Perth-based explorer Wildcat Resources [ASX:WC8] released more drilling results from the Tabba Tabba Lithium Project in WA.

The company acquired the project in May this year and its potential has continued to excite investors.

Now with the latest results, the company has boldly stated that it is in the midst of ‘uncovering a tier-1 lithium deposit’.

The company looks overpriced to some, who have watched in disbelief as shares rose a staggering 3,000% in the past 12 months.

Today’s strong intercept results have added another 12% to the share price, trading at 93 cents per share.

So, what do the latest results add to this company’s exciting trajectory?

Source: TradingView

For seasoned lithium investors, the results today will hardly come as a surprise. Tabba Tabba sits beside some of the world’s largest hard-rock lithium mines in the Pilbara region.

Tabba Tabba continues to grow

The project is within spitting distance of the Pilbara Minerals [ASX:PLS] owned Pilgangoora Project and the Mineral Resources [ASX:MIN] Wodgina Project.

Both of these are monster lithium projects that put Australia on the map for lithium. But investors could soon see another name in the pantheon of big lithium mines.

Wildcat purchased the Tabba Tabba project from Global Advanced Metals on 17 May for $7.5 million and a 1.75% revenue royalty.

Since then, Wildcat has wasted little time with an aggressive drilling campaign.

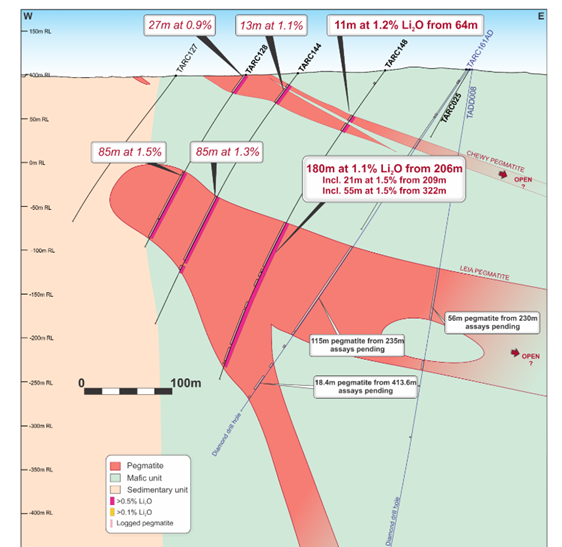

The latest results are for the Leia Pegmatite, one of six potential pegmatite prospects in the 3.2km long field.

Some of the highlights from the Leia site include:

- 180m at 1.1% Li₂O from 206m

- Including 21m at 1.4% Li₂O from 209m

- And 65m at 1.2% Li₂O from 234m

- And 55m at 1.4% Li₂O from 322m

- 70m at 1.0% Li₂O from 183m

- 98m at 0.8% Li₂O from 226m

Here’s a cross-section of some of the drilling to better visualise the 1.65km long Leia pegmatite.

Source: Wildcat Resources 6-11-23

The company has completed 73 drill holes into Leia to date, with results from 34 still pending.

Wildcat’s Managing Director, Samuel Ekins, commented on the results:

‘The thick and high-grade assay results consistently being returned from Leia convince us that Tabba Tabba is host to a very significant lithium deposit.

‘The Project’s setting on Mining Leases and its proximity to infrastructure in the centre of the most prolific hard rock lithium district in the world, truly cements it among the best lithium development opportunities today.’

At the beginning of November, Wildcat also announced that Mineral Resources completed a block trade to become a majority stakeholder.

MinRes bought at a share price of 85 cents and now holds 19.85% of Wildcat’s total issued shares.

For Wildcat, the purchase was a validation of the Tabba Tabba site.

But what is needed to turn this find into a working mine?

Outlook for Wildcat Resources

Investors are buying heavily today as lithium speculators anticipate the project’s future, which will likely be determined by an experienced miner in the region.

Early reporting shows this will likely come from billionaire Chriss Ellison of Mineral Resources [ASX:MIN].

He is known to share ties with the Wildcat Chairman and has shown early interest in the project.

After the failure of the Albemarle deal— the potential for further WA mining consolidation is ripe.

His recent purchase of Wildcat shares betrays his intention to merge it with the Wodgina Project, located only 87km away.

Both projects sit 120km south of Port Hedland, which is gearing up to build a large lithium refinery plant.

MinRes acquired three smaller mines in the region with processing infrastructure and is aware of the project’s long-term potential.

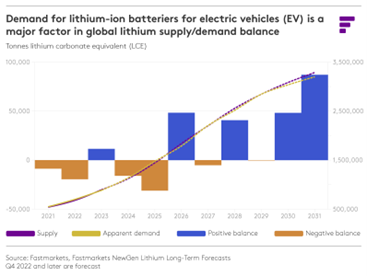

Global lithium demand continues to grow rapidly, driven by demand for EV batteries.

These lithium-ion batteries account for 80% of total demand. However, the lithium supply is also catching up.

The big risk from here surrounds lithium prices. Chinese lithium prices are down over 70% from their November 2022 top.

Demand for electric vehicles has been uneven, with Australia seeing a strong uptake of EVs while the US has fallen behind.

The Australian Department of Industry has forecasted prices are likely to ease through 2028 as more supply comes online.

Source: Fastmarkets Forecast

That same report also highlights another metal to look out for in the move towards renewable sources…and that’s copper.

According to the October resources report:

‘With significant demand growth expected over the outlook period, and with mined production growth likely to slow, it is projected that a market deficit will emerge.’

Copper shortages this decade?

Stopping climate change will need a vast amount of critical metals — one special metal from this range is copper.

Copper is essential in all electronic devices, and EVs are no different.

Each EV requires around four times as much copper as regular combustion vehicles.

As we heard from our latest government forecast, that demand is beginning to outstrip supply.

Our resident resources expert has seen this coming and has mapped out the best move for investors to capitalise on this shortage.

If you subscribe to Fat Tail Commodities, you will have access to resources expert James Cooper’s most recent thoughts on the subject.

James provides a wealth of investment ideas and veteran insights into the copper industry.

He’ll also explain the copper supply crisis and how you can position yourself to take advantage of incoming changes in the industry.

Find out more about the coming red drought and click here today.

Regards,

Charlie Ormond

For Fat Tail Daily