Shares in coal producer Whitehaven Coal [ASX:WHC] have jumped again today as investors react to news of a significant fire at a competitor’s mine in Central Queensland.

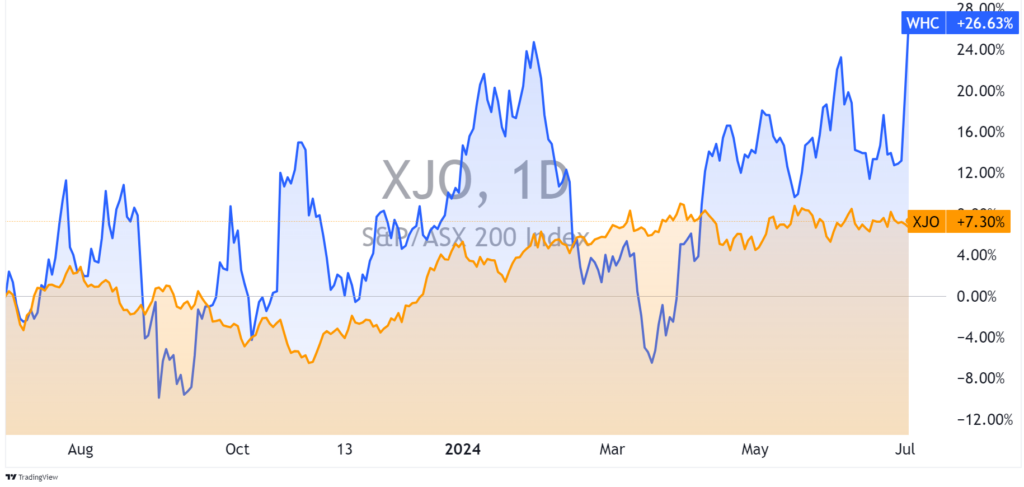

As of this writing, Whitehaven shares are up over 12% since last Friday, outpacing the broader ASX 200 index which has remained relatively flat.

The surge comes as a major fire continues to burn at Anglo American’s Grosvenor coal mine in Moranbah.

Experts suggest the blaze could take weeks or even months to fully extinguish, potentially squeezing supply.

With this week’s gains, Whitehaven’s shares are now up 26.6% in the past 12 months at $8.56 per share.

But this news didn’t just benefit Whitehaven; other ASX coal players also saw their shares jump this week.

Is this a good time to invest, or will these share moves reverse course soon?

Fire disrupts coal production

The incident at the Grosvenor mine, which began early Saturday morning, was reportedly triggered by an ignited methane leak at the longwall coal face.

Anglo American, the multinational that owns the mine has begun efforts to temporarily seal the mine, a critical step in stopping the fire.

However, they expect the smoke to continue for several days, impacting the nearly 10,000 nearby residents.

In a statement on Facebook, Anglo American said:

‘Our priority is to safely extinguish the underground fire, which emergency response teams are managing from the surface.‘

This ongoing blaze at such a major coal production site has sent ripples through the industry.

The Grosvenor mine produced 2.8 million tons of metallurgical coal in 2023, making up around 17% of Anglo American’s coal output.

This disruption to coal supply has seen investors flock to Whitehaven and other producers, anticipating restricted supply and potentially higher prices for their coal.

The ASX coal sector has seen broad gains since the news; some highlights include:

- Coronado Global Resources [ASX:CRN] up 14.15%

- Stanmore Resources [ASX:SMR] up 6.2%

- New Hope Corporation [ASX:NHC] up 8.58%

- Yancoal Australia [ASX:YAL] up 11.84%

These gains come against the backdrop of an otherwise subdued ASX 200 this week, as investors remain concerned about the RBA’s next move.

So, is this an opportunity for quick investors?

Outlook for Whitehaven

Whitehaven, as one of Australia’s largest independent coal producers, could benefit from any prolonged disruption to Anglo American’s operations.

The company has both thermal and metallurgical coal operations in QLD, allowing it to capitalise on potential supply shortages across coal markets.

While today’s share price jump is largely driven by speculative buying on the back of the Grosvenor incident, it adds to what has been a strong year for Whitehaven.

The company has benefited from surprisingly robust coal prices and strong operational performance.

Whitehaven achieved an average coal price of $219 a ton in the last quarter and is on track to meet production guidance.

Although its sales slowed in the most recent quarter, it managed to deliver record profits in the most recent half-year results.

However, investors should be cautious about reading too much into today’s gains.

The full impact of the Grosvenor mine fire on the broader coal market remains to be seen, and much will depend on how long Anglo American’s operations are disrupted.

It’s also worth considering that the coal sector faces long-term headwinds from the global transition to cleaner energy sources.

While near-term supply disruptions may boost prices, the industry’s long-term outlook remains challenging.

Whitehaven has been working to diversify its portfolio and improve its environmental credentials, but it will need to balance meeting current demand and preparing for a lower-carbon future.

Still, a bet on the coal industry here could make sense if you feel that the current energy policy is out of step with Australia’s future energy needs.

Energy-driven inflation is something we will continue to battle with as a nation. For example, In the last monthly CPI figures, which measure inflation, the ABS noted that:

‘Excluding the Energy Bill Relief Fund rebates, Electricity prices would have increased 14.5% in the 12 months to May 2024.’

That detail was missed by most of the press but should have alarm bells ringing for investors.

Time to reconsider your energy investments?

With ongoing volatility in energy markets and the accelerating push towards renewables, now might be the time to reassess your exposure to the sector.

It seems we are repeating a pattern from the 1970s when energy stocks outperformed the rest of the stock market.

Our latest report delves into the energy landscape and the challenge for Australia in the coming decade.

We examine the potential winners and losers in the transition to cleaner energy and highlight some under-the-radar companies that could benefit from this shift.

Ready to future-proof your energy investments?

Click here to access our full report and start positioning your portfolio for the energy transition today. Your financial future may depend on it.

Regards,

Charlie Ormond

For Fat Tail Daily

Comments