At time of writing the Afterpay Ltd [ASX:APT] share price is trading at $113.98, up 4.71%.

2020 saw Australia’s leading ‘buy now, pay later’ (BNPL) provider forge ahead to new heights.

Source: Optuma

Afterpay and 2020

What can only be described as a horrible series of events for humanity unfolded in the form of the COVID-19 pandemic this year been.

Sweeping the globe at an alarming rate from the end of February, the virus changed life as we know it.

As the virus appears to be transmitted by being in close proximity with others, one of the most significant changes we have experienced this last year has been the lockdown and stay at home orders.

For typical retail businesses, hotels, and anything travel related, these changes were a disaster.

Keeping people home and away from each other kept them and their money away from companies.

Afterpay on the other hand were one of the big winners from the lockdown orders.

A series of related events and measures seem to have created the perfect storm for the BNPL company.

As the pandemic hit, many lost their line of employment — the federal government had to step in with financial aid packages.

This came in the form of JobKeeper and a raise in the JobSeeker payment. Up to $1,500 per fortnight in some cases.

With people stuck at home and propped up by governments, the shopping frenzy started.

Source: Optuma

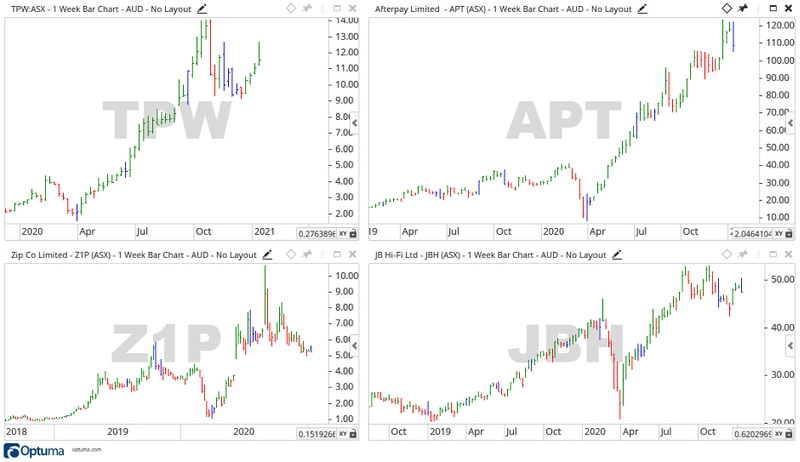

Zip Co Ltd [ASX:Z1P] saw its share price grow alongside Afterpay, its competition in the BNPL sector.

Temple & Webster Group Ltd [ASX:TPW], the online furniture retailer, saw its share price and profits grow.

JB Hi-Fi Ltd [ASX:JBH] experienced similar growth, as people spent up to make home offices and set their kids up for home schooling.

As the saying goes — a rising tide lifts all boats.

As alluring as this all is, it’s now time to ask whether this will continue into 2021.

The Afterpay Share Price in 2021?

At the time of writing, Afterpay held a market cap of $31.04 billion.

Much of the growth in the market cap is fuelled by investors jumping into a rising ship and people taking advantage of the credit offered by the lender.

A recent survey showed that one in three millennials have added to their credit debt since the onset of the pandemic.

With Afterpay noting that 65% of its US-based users are either millennials or from Generation Z.

Taking into account the easing of government support payments (due to end in March 2021) along with a current unemployment rate of 6.8%, the rapid growth of Afterpay and the BNPL sector overall may be creating a debt bubble.

Source: Optuma

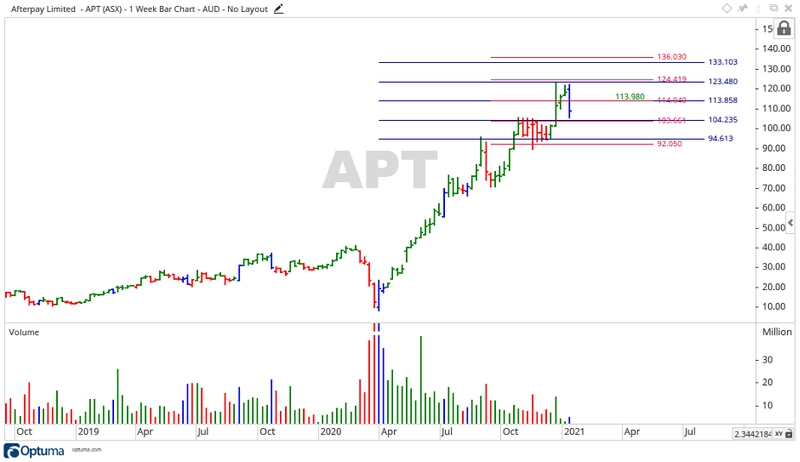

Taking a closer look at the Afterpay share price, the chart above shows that at time of writing the price is sitting around the support level of $114.

If the price can continue to move to the upside then the levels of $124 and $135 may become the focus.

Although the most recent move up took place on declining trading volume, indicating the buyers may not be committed to move higher at this stage.

If the price starts to fall then the levels of $103 and $93 may be enough to halt a further fall.

Afterpay proved to be the darling of the All Ords this past year. In saying that, the company found itself in some very favourable circumstances.

As these circumstances change so could the share price and outlook for Afterpay.

Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Regards,

Carl Wittkopp,

For Money Morning

Comments