In today’s Money Morning…a complete unwinding of the global debt system…don’t get shaken out by this hiccup…I’ve seen this con before…and more…

Dear reader,

It’s looking a bit dicey out there, with the ASX on course to shed more than 1% today.

Shock, horror! A 1% decline after an almighty rally that dragged just about everything up with it.

You can see the ASX 200 [XJO] had a nasty big red bar yesterday, which brings it within a hair of the early 2020 peak:

|

|

| Source: Tradingview.com |

A few key levels there, should the correction on the weekly chart play out as many expect.

There’s this from the Australian Financial Review to explain:

‘Australian shares are set to plummet at the open amid a broad global sell-off. US stocks pared some losses in the final hour of the session.

‘ASX futures were down 98 points or 1.4 per cent to 7118 at 7am AEST; they earlier fell by 146 points. The local currency was 0.2 per cent lower.

‘Bitcoin shed more than 7 per cent to trade close to $US43,700 near 7.15am AEST on bitstamp.net; it briefly fell below $US43,000 earlier.

‘The yield on the US 10-year note plunged 5 basis points to 1.31 per cent near 5pm in New York.

‘Wall Street’s main indexes tumbled, as concerns about the pace of a global recovery spurred a broad sell-off though “buy-the-dip” investors helped checked the losses. In addition, there’s increasing angst ahead of this week’s US central bank policy meeting.’

There’s also a geopolitical bent to this slump with the US-Australia nuclear sub deal fresh in investors’ minds.

Bloomberg also ran a piece asking the following:

‘How far will President Xi Jinping go with his crackdown on China’s real estate sector?

‘The question has suddenly become an urgent one on trading desks around the world. After months of treating the crisis at indebted developer China Evergrande Group as largely contained, investors on Monday rushed to price in the risk that Xi will miscalculate as he tries to curb China’s property-market excesses without derailing the economy.’

If the correction does play out, it becomes near-instantly contrarian to say the rally will continue after the market blows off some steam.

Here’s what’s not happening…

Three Innovative Fintech Stocks to Watch Now. Discover more.

A complete unwinding of the global debt system

The problem in my eyes is China debt, not world debt. For now.

I think this problem will be contained to China, which again, the Australian Financial Review explains:

‘China’s Evergrande, the world’s most indebted real estate company, is set to default when its next debt payments come due on Thursday, according to CBA. However, the risk of broad contagion spreading across financial markets is limited.

‘“Evergrande will likely default on its debt this week,” said Kim Mundy, senior economist and currency strategist for CBA.

‘“However, we doubt the government will bail out Evergrande by using public funds. Instead, we believe the most likely scenario is that local government in Guangdong province will nominate a working group to manage an orderly restructuring. We expect the restructuring will take years to complete,” she said.’

This is the slow-motion restructuring we discussed last week.

The world is awash in debt — that much we know.

This is the world where ‘debt is money, and money is debt.’

But central bankers aren’t going to have a moment of clarity here.

They will double down and then change the rules (CBDCs), is my bet.

Meaning the rally should resume once the world moves on from the Evergrande fiasco.

I think this is a classic set up by the financial media complex too.

Don’t get shaken out by this hiccup

It was a sea of red yesterday and a sea of red will almost surely follow today.

Stop-losses could be hit, accelerating a correction.

But novices get shaken out of investments by ‘flavour of the month’ bear narratives.

While pros know that there’s heaps more fiscal stimulus to come in the US and that the rally could go for a while longer after the dust settles on Evergrande.

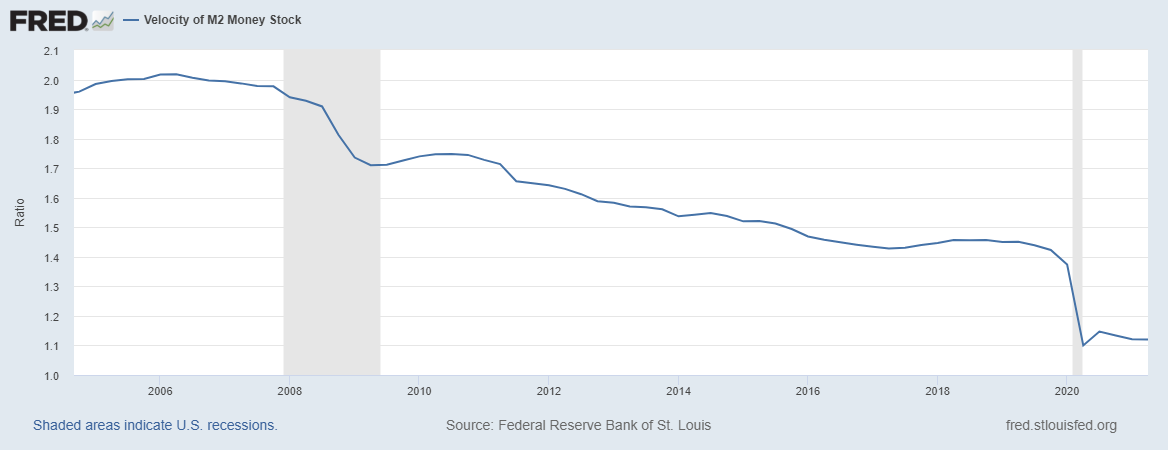

Yes, the velocity of money (M2) looks grim:

|

|

| Source: Fred.stlouisfed.org |

Has that ever stopped the printer?

Not yet. And maybe not for a while longer.

If you’re a trader you could think about tightening up stop-losses on your winners, for sure.

As an investor, I’ve seen this con before.

Big, nasty headlines as a shield for a bit of profit-taking from the huge funds as retail investors get the heebie-jeebies and retreat to cash…

Only to be left in the dirt as the big funds pile back in on the sly.

Yes, this Evergrande fiasco has huge geopolitical implications.

But no, this is not the end times for the market.

Hold tight.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.