Market jitters.

Bond sell-offs.

Extreme fear.

Rising volatility.

Panic at the disco?

Panic or not, it’s certainly getting exciting.

In the 20th episode jubilee of What’s Not Priced In, Greg Canavan and I cover the latest moves in the bond market, the Reserve Bank’s latest decision, fearful market sentiment, and the outlook for key commodities.

Greg thinks markets are not at a capitulation low just yet and more volatility is in store.

So is this a time for panic?

Not necessarily.

For the steadfast investor, now is a great time to look for discounts.

Further tightening may be required…

Michele Bullock conducted her first Reserve Bank Board meeting as the newly crowned RBA governor.

But she didn’t stamp her authority with a shift in approach.

The Reserve Bank kept the cash rate at 4.10%, yet another month of no change.

Bullock kept her first post-decision statement largely unchanged from her predecessor’s, too.

The only substantial edit on the previous statement was an added reference to growth in the Australian economy being ‘a little stronger than expected over the first half of the year.’

But the insertion was immediately qualified by the fact this growth is still below-trend.

Again, Bullock kept the final cautionary statement.

The central bank kept interest rates steady for the fourth straight month but it reiterated ‘some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe.’

This dangled threat of further tightening is likely a way to keep inflation expectations subdued.

Inflation is still well above the RBA’s target. It doesn’t want to reinvigorate splurging spirits of households and businesses by hinting it’s done with tightening.

Managing inflation expectations is one transmission channel of monetary policy.

As long as core inflation remains materially above target, the RBA will keep tacking on the ‘some further tightening may be required’ disclaimer to its monthly statements.

…But we may be at the rate hike peak

Some RBA counterparts in the US are taking a slightly different approach.

Loretta Mester, president of the Federal Reserve Bank of Cleveland, told journalists this week she’d likely vote for a rate hike in November if the US economy retains the strength evinced in September.

Mester’s remarks followed her speech on the outlook for inflation.

She was direct in saying the US is likely ‘near or possibly at the peak of the Fed funds tightening cycle’.

But Mester warned the task is now all about keeping policy ‘restrictive for long enough’ (emphasis added):

‘Progress is being made on inflation, but the level of inflation remains too high. We are likely near or possibly at the peak of the Fed funds tightening cycle. Now our task turns to ensuring that we keep monetary policy restrictive for long enough to be confident that inflation returns to our 2 percent goal in a timely way. We are not there yet, but we will get there …’

That seems like a long-winded way of corroborating the current ‘higher for longer’ consensus…

And partly explains the surge in bond yields.

Markets spooked by rising yields

The yield on the US 10-Year Treasury bond topped 4.80% earlier this week, setting yet another multi-year high.

And markets are getting spooked.

The stodgy Dow Jones index erased all of its 2023 gains on Wednesday.

And our ASX 200 is flat as a pancake year to date. In fact, the index is down ~9% since early February.

Elevated bond yields are coinciding with falling headline inflation, meaning real rates are rising.

Real interest rates — 10-year bond yields minus inflation — have steadily risen from negative territory in 2021–22.

|

|

| Source: Jason Furman |

Positive real rates are restrictive. And are causing jitters.

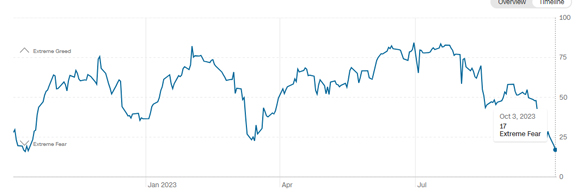

The CNN Fear & Greed Index suggests the market is the most fearful it’s been in 12 months.

We are at Extreme Fear territory.

|

|

| Source: CNN |

Some think further rises in real rates will hurt equities and burden firms with higher costs of capital.

Cue shrinking profit margins and slowing earnings growth.

These worries aren’t unfounded.

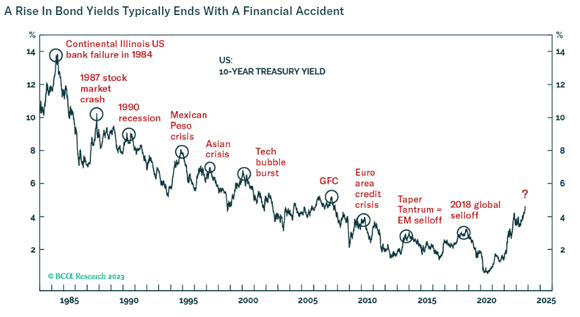

Research firm BCA Research cautioned that a ‘rise in bond yields typically ends with a financial accident’.

That doesn’t sound good.

|

|

| Source: BCA Research |

BCA’s chief emerging markets strategist Arthur Budaghyan elaborated that ‘cyclical bond bear markets in 1982-2021 ended only after an eruption of financial turmoil’.

Budaghyan then voiced his fear:

‘In short, US Treasury yields are set to overshoot before topping out. The bear market in US bonds will likely end with a bang rather than a whimper.

‘I do not know what this “bang” will look like, but a material drawdown in global risk assets is very likely before US Treasury yields peak.’

Will things be as calamitous as the likes of Budaghyan suggest?

Watch on to find out!

Contrarian market indicator — labour market edition

Finally, sometimes, Greg and I like to canvas prominent magazines for contrarian indicators.

Magazine covers can sometimes highlight ideas that have crested their peak popularity and relevance.

The time it takes to research, edit, and publish a story means that a magazine cover is often a lagging indicator.

By the time a theme hits the front page of The Economist, Barron’s, or Businessweek, the story is likely already fully priced in by the market…or has changed materially.

So, here’s a recent Barron’s cover on the ‘extraordinary’ US labour market.

|

|

| Source: Barron’s |

Does this suggest the US labour market is about to become ordinary?

Maybe.

What’s interesting is the compounding of lagging indicators here.

Employment data lags wider economic developments as businesses are slow to adjust hiring decisions. Consumers can curb spending faster than companies can downsize.

And magazines only put an idea on the front cover once it’s trending, not before.

At the very least, we can say markets have likely fully accounted for the recent strength in labour markets.

Recent stock sell-offs suggest markets have moved on to something else — pricing in the impact of rising real yields.

Can economies and firms withstand them before inflation returns to target?

Or will we see an ‘eruption of financial turmoil’?

Greg and I canvassed the likelihood of both possibilities in the episode.

But we also ended on a more positive note.

It is easy to get bogged down in the mania surrounding the latest macroeconomic moves.

But on the micro level, the stock market still has great businesses going about their day, largely unperturbed by the machinations in bond markets.

Current volatility is tangential to these firms’ success.

And if the markets continue to be fearful, and if fear continues to distort prices, then these businesses may soon sell at attractive discounts.

Stock pickers rejoice!

Regards,

|

Kiryll Prakapenka,

Editor, Money Morning