I’m pumped!

In December, I recommended my subscribers buy Maas Group Holdings [ASX:MGH].

Here’s a snippet of what I said at the time:

‘Now’s your chance to back a gun entrepreneur at a great price.

‘Don’t forget, Maas is still cashed up from that capital raising. More exciting deals could be coming.

‘I know, I know…the current bear market is boring, dispiriting, and off-putting.

‘But you must see the opportunity for what it is…a bargain-hunting one!’

Here we are in February.

We can see now that comment was bang on!

How?

Last week, Maas Group confirmed it was back on track after a tough year in 2022. It’s all set to cash in on Australia’s booming infrastructure spending.

Any subscriber that acted on this is now up nearly 25% in less than three months.

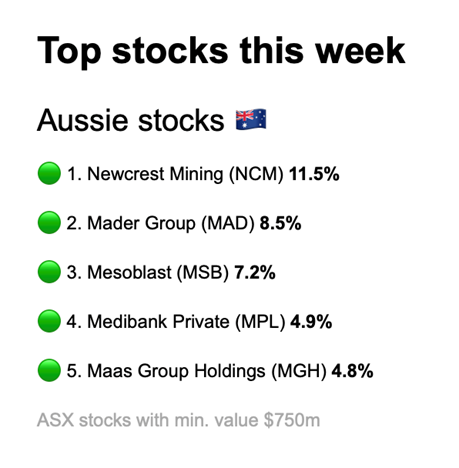

Maas even snuck into the top five winners on the share market for the week.

Check it out:

|

|

| Source: Selfwealth |

I have good news.

There are still loads of cheap stocks on the ASX with great potential to spring back in the same way.

Here are another five bargain ideas I strongly suggest you consider right now.

You’ll also need to do something else…

Put Wednesday down in your calendar as important.

That’s when Commonwealth Bank [ASX:CBA] tells us how many billions it’s raked in and how the average Aussie borrower is coping with life.

It’s going to be a ‘bumper’ profit, say analysts cited in the Australian Financial Review. Dividends could be 17% higher over the full financial year too.

The market knew this was coming a while back. That’s why the share price pushed up to new highs.

What investors can’t anticipate exactly is the current outlook.

The market will be keen for guidance on any rise in bad debts as higher interest rates really kick in.

I wonder if CBA will surprise everyone with how low loans in distress remain. Aussies are apparently doing everything except worrying about spending money.

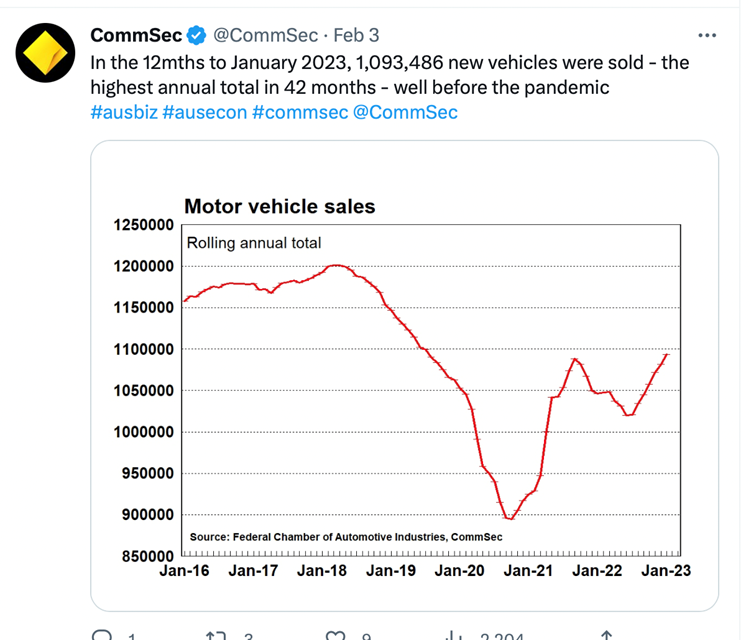

We’ve seen ripping results from the retail sector. And check out this recent graph of car sales:

|

|

| Source: CommSec |

Such a chart is just not consistent with an impending recession…and neither is CBA trading around a record high.

That’s why I still advise the same game plan as I’ve been saying since late last year: grabbing cheap shares with gusto!

We can see it working right in front of us too. See my introductory point about Maas Group.

I know. I know. All the mainstream press does is hammer us with how rising rates will wreck the economy and the housing market.

Beware: The market has now largely ‘discounted’ the rise in interest rates. It’s built into prices. That’s why 2022 was such a rough ride for a bit!

It’s where we go from here that matters.

What we want to see is inflationary pressure cooling off.

We’re getting that, in part, from coal all of a sudden.

See this report from Friday:

‘Newcastle coal futures tumbled 6 per cent overnight to US$225.50 per tonne amid reports that embattled coal developer Adani is offering discounted volumes.

‘Prices have halved from a record high around $US450 in September as Russia’s war in Ukraine fuelled a comeback for coal.’

That burnt Aussie coal producers on the ASX last week. Pun intended!

But it can’t be anything but good news for China and India, who still rely so much on coal power. What’s good for them is good for global growth.

That, in turn, may help discretionary spending feedback to Australia in other ways and industries, such as wine.

We’re not quite there yet, but there are reports that Chinese authorities are considering removing the punitive tariffs on Australian wine.

Point being: there’s good news out there if you look for it.

Another case in point: It’s also possible the housing market is beginning to stabilise. Mirvac [ASX:MGR] and REA Group [ASX:REA] came out with their results last week.

Both see lots of buyer demand temporarily sidelined from the uncertainty around interest rates, not the actual level.

In general, I think it’s fair to say that the share market goes along with the vibe both REA Group and Mirvac have put out.

Why?

Their share prices held roughly steady.

If the market were stunned or scared, their prices would’ve tanked. They didn’t.

The housing market also has roaring rental growth currently, and tiny vacancies. This sets the stage for investors to load up in a big way.

Now…what will confidence be like if house prices stop falling? Pretty good, I reckon.

Shares look primed to continue to rebound in 2023 to me.

Regards,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: My colleague Jim Rickards is a cracking macro analyst of the global forces that drive the world economy up and down. I’m excited to see his latest book is now finished. Stay tuned to see how to grab your copy this week!