- ‘Find the narrative whose premise is false…and bet against it.’

All hail the great words of George Soros, one of the greatest speculators of all time.

But where should I look, Mr Soros?

Feel free to take your own guess, but here’s mine: iron ore stocks.

I know, I know. You want to hear about all the exciting things going on in lithium, rare earths, and copper.

Me too! Those are off the boil — for now.

However, here’s the reality. Iron ore is barnstorming its way towards US$120 a tonne…against all expectations.

After all, isn’t Chinese property supposed to be collapsing? Isn’t iron ore in a structural decline?

Hee-hee! That’s the vibe you might get from reading the press and commentary.

I think we have our false premise, a la Mr Soros…because here’s the chart of iron ore lately:

|

|

| Source: X |

Goodness gracious me, that’s what I like to see.

What I love about this is that iron ore stocks took a beating while the market agonised over the outlook for China.

I see related stocks trading cheaply…but currently minting a fortune.

This is why one of the five recommended stocks in my latest report is an iron ore miner.

I was perfectly happy to put this on the record. I’ve seen this rodeo before. Back in 2021, everyone got all bearish on China and iron ore…and it went on to spike more than $200 a tonne.

I’m not going to say that will happen again. All I know is I got some ripping trades away at that time for subscribers. I’m ready to go dancing again.

Here’s another kicker. Iron ore companies sell in US dollars. That means you get a kick from the Aussie dollar being down in the dumps too when it comes to potential dividends.

You see…this is the thing about iron ore.

It doesn’t have the fancy story that investors find so alluring about rare earths and lithium and all the rest of it.

What the industry has is cold, hard cash.

A good chunk of iron ore miners on the ASX are producing already. As soon as iron ore goes up, the dollars going into their account do the same thing.

You can’t say that about many mining juniors. Often they’re months, in fact, years, from any cash flow.

That recommendation I mentioned in my latest report banked nearly $90 million in cash flow last quarter. That was when iron ore was relatively weak.

How much will they make this quarter? I can’t wait to find out — or see how big the dividend they’re planning is going to be.

See for yourself here my favourite way of playing this.

- Why is iron ore going up, anyway?

Don’t ask me, I’m just a humble small-cap analyst.

One man who should have a pretty good idea is the head of iron ore operations at Vale — the biggest iron ore miner in the world.

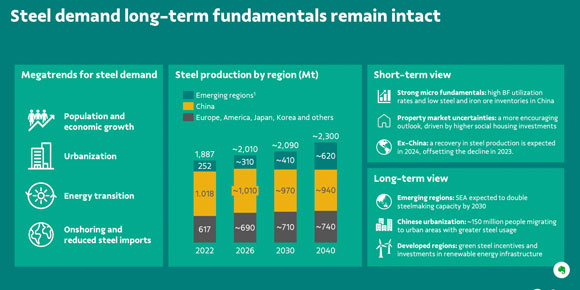

He just released a presentation. Here’s the key slide:

|

|

| Source: Market Watch |

There was also a report released recently, that said in part:

‘The one commodity that should be getting hammered by China’s worsening property crisis is actually doing rather well…

‘“Iron ore is still very resilient for an environment like this, and I think Chinese demand is playing a role in that,” said Hao Hong, chief economist at Grow Investment Group. It shows parts of the economy, outside the property sector, are relatively healthy, he said.’

I’m not saying this is an easy ride, by the way. Iron ore is a volatile beast…and loves nothing more than spooking everyone…before it goes on an unexpected rally.

If that’s not your style, feel free to give it a miss. But this volatility sure does throw up some great trading opportunities.

And let me tell you something about the broader market right now. There ain’t much moving elsewhere. The only other sector I’ve seen with any spark lately is uranium.

However, there’s a consensus there I find unappealing, even if it’s probably true. I’m a contrarian by nature. Running with the herd is against my instincts, generally speaking.

Decide what works for you. But I’m following George Soros’s advice.

Will you take the same bet?

Best wishes,

|

Callum Newman,

Editor, Money Morning