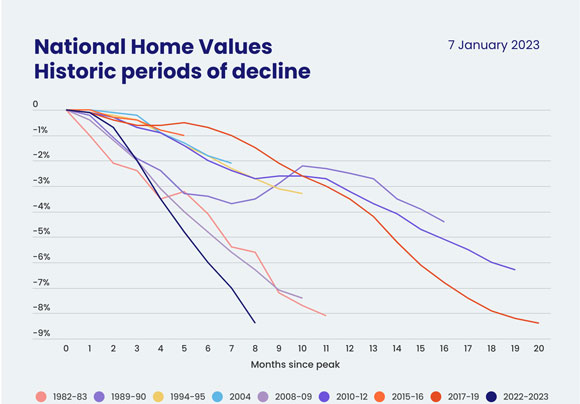

By January this year, median prices had experienced the largest and fastest annual decline on record due to it.

|

|

| Source: CoreLogic |

However, it’s all about to change.

And with that, the property market is undoubtedly in for a U-turn.

If so, it threatens to put a light under the market as we transit into the ‘winnercurse’ phase of the cycle between 2024–26 — exactly as we would expect as we run into the peak.

As I wrote earlier this week in Land Cycle Investor, shifts in both monetary and regulatory in response to the banking panic in the US are inevitable.

From the Financial Times…

‘Investors have rapidly increased bets that the Federal Reserve will cut US interest rates this year in a frenzied day of trading that strained the functioning of markets.

‘The turbulence was such that the main US futures exchange temporarily halted trading in certain interest rate contracts…

‘The market moves on Wednesday came a week before the Fed is scheduled to decide on interest rate levels at its next monetary policy meeting after months of increases in the past year.

‘Many bond traders now expect the Fed will not raise rates though some still see a chance of a 0.25 percentage-point increase as it battles stubborn inflation, according to pricing in futures markets.’

We might be in Australia, but the US economy leads the 18.6-year cycle — and movements in the Aussie stock and property markets generally correlate to its lead.

Therefore, we look toward it for changes in trend — and that’s now occurring.

To give an example, US median property values have historically peaked prior to the Australian market peak at the end of the cycle.

For example, in the last cycle, they peaked in 2006. The Australian median dwelling value, however, peaked in 2008.

In the previous cycle before this, the US market peaked in 1989, while the Australian market peaked approximately one year later in 1990.

You can trace the pattern back further, and therefore, we’d could expect it to repeat in this cycle also.

Time will tell.

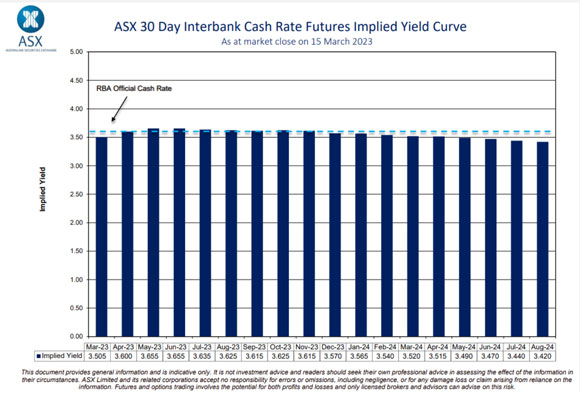

But, needless to say, RBA rate futures are now also pricing in cuts.

|

|

| Source: ASX |

From Pete Wargent’s daily blog…

‘There have been some absolutely face-ripping moves in bonds over the past week, to the extent that markets think the rate hike cycle in Australia is now over and done with.’

|

|

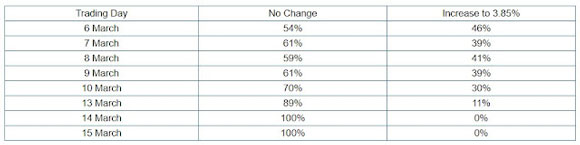

| Source: Pete Wargent |

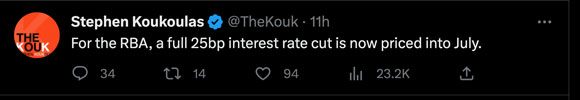

Then this from Stephen ‘The Kouk’ Koukoulas, whom we interviewed last week…

|

|

| Source: Twitter |

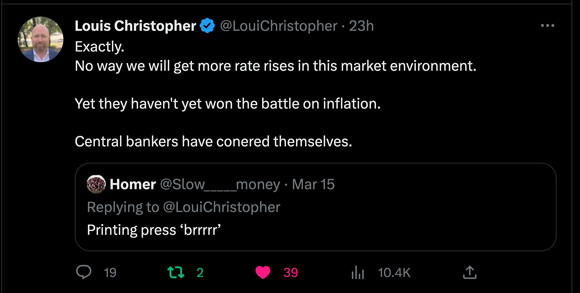

And this from SQM Research Founder Louis Christopher…

|

|

| Source: Twitter |

What does this mean for the property market?

