In my previous life, I was a financial advisor helping clients construct investment portfolios.

The basic theory behind portfolio construction is to diversify into different asset classes (stocks, bonds, property, cash, etc) in a ‘smart’ way that makes sense to the investor’s risk tolerance.

It all boils down to risk and return.

Or more accurately, what asset mix gives you the best chance of achieving your desired rate of return for the least amount of risk (volatility) possible.

This is the fundamental aim of portfolio construction.

Not many ordinary investors fully appreciate this point about investing. They focus only on the returns made.

However, professionals understand that your returns are only one side of the equation.

After all, anyone can take a huge punt on a speculative idea and get lucky.

But that doesn’t mean you didn’t take a heck of a lot of risk at the time.

Anyway, I’ve always kept that thinking in the back of my mind as I’ve recommended cryptocurrencies over the years.

Making sure you allocate smartly, and understand the risks you face has been a clear goal of mine.

But here’s the thing…

My estimations for an ideal allocation to Bitcoin have maybe been a bit too conservative!

Let me explain why…

The Industry’s Preferred Number

The big question…

How does the investing industry optimise the risk-adjusted returns on a portfolio?

The industry-standard is a metric called the Sharpe ratio.

It’s been around since 1966 but I won’t go too deep into the reeds of how it works.

Just understand it’s how all the major asset managers — like super funds — still create portfolios today.

As Investopedia explains:

‘The ratio is particularly valuable in comparing different investment opportunities or portfolios, as it allows investors to make more informed decisions by considering both returns and risk.

‘The Sharpe Ratio calculates the excess return of an investment above the risk-free rate, meaning you can analyze beyond just the total return.

‘A higher Sharpe Ratio indicates a better risk-adjusted performance. This means an investment is generating more return for each unit of risk taken.’

As a new asset class, we’re starting to see Bitcoin being added to investment portfolios.

As we reported recently, Fidelity Canada has added it to their ‘All-In-One’ ETF portfolios.

Depending on the investor’s risk profile, they’ve allocated between 1% and 3% of the total portfolio to Bitcoin.

But this as it turns out, ‘toe in the water’ approach isn’t the optimal percentage fund managers will eventually get to, according to a recent study.

Andre Dragosch, a PhD in financial history and Head of Research at the German-based ETC Group put out a report that put this number at 14%.

14%!!!

He stated:

‘Think most are still not bullish enough.

‘Optimal Bitcoin allocation which maximises Sharpe Ratio in a 60/40 stock-bond portfolio appears to be around 14%.

‘So, allocations will ultimately converge towards that number…’

The report studied the effect of adding Bitcoin to a typical 60/40 (60% equities, 40% bonds) portfolio using figures from 2010 through to today.

To be clear here…

14% is the figure that historically provides the best Sharpe Ratio — the metric almost all portfolio managers aim to optimise!

The takeaway from this?

If that figure is even half correct, portfolio managers who under allocate to Bitcoin will dramatically underperform relative to their peers.

In other words, NOT adding enough Bitcoin to a portfolio in the future could be career suicide!

The kicker?

While this has been true for a while, the new era of the Bitcoin spot ETF has now placed Bitcoin for the first time within the universe of the entire investment industry.

