At the time of writing, the share price of Webjet Ltd [ASX:WEB] is down more than 3%, trading at $4.91.

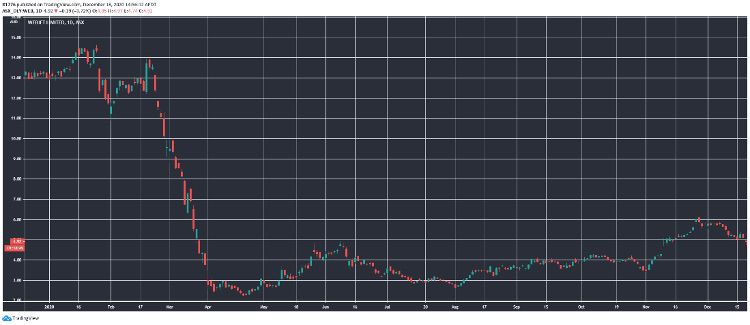

As you can see, the WEB share price had managed a muted recovery rally as Victoria emerged from lockdown and vaccine rollouts started to take shape:

Source: TradingView

Let’s look at why the WEB share price was lower today and its prospects for a sustained recovery.

WEB share price hurt by new case numbers

There are now 28 cases from the Northern Beaches cluster in Sydney, and images emerged showing a packed Sydney Airport as people scramble to get out of the city before Christmas.

Naturally, the WEB share price was hurt by this latest development.

Back in October, the company gave some insight into how its business will move forward in this difficult trading environment.

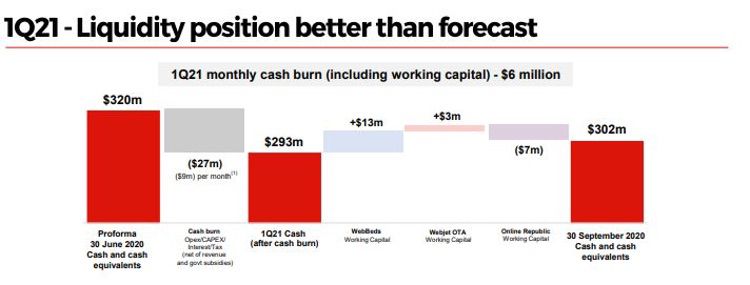

You can see its liquidity position below:

Source: Webjet

The company presentation, from October, outlined how WEB has ‘adequate cash reserves for at least two years of difficult trading, as well as an extended senior debt maturity.’

Outlook for WEB share price

Webjet did what it had to do in order to survive with its recapitalisation.

That being said, the prospect of new travel restrictions could dent what little domestic air travel we have.

Even beyond this, a lot hinges on travel arrangements between countries, even after a vaccine is rolled out.

Will countries trust each other enough to let their respective citizens travel beyond domestic borders?

As such, Webjet may continue to see its share price trade sideways for a protracted time as the vaccines are rolled out.

If you have immense patience, though, and can wait a few years, Webjet would probably fall into the ‘world back to normal’ stock category.

More bad news could change this, however, which is why you should be particularly cognisant of risk with regard to your trades and investments.

Discover a unique technical analysis strategy from our chart guru, Murray Dawes, in this report. If you’ve ever wondered what information can be gleaned from a deep dive into a chart, this report is a must-read.

Regards,

Lachlann Tierney,

For Money Morning

Comments