July is always a handy month when it comes to trading the market.

It’s because so many firms released their quarterly results.

These can be handy guideposts, both in terms of what the companies say…and how the market reacts.

Earlier in the week I alluded to the fact that lithium firms are in the ‘buy zone’, as my colleague Murray Dawes might say.

As it happens, the flagbearer for the sector, Pilbara Minerals ($PLS), put out their latest announcement yesterday.

What did they say?

Quarterly production, sales and revenue were all up. Costs were down too. They managed to hit their forecasts on various metrics for the last financial year.

That said, after all costs, the cash balance for the company went down.

The stock finished the day up 3%. It’s up 25% for the month.,

Check out the chart…

| |

| Source: Market Index |

You can see that PLS looks to be forming the start of a new uptrend.

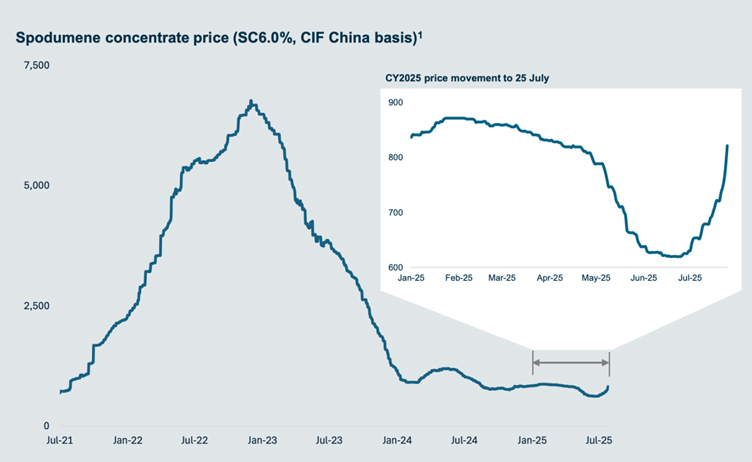

However, it’s not something I expect to blast off like a firecracker. Lithium pricing is still down in the dumps, as we can see off this chart from the PLS slide deck…

| |

| Source: PLS |

The recent rally in lithium names has come from an uptick in the spodumene price. But we’re still a long way from the boom days.

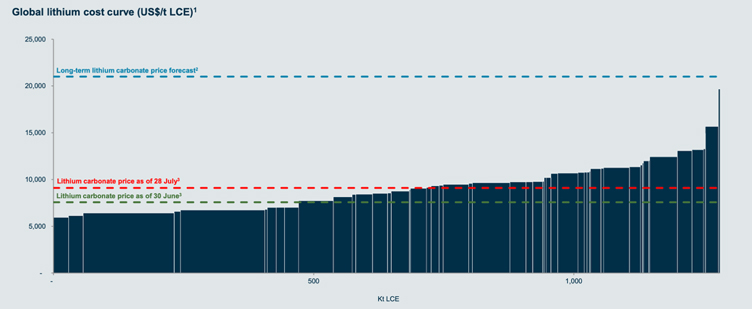

PLS also shared this chart which shows that this current price is unsustainable for much of the lithium industry.

| |

| Source: PLS |

If you can take the long term view, PLS looks like a good counter cynical opportunity here.

The CEO bought $1 million in shares recently too. That’s a vote of confidence if I’ve ever seen one.

Right now, there is an opportunity to scoop up lithium assets that are 50-90% down off their highs.

Lithium has been down in the dumps for 2 years.

The lithium bear market we’ve been in since 2023 is a cyclical slump in a structural bull market.

We see this all the time in commodity markets.

For example, the lithium sector soared from 2015 to 2017 before collapsing in 2018…only to start soaring in 2020 again.

Lithium is still a small, niche market relative to the massive resource markets like oil, coal and iron ore.

Volatility comes when you have a smaller range of buyers and sellers, and even possible market manipulation. China dominates the battery supply chain too.

Even so, that kind of thing can only work for so long before fundamentals bear out.

I can tell you one thing from experience.

The time to get interested in commodities is during a down (bear) phase.

Why? This is when all the heat, enthusiasm and overblown expectations are smashed out of prices.

Even better, you can pick up assets and projects that are, at least in part, already paid for.

We’ve seen all the classic signs of a bear market in the lithium sector:

- Mine shutdowns

- Production slowdowns

- Investment deferrals

- Price weakness

- Sentiment crash

- No IPOs, or capital raisings

- Mining juniors switching away to hotter markets, like gold

You run toward this type of situation when it happens – if the potential pay off is big enough. I think we’re in this rich buying zone now with lithium.

We did a similar and successful call like this here at my service Australian Small Cap Investigator on gold in 2022.

It led us to a 164% return in Spartan Resources ($SPR) in under 12 months, and a 60% return in Bellevue Gold ($BGL) in about half a year back in 2022.

Now we’re going to try and do something similar with lithium.

If the world auto and energy systems are going to run on batteries, that means they’re going to run on lithium. As yet there’s no viable alternative, at scale.

Demand for lithium is already up 5x since 2020. It could go up 400% more by 2040, and possibly a lot more.

A man they call “Mr Lithium”, Joe Lowry, puts it like this:

“It is easy to let the current negativity cloud your thinking. The longer term fundamentals remain intact.

“The still immature lithium market gyrates on relatively small under & over supply situations. The last eight years prove it.

“Even in a battery & EV market dominated by China, low cost producers still win in the end.”

If this sounds of interest to you, don’t forget to tune into my colleague, geologist James Cooper, on the opportunities in lithium…and the whole resource sector.

Best Wishes,

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

***

Murray’s Chart of the Day –

US Dollar Index

Source: Tradingview.com

Yesterday I pointed out the fact the Euro was starting to sell off after the tariff deal was announced at the start of the week.

Overnight saw another sharp drop in the Euro and a leap in the US Dollar Index [TSV:DXY].

I have recently been saying that if we saw the US Dollar heading below the recent low near 96.00 we could see another wave of selling.

That possibility has switched off for now.

You can see in the chart above when the weekly MACD momentum indicator in the bottom window turned positive after a period of weakness (the orange circles).

Even though we may see more downside again in the near future, while the momentum is positive on the weekly MACD we have to be aware that a larger rally could occur.

You can also see that the US Dollar Index got quite close to the buy zone and has seen quite a sharp fall over the past six months, so we shouldn’t be surprised to see a recovery bounce.

The strength of the US dollar is rippling through the commodity sector with gold, silver and platinum falling heavily overnight.

Copper also saw a huge fall of 20% after Trump announced that the 50% tariffs would apply to downstream copper products rather than copper itself.

Now that the tariff deals are getting wrapped up and investors can consider their ramifications, a strong US dollar might be the outcome few expected.

Regards,

Murray Dawes,

Editor, Retirement Trader

Comments