Mineral explorer 29Metals [ASX:29M] released its quarterly report for December 2022, claiming its full-year guidance was either met or exceeded in metals production.

The miner declared ‘excellent zinc production’ with solid production and performance noted across operations, including 22 kt of zinc and 8 kt of copper.

The 29M share price was moving slightly down by noon on Tuesday, worth $2.04 at time of writing.

The share value for the mineral mining stock has flunked 28% in the last full year, down 32% in the wider market 12-month average.

Meanwhile, fellow minerals miner, Arrow Minerals [ASX:AMD], has entered into a trading halt as the ASX investigates its 50% leap in share price.

Source: TradingView

29M’s December quarter

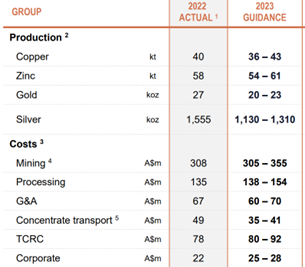

The metals miner reported 8.0 kt copper was produced in the December quarter, though down on previous quarters, this added to its meeting guidance of 39–46 kt, with a full year total of 40.8 kt copper delivered.

Zinc, likewise, hit guidance of 55–65 kt, with 57.6 kt reached for the 2022 year, and December’s quarter producing the most of all quarters with 22.0 kt.

Gold produced 8.1 kt in the December quarter, 26.6 koz in the full year, and at the high-end of guidance (23–27 koz).

Silver production also topped all quarters with 532 koz, 1,555 koz for the full year, exceeding guidance of 1,250–1,500 koz.

29Metals reported $208.9 million in gross revenue for the December quarter, adding to the 2022 total of $798.9 million in total gross revenue.

29M’s unaudited cash balance as at 31 December was $172 million, down from 30 September’s total of $189 million.

The company’s debt included a principal repayment of US$6 million for its term loan facility, and unaudited debt by the end of the quarter was US$138 million (down from US$144 million in September).

‘A strong finish to a year which provided a challenging backdrop across the sector, especially in the first half’, commented 29M CEO Peter Albert.

‘Despite challenges, we met or did better than our guidance for production, costs and capital for the year.

‘2022 production ended strongly as expected. Zinc production was a particular highlight, with Golden Grove producing 22kt of zinc for the quarter on the back of the higher-grade material coming through.

‘Costs management generally remained positive, with the increase in site costs in line with activity, combined with the impact of continuing inflationary pressures being felt across the sector. C1 Costs benefitted from strong by-product production and sales in the quarter, with reported unit costs adversely affected by lower copper sales for the period.’

A mixed outlook for 2023

29M appears optimistic for what will transpire in 2023, though expects copper to be broadly flat year-on-year, with milling rate constraints set in the near-term — a sentiment mirrored for the group’s precious metals segment.

‘Looking ahead to 2023, we are encouraged by the recent uplift in metal prices’, said Albert.

‘The mid-to-long term outlook for copper and zinc is incredibly positive. 29Metals is in the right space at the right time.’

The group expects mining and processing costs to align with planned activities, despite inflationary pressure.

Transport costs are expected to lower, shipping rates are to improve, and 29M expects to grow its capital with long-term investments expanding production capacity:

Source: 29M

Australia’s next commodity boom

Our resources expert and trained geologist, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

James is convinced ‘the gears are in motion for another multi-year boom in commodities’…a boom where Australia and its stocks stand to benefit.

You can learn more AND access an exclusive video on his personalised ‘attack plan’ right here.

You’d be sorry you missed it!

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia