Fat Tail has a new podcast – What’s Not Priced In – and the first episode just dropped!

Every Friday, Greg Canavan and I will look beyond the headlines and investigate ideas flying under the market’s radar.

Yes, WNPI is another investing podcast. But we hope it’s unlike other podcasts.

We don’t want to rehash the trending stories, but look beyond them.

You could argue that newspapers, talk shows, and podcasts are lagging indicators of where the smart money is.

If a story is plastered on the covers of The Economist or Businessweek, chances are the smart money has already latched onto it months earlier.

A favourite motto around here is – if it’s in the news, it’s in the price.

What matters is what the market has already discounted…and what it hasn’t yet.

WNPI will focus on the latter, on what the markets aren’t pricing in.

However, part of knowing what’s not priced in is identifying what already is.

With that in mind, this week we covered Nvidia’s [NASDAQ: NVDA] historic intra-day surge, the growing AI hype, and the tech stock rally.

The key question with Nvidia and the AI boom is – how much of the disruptive growth is already priced in?

Now, while the tech sector rallies, the retail sector struggles. We discussed whether the consumer discretionary stocks are set for further pain in the months ahead.

As for what the markets are not pricing in, Greg turned his attention to interest rates. In his view, the market continues to underestimate the possibility of higher-for-longer rates.

You can watch the full podcast here (or listen on Spotify).

For those interested, below is a short summary of some of what we talked about.

Nvidia’s star rises

We’ve all seen the numbers.

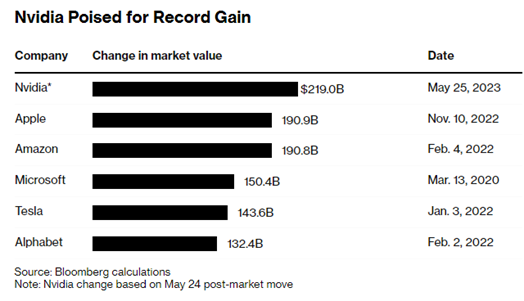

Overnight, Nvidia closed about 25% higher after a huge first quarter beat, gaining about US$200 billion in market value in one day.

Its market cap is now nearing US$1 trillion.

Nvidia said it now expects sales in the three months ending in July 2023 to be about US$11 billion, way higher than the average analyst estimate of roughly US$7.2 billion.

According to Bloomberg, the forecasted revenue beat is the biggest in five years.

Nvidia is now about eight times the size of Intel [NASDAQ: INTC]!

That’s despite the fact that last year, Intel’s revenue was US$63 billion.

Nvidia’s? US$27 billion.

Clearly, the market likes Nvidia’s growth potential.

Source: Bloomberg

Nvidia’s rise reminded me – fairly or unfairly – of Sun Microsystems co-founder Scott McNealy.

Speaking in 2002 after Sun Microsystems lost about 90% of its value, Scott McNealy bluntly asked what investors were thinking bidding the price so high at the peak of the dot-com bubble.

Here’s the snippet:

‘… two years ago, we were selling at 10 times revenue when we were at $64. At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?’

After its massive share price jump on Thursday, Nvidia is now trading on a price to sales (P/S) ratio north of 30!

Of course, the bulls will say that Nvidia’s forward P/E is much lower than 150.

And that’s true. According to MarketScreener, Nvidia is trading on a forward FY26 P/E of about 47.

As a back of the envelope exercise, what would it take to get Nvidia’s P/S ratio down to 10 – which is still too high for someone like Scott McNealy?

In FY23, Nvidia’s revenue was US$27 billion.

Given a current market cap of about U$940 billion, Nvidia’s annual revenue would need to hit US$94 billion to trim its P/S ratio to 10.

AI is the next big thing, but is it that big?

At this point, I am reminded of the Warren Buffett quote that goes:

“The idea of projecting out extremely high growth rates for very, very long periods

of time has caused investors to lose very, very large sums of money.”

Of course, if AI lives up to the hype, maybe Nvidia will continue to grow strongly.

After all, in a gold rush, it’s good to be selling picks and shovels. And Nvidia seems to be the premier picks-and-shovels distributor of the AI age.

And as Greg pointed out when talking about valuations – mega-cap stocks like Nvidia generate massive cash flows that they reinvest at a high rate of return.

That helps Nvidia compound value.

A high P/E stock may not necessarily be overvalued if it reinvests profits at a sustainably high rate of return.

That said, I think we should be prepared for more volatility in AI stocks as markets go through a price discovery phase.

How should we price AI stocks? On what basis? What’s their ceiling? What’s their floor?

What are the most monetisable AI business models? And what are the least monetisable?

The AI boom and the tech rally

Nvidia’s result ties into the larger rally in tech.

