At time of writing the Zip Co Ltd [ASX:Z1P] share price is trading at $6.32, up 5.69%.

Zip Co recently announced their results for Q2 2021, with the company having strong growth both in Australia and the US, marking its place as one of the fastest-growing ‘buy now, pay later’ (BNPL) providers.

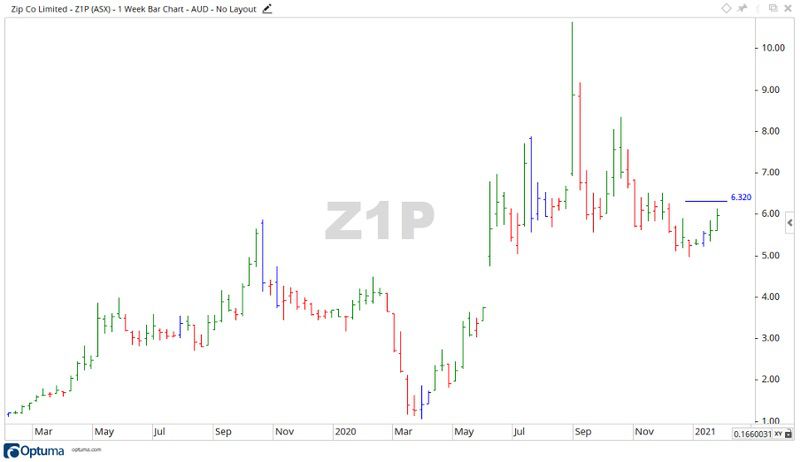

Source: Optuma

Zip Co and 2020

2020 provided a perfect set of conditions for BNPL providers.

The drastic events of the year that unfolded as the COVID-19 pandemic swept the world gave rise to more and more people using BNPL services.

As the virus covered the globe, it proved to be very contagious and transmittable through air.

To stop people breathing all over each other, governments around the world instituted lockdown orders, forcing people to stay home.

The knock-on effect was people doing more shopping and spending from home. This saw a lot of online retailers experience a boost in their online users.

The same thing took place in the BNPL sector.

Zip Co benefited handsomely from this — in Australia the company recorded:

- Record group quarterly revenue of $102.0 million

- BNPL December revenue $40.2 million (up 94% YoY)

- Record quarterly transaction volume of $1.6 billion (up 103% YoY)

- Customer numbers increased to 5.7 million, up 97% YoY

- Merchants on the platform increased to 38.5k (up 73% YoY)

Across the pond in the US the company operates Quadpay, whose results were just as, if not more impressive:

- Transaction volume for Q2 FY21 increased 217% YoY to US$518.4 million (AU$673.1 million)

- December transaction volumes exceeded November by 7.5%, even with the sales lift from Black Friday and Cyber Monday in November

- Annualised transaction volume of US$2.5 billion (AU$3.3 billion)

- Revenue as a percentage of transaction volume remains extremely healthy at over 7%

- 915k customers joined the platform in the quarter, with the app downloaded 1.8 million times

The Zip Co Share Price and the Outlook for 2021

The growth of the BNPL sector through 2020 looked to come off the back of the COVID-19 pandemic.

While the virus looks to be somewhat contained in Australia, it still rages in the United States, with the death toll recently hitting 400,000 people in the US.

It remains to be seen if the BNPL sector will keep growing at the current pace once the global pandemic is under control.

Looking at the chart:

Source: Optuma

The share price moved up over the last four weeks to reach $6.32 at time of writing.

Should the move up continue, then the levels of $6.98 and $7.90 may provide future resistance.

If the price retraces to the downside, then the level of $5.03 may become the focus.

Z1P had a fantastic run-up through 2020 to reach an all-time high of $10.64.

It may not reach these heights again in the short term but could be in line for a run-up in the near future.

A good share for a watchlist.

Discover three innovative Aussie fintech stocks with exciting growth potential. Download your free report now.

Regards,

Carl Wittkopp,

For Money Morning