When you realise all this, it’s no wonder these ETFs are breaking records…

Best Ever Launch

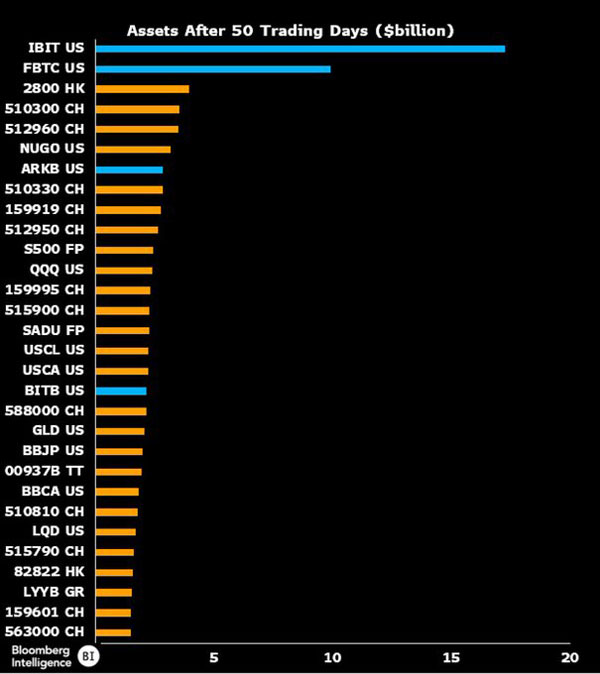

Check out this chart:

| |

| Source: Bloomberg Intelligence |

It shows that the Blackrock and Fidelity Bitcoin ETFs have accumulated more assets in the first 50 days than any ETF ever launched!

This is simply stunning and shows there’s a real race on to acquire Bitcoin while it’s still cheap.

It also goes to show the latent pent up demand for Bitcoin that existed in traditional markets.

And it now seems other countries are trying to play catch up.

In the UK, the London Stock Exchange just announced the trading of Bitcoin and Ethereum Exchange Traded Notes (ETNs) starting on 28 May.

These ETNs are slightly different than ETFs (you can read more here) and will only be available to professional investors (I’d be livid about this if I lived in the UK).

But it’s the first step in playing catch-up, and UK funds will have access to it.

The addition of an Ethereum ETN is something new too, especially as it seems a US Ethereum spot ETF may be delayed.

Elsewhere…

Big news out of Hong Kong suggests the Chinese authorities are ready to approve their own Bitcoin spot ETFs very soon.

Amazingly, these new ETFs go one step further than the US ones.

You see, they are set to approve an ‘in-kind’ model.

This means you can use Bitcoin to buy into an ETF.

But more importantly, if you want to withdraw your Bitcoin from an ETF, you can have them send your BTC to your own address.

The US ETFs don’t allow this yet and instead operate on a ‘cash basis’ (though I reckon this will be challenged at a later time).

The advantages of the Hong Kong model for investors are two-fold.

First, it comes with some tax advantages as you don’t need to sell the underlying asset when you withdraw.

Secondly, the ability to withdraw your BTC to self-custody if you choose offers an immense layer of transparency.

A fund manager can’t do dodgy shenanigans on the Bitcoin it holds, if it knows investors can withdraw it at any time.

This is a big advantage Bitcoin has over gold stored away in secret vaults — you never know how much gold there is to back everyones claims to it.

Anyway, the point is these new funds are going to attract even more demand for Bitcoin!

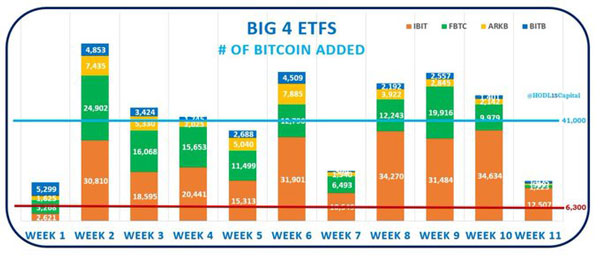

Check out this graphic to see why matters:

| |

| Source: HODL15 Capital |

This chart shows the number of Bitcoin purachsed each week by the four biggest US Bitcoin ETFs (the blue line is the average so far).

The red line shows the amount of new Bitcoin mined each week.

As you can see, there’s a gaping chasm between the supply of new Bitocin and the demand for Bitcoin from the US ETFs alone.

I ask you this…

What happens when the UK and Hong Kong funds start piling in too!?

And what happens when the supply of new Bitcoin gets cut in half around the 20 April 2024?

We could be in for a very big 2024…

Speak soon…

Good investing,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader