Vulcan Energy Resources Ltd [ASX:VUL] on Wednesday announced an offtake with Germany’s ‘largest municipal energy supplier.’

The offtake isn’t for lithium, however.

Vulcan, who aims to be both a lithium producer and a geothermal energy provider, struck a deal with German energy company MVV to supply it with ‘renewable heat’ via Vulcan’s proposed geothermal plants.

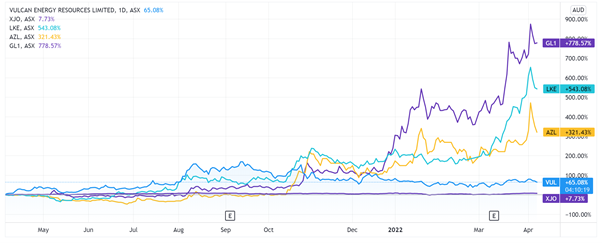

VUL was one of the hottest lithium stocks in 2021 as the electric vehicle and battery tech themes gained momentum last year.

VUL shares reached a high of $16.65 a share before facing a negative short report from J Capital.

Investor sentiment has been relatively cool ever since, with Vulcan trading 6% lower year to date.

Still, the lithium stock is up 65% in the last 12 months.

Source: Tradingview.com

Vulcan’s renewable heat offtake agreement

In a corporate presentation released on the day of the offtake announcement, Vulcan mused how best to support Germany as the country faces an energy crisis.

Vulcan thinks part of the solution lies with geothermal energy.

In its presentation, VUL suggested that Germany should ‘make greater use of the potential of geothermal energy for energy supply.’

The deal with MVV Energie is VUL’s first step to realising that geothermal ambition.

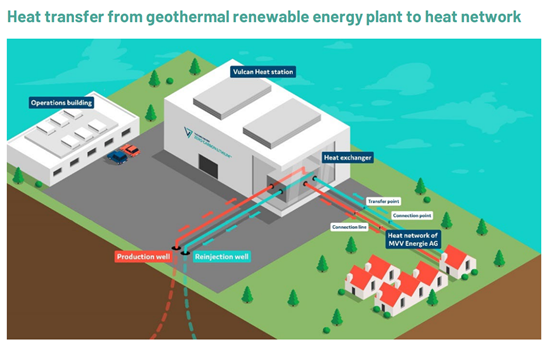

Vulcan and Germany energy supplier MVV Energie have signed a 20-year purchase agreement for 240 gigawatt hours per year of renewable heat for the German city of Mannheim.

The 20-year agreement commences in 2025 and includes the supply of at least 240,000MWh per year, with a maximum of 350,000MWh per year to Mannheim households.

This renewable heat will come from Vulcan’s planned geothermal wells in the surrounding area.

VUL said that heat will be transferred via heating grids and underground pipes that will deliver hot water or steam to buildings in the community.

MVV’s management said the agreement with Vulcan ‘secures us substantial volumes of heat from renewable sources – for the good of our climate and for greater security of supply.’

Dr Francis Wedin, Vulcan’s Managing Director, said:

Vulcan is committed to playing a leading role in Germany’s “Wärmewende”, or heat transition as the country looks to reduce its reliance on Russian energy.

This agreement represents a real and immediate step taken by a German energy utility to achieve energy security whilst not compromising on climate goals.

We believe that Geothermal renewable energy on a mass scale, combined with lithium extraction from the same deep geothermal source, can and will play an important part in achieving Europe and Germany’s energy security and independence.

Vulcan intends to build several further distributed geothermal renewable energy plants across the Upper Rhine Valley region and we are in discussions with other regional communities regarding additional heat offtake agreements.

Source: Vulcan

How did the market react to Vulcan’s geothermal deal?

According to Vulcan, Europe is the ‘world’s fastest growing lithium chemicals market, with zero local supply’.

So Vulcan’s decision to locate its lithium plant in the Upper Rhine Valley of Germany is prescient.

