Today is ANZAC Day when we commemorate the anniversary of Australian and New Zealand troops landing at Gallipoli, Turkey, on 25 April 1915.

These commemorations, including Remembrance Day, honour those who died in the line of duty.

Most importantly, they remind future generations about war’s horrible costs.

And that’s never been so important today.

As I’ve highlighted several times to Diggers and Drillers readers, political leaders continue to beat the drums of war.

Last weekend, the US House of Representatives approved more than US$61 billion in military aid for Ukraine.

Billions more will be funnelled into Israel for its relentless assault on Gaza, and escalation against Iran.

Taiwan will also get its fair share with billions in military aid to fend off a possible future ‘attack’ from China.

No doubt the US military elite will do all they can to stir up tensions here.

We live in troubled times and the world’s largest economy is failing miserably in its role as ‘global peacekeeper.’

Overall, the US is set to deliver a colossal $95 billion in military aid.

No doubt, that will fatten the purse strings of the country’s biggest defence contractors.

Therein lies many of the problems…

Rather than engineer an agreement for peace between Ukraine and Russia, the Biden administration is determined to keep endless wars rolling on.

This gravy train feeds the likes of Boeing, Lockheed Martin, General Dynamics, and Raytheon, among others.

Meanwhile, in Gaza, the US publicly asks Israel to show restraint, yet behind the curtains, continues to bulk up the country’s war chest.

America once ruled as a moral leader, liberating Europe from Hitler’s Nazi regime.

It also defeated the Japanese Empire which inflicted atrocities all across Asia in its pursuit of regional dominance.

But the current political class continues to ignore lessons from history.

As US President Dwight Eisenhower, a former military officer who led the liberation of Europe from Nazi control in 1944, famously stated in his outgoing speech as President:

“In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military-industrial complex. The potential for the disastrous rise of misplaced power exists and will persist.”

Indeed, we’re seeing the ‘disastrous’ impact of this misplaced power today.

The emphasis remains on amplifying war and military funding rather than recovering avenues for peace.

So, how does all this relate to your

financial security?

It may seem trite to shift our discussion to growing and preserving wealth.

Don’t get me wrong, I find the government’s role in promoting war abhorrent.

They continue to ignore lessons left by truly intelligent leaders like Eisenhower.

Many look to politicians to promote peace and put diplomacy ahead of escalation.

Unfortunately, neither are happening today.

That’s why you should be thinking about protecting yourself from political stupidity.

Tensions are breaking out across commodity-rich nations.

This will affect the supply of basic minerals and energy over the coming years. That will be highly inflationary.

This is not a situation that bodes well for cash or bond holders.

Given the pressure on central bankers to moderate interest rates, there’s very little room (or appetite) to push rates higher from here, even if inflation picks up.

National debt loads are already brimming at historically high levels.

Businesses and consumers are reeling from the impacts of the 2022/23 rate-rising cycle.

If central bankers fail to respond to future inflationary pressures, the purchasing power of cash and bonds is likely to erode quickly.

So, given the global backdrop, how should investors be positioning for a return of inflationary pressures?

Focus on real-asset investments; gold, commodity ETFs, inflation-linked bonds, real estate, and even Bitcoin.

Why commodities will sit front and centre

While I truly wish the reasons were different… history tells us that major geopolitical tensions and the build-up to war are extremely bullish for metals.

The outbreak of WW1 witnessed one of the most prolific price surges on record for copper.

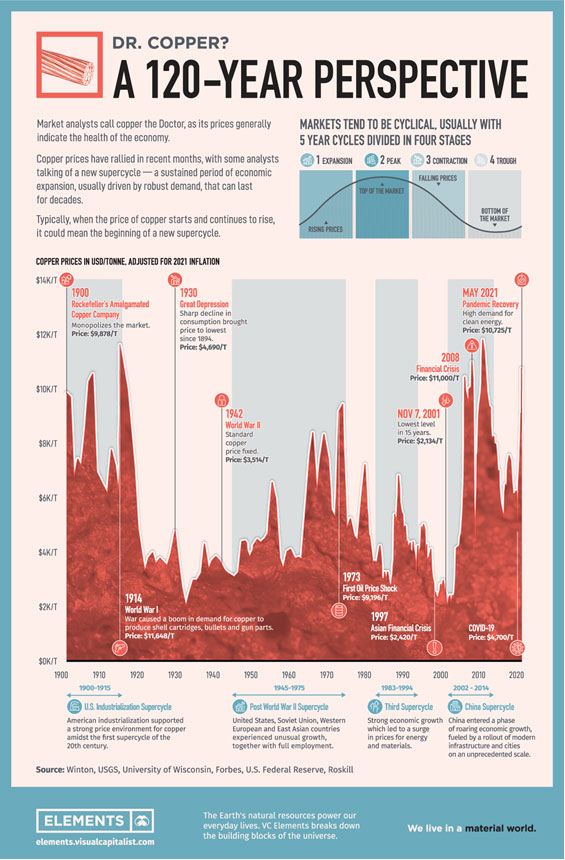

Here’s a graphic of the 120-year price history, adjusted for inflation.

| |

| Source: Visual Capitalist |

As you can see, copper reached the equivalent of US$9,878 per tonne in 1914 as the demand for bullets and other war munitions rose.

Yet, that failed to repeat in WW2.

Learning from the First World War, the US government fixed the price of copper to avoid speculation in this critically important metal.

Given the enormity and scale of that war, there was no room for free markets to dictate the price and supply of this battlefront commodity.

While not annotated, the Korean War witnessed a sizeable spike in the early 1950s.

The same thing occurred over the Vietnam War throughout the late 1960s and early 1970s.

Copper and base metals performed extremely well throughout this war-induced inflationary era.

Proof that metals will be a strong performer amid political chaos and geopolitical chest beating.

A final word, before I leave you:

While financial commentators preoccupy themselves with the energy transition or the level of growth in China to measure the outlook for commodities, they’re continuing to miss the MOST important point.

Supply fragmentation, weaponising the supply of commodities, trade hostilities and outright war…

These are the real reasons commodity prices are embarking on a new era of price inflation.

Start preparing for these consequences NOW.

Until next time.

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments