In today’s Money Morning…how long that stays the case has big implications for you as an investor…easy money means big risks…this distorted system makes no sense…and more…

If there’s one thing that’s underpinning speculation in both stock and property markets, it’s the belief that low interest rates are here to stay.

How long that stays the case has big implications for you as an investor.

While Greg’s analysis on why rates could stay low is a lot more nuanced, there’s definitely a wider feeling in the general public that the government just ‘won’t let’ rates go up.

For example, in Australia, property prices in Sydney and Melbourne would get smashed if we got back up to even 4% mortgage rates (right now most are in the 2s somewhere; even the 1s if you look around).

It’d be a political disaster for whoever presided over a world of rising rates.

But that widely-held belief I talked about at the start — that low interest rates are here to stay — is causing a monumental rise in house prices.

In a way, buyers are being perfectly rational. They’re calculating that they’re joining a ‘too big to fail’ group of voters.

In the financial world, the same attitude applies…

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Easy money means big risks

In a world of cheap money, speculators are ramping up their bets, and banks — needing to bolster their profits — are taking big risks with them.

As Adrian Blundell-Wignall explained in the AFR:

‘The allure is irresistible. Credit Suisse reports a mere $US27 billion in derivatives on its balance sheet, where leverage rules are calculated. But the notional value of the derivatives with which it is associated is some $US22 trillion.

‘Small spreads on large notional contracts and trading skills are very attractive in a zero-rate world.’

We saw the consequences of this play out recently with both the Archegos and Greensill sagas.

Morgan Stanley lost nearly a billion (US), Nomura said it could book US$2 billion in losses, and Credit Suisse — a whopping US$4.7 billion on the back of the Archegos meltdown.

In a further blow to Swiss banking pride, Credit Suisse are said to be on the hook for another US$2.3 billion from the Greensill collapse.

This is what a world of zero rates does. It encourages rampant speculation amongst even the staidest of banking institutions.

As you might’ve guessed, central banks are at the heart of the problem.

As Blundell-Wignall continued:

‘Central bank QE greatly increased central bank money (banks’ reserves at the central bank). What do banks do with it? In part, they meet a new regulatory requirement.

‘They also lend to each other in settlement. They also act on behalf of shadow banks needing cash (for derivatives), which can affect reserves.

‘Central banks don’t deal with hedge funds etc directly, but they facilitate their risk-taking indirectly when they operate through bank intermediaries.’

This distorted system makes no sense

Central bank meddling has given us a completely distorted market. A market that encourages gambling from systemically important banks.

Everyone, it seems, believes they’re too big to fail. So why not go for broke?

It makes a kind of perverse sense when you realise no one is ever accountable for the downside.

[Editor’s note: While the old financial system looks increasingly broken, thankfully there’s a new system sprouting up in parallel. This new system isn’t governed by the financial elite. It’s a free market for money and it could just be the life raft we need should the existing system fail. Keep an eye out for more on this later this week.]

Not only that, but central bank policies have distorted the price of debt beyond recognition.

We’ve all heard of ‘yield curve control’ — where central banks artificially bring down long-term bond yields.

This is not without consequence.

It means historically important signals provided by bond markets no longer make sense. That makes estimating things like inflation and credit worthiness hard for investors.

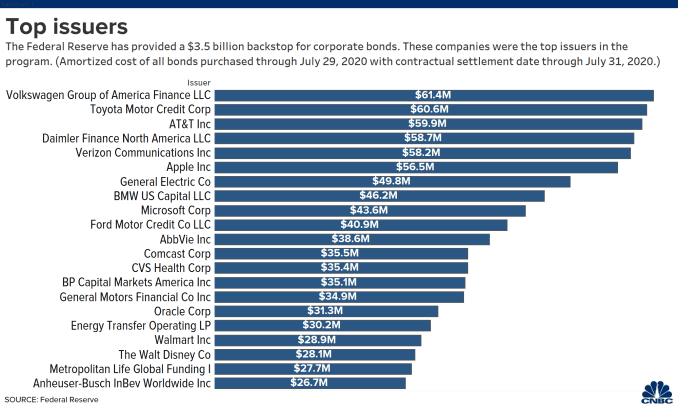

We even had the extraordinary situation in August last year where the Fed actually bought up, not just AA and AAA rated bonds, but junk bonds.

These are the debts of companies deemed ‘not investment grade’.

|

|

| Source: Federal Reserve |

You need to understand how crazy all this is…

It means no private, rationale lender was willing to lend to these companies at the prevailing interest rate.

So, rather than let markets decide what rate makes sense, the Fed jumped in to intervene.

This completely obliterates the concept of pricing for risk. Not just in the junk bond market but in all bond markets.

That’s a US$123 trillion industry that is being carried by the Fed.

You can see now why everyone has the belief that the government will protect them. It’s basically what they’ve been doing since 2008.

So back to the question I asked in the title…

Will the bond vigilantes strike back?

The phrase ‘bond vigilante’ is normally attributed to Ed Yardeni, a Wall Street economist who coined it in the 1980s to describe the role of bond markets in disciplining governments.

‘“Bond Investors Are The Economy’s Bond Vigilantes”, Yardeni once declared. “So if the fiscal and monetary authorities won’t regulate the economy, the bond investors will. The economy will be run by vigilantes in the credit markets.”’

Meaning free markets can try to put pressure on this dishonest market and start to raise interest rates on bonds, even as the Fed attempts to keep them low.

While some think the Fed is too powerful, a vigilante strike isn’t without precedent.

From 15 October 1993 to 7 November 1994, the 10-year yield climbed from 5.19% to 8.05%, fuelled by concerns about federal government spending.

Clinton political advisor James Carville famously said at the time:

‘I used to think that if there was reincarnation, I wanted to come back as the President or the Pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.’

As reported in National Interest magazine, a number of factors could spur bond traders into action under another big-spending Democrat president:

‘The bond vigilantes are coming out of the woodwork because they fear that the passage of Joe Biden’s proposed $1.9 trillion budget stimulus would almost certainly result in rising inflation later on this year.

‘Today’s global everything bubble is premised on the assumption that U.S. interest rates will remain indefinitely at their currently ultra-low levels. A real risk of the Biden stimulus proposal is that it could force long-term U.S. interest rates to rise as inflation fears put the wind in the bond vigilantes’ sails. As in the past, rising interest rates could prove again to be the trigger for the bursting of today’s everywhere bubble.’

Understand this…

Structurally the bond market dwarfs the equity market in both size and importance.

The risks of contagion — where an issue in one small part of the credit market spreads to all — is very high.

That’s the reason the Fed intervened in the junk bond market so aggressively last year.

They fear contagion.

But what if they eventually run out of firepower and the market calls their bluff?

Well, if the bond vigilantes push up US rates, most likely our rates will rise too.

While I’m certainly happy to make hay while the sun shines, you should keep a very close eye on the bond market too.

Because if there is going to be a day of reckoning for low interest rate-driven investments, the warning signs will come from there.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Promising Small-Cap Stocks: Market expert Ryan Clarkson-Ledward reveals why these four undervalued stocks could potentially soar in 2021. Click here to learn more.

Comments