On Thursday, the ASX 200 Information Technology Index closed 2.4% higher and added another 1.4% on Friday.

The Information Technology is now up 28% year to date while the benchmark ASX 200 is up about 3%.

Earlier this week, WiseTech Global [ASX:WTC] hit a record high, hitting $74.46 with a market valuation of $24.5 billion.

WiseTech is up nearly 50% year to date.

Xero [ASX:XRO] is up over 55% year to date, too.

Nextdc [ASX:NXT] is up 40% year to date.

Nuix [ASX:NXL] is up 50%.

Obviously, this isn’t exclusive to the ASX.

US mega-cap tech stocks are surging in recent months. For instance, Meta Platforms [NASDAQ: META] is up 100% year to date!

So here’s a question.

Are tech stocks overvalued?

Is this a valuation bubble or is the recent run up in valuations reasonably reflect the growth potential of these tech stocks?

Retail stocks in retreat

While tech stocks may be booming, retail stocks are retreating.

Just this week we had Universal Store falling nearly 30% on Wednesday.

Despite forecasting ‘record FY23 sales’, Universal admitted soft trading conditions in April and May and thinks these ‘tighter’ conditions will roll into FY24.

And on Monday we had City Chic [ASX:CCX] declaring it continues to unwind inventory and push promotional activity to clear excess stock. Despite that, year to date sales were down 15%.

City Chic said it expects margins to ‘remain soft’ well into FY24.

Fragrance retailer Dusk [ASX:DSK] is down 40% YTD and hit a 52-week low this week. It disappointed the market with a soft trading update last Friday.

“Trading conditions in the second half of FY23 have been impacted by an increasingly cautious consumer environment, driven by higher interest rates and mounting cost of living pressures impacting the disposable income levels of our core customer.”

And of course the recent retail sector struggles come after beauty retailer BWX [ASX:BWX] entered voluntary administration.

One outlier is Cettire [ASX:CTT], up 50% YTD. Although it, too, tumbled in recent days, along with Lovisa [ASX:LOV].

What are the retail stocks saying about consumer spending?

That spending is softening.

And no wonder. The Aussie consumer is being squeezed by higher rates and higher cost-of-living.

On Friday, the Australian Bureau of Statistics released the latest sales data for April.

April retail turnover was completely flat, after rising 0.4% in March and 0.2% in February.

Ben Dorber, the Bureau’s head of retail statistics, said:

‘Retail turnover has plateaued over the last six months as consumers spent less on discretionary goods in response to cost-of-living pressures and rising interest rates. Spending was again soft in April but was boosted by increased spending on winter clothing in response to cooler and wetter than average weather across the country.’

For Greg, retail stocks may be in the doldrums for a while. But the sector may offer up opportunities if quality names get oversold.

Interest rates – higher for longer

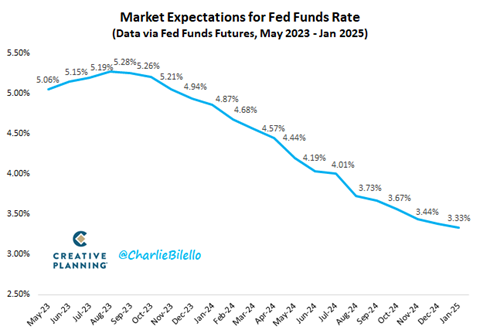

Now, while markets are pricing in plenty of AI-boosted revenue growth for stocks like Nvidia, Greg thinks there is something bigger the market should be pricing in, but isn’t.

And that is the possibility of prolonged high interest rates.

Source: Greg Canavan

Core inflation is stubbornly sticky and the labour market remains tight. So the Fed will have to keep monetary policy restrictive for a while yet.

This week, the Fed released its May meeting minutes. The minutes suggest the Fed is prevaricating over hiking or pausing.

But cutting interest rates is not an option for the central bank at this stage.

A crucial passage from the minutes was this:

‘Participants generally expressed uncertainty about how much more policy tightening may be appropriate. Many participants focused on the need to retain optionality after this meeting. Some participants commented that, based on their expectations that progress in returning inflation to 2 percent could continue to be unacceptably slow, additional policy firming would likely be warranted at future meetings. Several participants noted that if the economy evolved along the lines of their current outlooks, then further policy firming after this meeting may not be necessary.’

Further policy firming may not be necessary…but that doesn’t mean policy easing is on the cards.

And when the Fed does start hiking rates, it won’t be as happy an occasion as some anticipate.

Greg thinks rate cuts will presage a demand-led recession, an outcome the market isn’t yet pricing in as a real concern given the current tech rally.

Regards,

Kiryll Prakapenka

Analyst, Money Morning