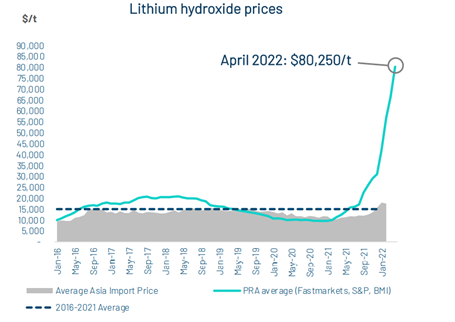

Vulcan also highlighted the strong market for lithium right now, with lithium hydroxide prices skyrocketing this year.

Source: Vulcan

But that’s lithium.

VUL’s offtake announcement was all about geothermal energy and supplying German cities with renewable heat.

Is that why the market didn’t react positively to the MVV deal, with VUL shares down 5% in midday trade on Thursday?

Is the market less enthused about the economics of Vulcan selling renewable heat to the grid than they are about Vulcan supplying Europe’s EVs with lithium?

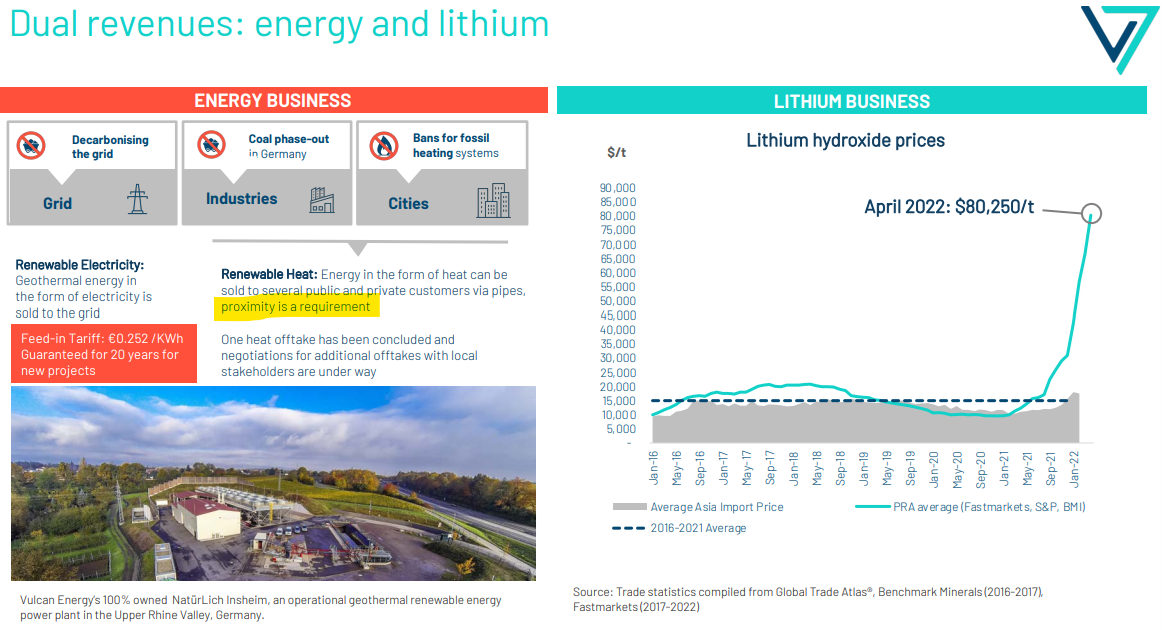

Vulcan certainly thinks its future lies with lithium and energy, making the case for ‘dual revenues’ in its corporate presentation.

Source: Vulcan Energy

How much will VUL’s energy business contribute to profits compared to its lithium business?

And how capital intensive is its plan to sell renewable heat to customers, given that it admitted ‘proximity is a requirement’?

Since the MVV offtake is only set to commence in 2025, investors will likely have plenty of opportunities in the intervening years to get some answers to the above questions.

In the meantime, are there ASX lithium stocks the market is overlooking right now in favour of high-flying juniors like Lake Resources [ASX:LKE] and Sayona Mining [ASX:SYA]?

In our latest free research report, our team at Money Morning thinks, yes, there are some overlooked lithium stocks out there.

In fact, the research report profiles three such stocks.

Access the report for free here.

Regards,

Kiryll Prakapenka,

For Money Morning