The Nick Scali Ltd [ASX:NCK] shares are down today despite beating guidance by a fair margin.

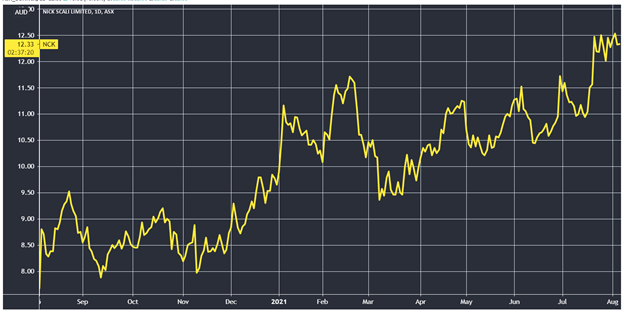

Shares of the prominent Aussie furniture retailer are trading at $12.28 a share, down 0.33% at time of writing.

However, if you zoom out and look at the NCK stock’s 12-month performance, you will see the retailer has been in a consistent uptrend.

NCK shares are up 60% over the course of 12 months.

Nick Scali reports 100% profit growth

COVID-19 impacted many businesses but Nick Scali wasn’t one of them.

In fact, the pandemic acted as a catalyst for its growth in profits.

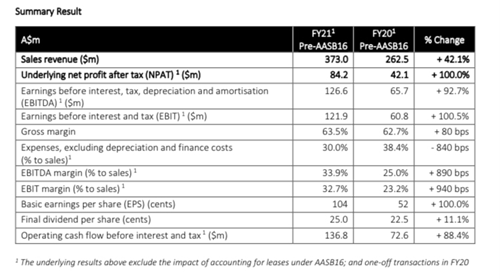

Nick Scali reported a solid 100% gain in profit from $42.1 million to $84.2 million.

Moreover, the furniture retailer also boosted its revenues by 42.1% to $373 million from $262.5 million.

The good news for investors is that dividends is also climbing. Dividends climbed to 25 cents per share from 22.5 cents, an 11.1% increase.

Managing Director Anthony Scali was clearly enthused by the results:

‘The most pleasing aspect of our FY 21 result, was the ability of our distribution network across Australia and New Zealand to deliver the materially elevated sales revenue whilst maintaining the same level of costs as FY20.’

Nick Scali is targeting and profiting from both online and retail orders, as the COVID-19 restrictions are slowly being lifted.

Written sales orders in New Zealand grew by 95% compared to FY20, and same store written orders climbed by 40% over the same period.

Online written sales orders for FY21 were $18.3 million compared to $3.0 million in FY20.

The bottom line is that Nick Scali’s numbers today are strong and the business is adapting well to the e-commerce boom.

So, what’s the possible reason for the drop in the NCK share price today?

NCK stock is near all-time highs, and this can be one possible explanation of today’s minor correction in the share price.

There is a strong resistance level at the $12.50 mark and investors may be aiming to take profits off the table while they can.

Outlook for NCK Shares

Nick Scali was quick to realise the importance of jumping into the online retail business once the pandemic hit.

Due to this very decision, the company notes that ‘online growth was up 88% for the month of July 21 compared to July 20.’

Nick Scali could have a long way to go with solid fundamentals backed by consistent improvements in the business.

Continuation of store rollout and increasing online penetration could go hand-in-hand to aid the company’s future growth.

As I noted previously, the $12.50 mark could be a significant point of resistance. Smart traders and technical analysis focused investors would be seeing this as well.

If you’ve ever wanted to get into charting and understanding the strategies that these traders use, we have an excellent in-house charting guru, Murray Dawes.

Check out this report on technical analysis strategies and how to limit your risk when trading companies like Nick Scali Ltd [ASX:NCK].

Regards,

Lachlann Tierney

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here