We’ve already seen the seeds of a turn.

There was a sharp reduction in the rate of decline in CoreLogic’s home value index through February — the smallest monthly fall since May 2022 (-0.13%), when rate hikes commenced.

That trend is continuing through March.

Midway through the month, and it looks like the market has found its plateau with a moderate turn underway.

Sydney +0.5%

Melbourne +0.1%

Brisbane 0.0%

Adelaide -0.2%

Perth +0.2%

Five cities +0.3%

It won’t please the bears, but if you understand the cycle, you’d have been looking for it.

We’re certainly not facing recession.

In February, the number of unemployed people in Australia decreased to 3.5%, and the economy gained an estimated 65,000 jobs.

More Australians are now employed or looking for work, and they are also working more hours.

Additionally, the rate of underemployment has decreased by almost 3% since before the pandemic, which means more people are now fully employed.

In other words, the labour market is in good shape, which is one reason the housing market is showing resilience.

Also, according to Westpac, more than 400,000 people migrated to Australia last year.

That’s a lot! A record high, in fact.

This influx of migrants is flowing into bigger cities, particularly Sydney and Melbourne.

Migrants are renters before becoming buyers.

In other words, the surge in demand in the rental markets against vacancy rates at record lows puts an unprecedented strain on supply/demand dynamics.

‘Rental vacancy rates across Australia have plunged by half since the start of the Covid pandemic, showing just how severe the housing crisis is.

‘The latest PropTrack data reveals how surging demand from tenants is far outstripping the supply of dwellings in most capital city areas.

‘Perth has the most constrained rental market in the country, with a vacancy rate of just 0.85%, followed closely by Adelaide on 0.92%.

‘Conditions are very tight in the three major cities — Sydney’s rental vacancy rate is 1.7%, Melbourne’s is 1.4%, and Brisbane’s is 1.3%.

‘Things are particularly dire in Perth, where the rental vacancy rate has slumped by a staggering 69% since pre-Covid.’

And if all the above isn’t enough to promise a turn in trend sooner rather than later — we get news that Anthony Albanese is going to open the borders to a potential flood of Indian migrants!

Moves that would see the government give Indian qualifications the same status as Australian qualifications, thereby allowing migrants to compete on the same terms in the job market.

From MacroBusiness…

‘Prime Minister Anthony Albanese will make it easier for Indians to work or study in Australia after last week signing an agreement with counterpart Narendra Modi to expand immigration…

‘Anthony Albanese announced he would expand Australia’s visa processing capability “to enhance the immigration relationship”…

‘This followed the signing earlier in the week of the Mechanism for Mutual Recognition of Qualifications so that “Indian qualifications will be recognised in Australia”…

‘Australia is required to deem Indian vocational and university graduates to be “holding the comparable AQF qualification for the purposes of admission to higher education”.

‘Most importantly, “the Government of Australia will deem graduates with the qualifications listed in paragraph 12 [directly above] to be holding comparable Australian qualifications for the purposes of general employment, where such qualifications are required”.

‘So basically, Indian vocational and university graduates will now be allowed to work in Australia on the same terms as local graduates….

‘In turn, Anthony Albanese has rubber stamped a tsunami of migrant arrivals from India that will further suppress wage growth and exacerbate infrastructure and housing strains across Australia.’

I’ll be interviewing Leith Van Onselen from MacroBusiness next week to drill into the details further and discuss the potential for a bull in property markets through 2024/5.

Assuming we don’t see further rate rises in the months ahead, it’s all but baked in.

And if prices do take off — and push established property values higher than replacement costs. A building boom will inevitably follow.

If you’re looking for opportunities in the stock market in the run-up to the peak, we would expect banking and construction/materials to perform well as we transit through the last phase of this 18.6-year cycle.

Best Wishes,

|

Catherine Cashmore,

Editor, Land Cycle Investor