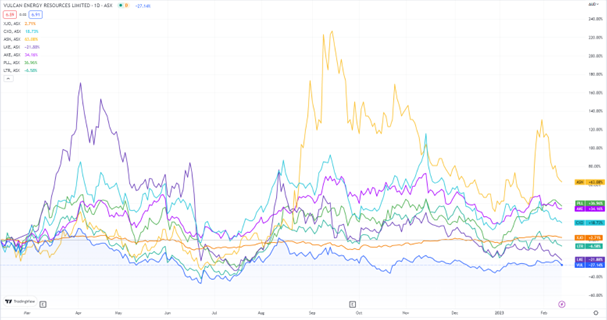

Europe-based lithium exploration and production group Vulcan Energy Resources [ASX:VUL] was slipping in share price Monday afternoon trade by more than 3.5% to $6.90 a share.

Vulcan’s shares have plummeted more than 27% in the past year, and the stock is trending more than 31.5% below its industry average.

VUL shares have fallen more than 4% in the past week alone, certainly not helped by today’s downgrade:

www.TradingView.com

Vulcan Energy completes Phase One DFS

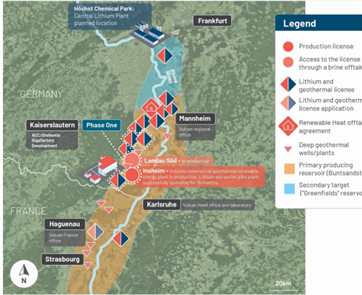

Vulcan Energy announced the completion of a Definitive Feasibility Study (DFS) on Phase One of its planned commercial development of the Zero Carbon Lithium Project in the Upper Rhine Valley Brine Field.

The geothermal energy, lithium extraction, and lithium hydroxide refining project is now confirmed to target approximately 24,000 tonnes lithium hydroxide monohydrate (LHM) annually from its Phase One development, as well as more than 300 GWh of power and 250 GWh of renewable heat production.

Vulcan’s in-house team of geologists and reservoir engineers, along with Groundwater Insight specialists, have confirmed these above targets, and the company can now focus on commencing construction for drilling geothermal brine in the second half of 2023, with lithium production to begin later in 2025.

The company said there is to be a 250% increase in estimated NPV (net present value) for the project of €3.9 billion (AU$6.09 billion) pre-tax, €2.6 billion and (AU$4.01 billion) post-tax, especially now the Phase One production target has been boosted 60%.

The company also expects to target €700 million annual estimated revenues, that’s AU$1.08 billion a year, and a targeted EBITDA margin of 84%.

Vulcan also outlined €1.4 billion (AU$2.3 billion) estimated for capital expenditure, which has been climbing rapidly — in line with larger project extensions as well as inflation — yet the company still predicts low estimated operating expenditure of €4,359 (AU$6,726) a tonne.

Vulcan’s Net-Zero Lithium Project is chalked up to 3.5 years for payback with production beginning by the end of 2025.

The lithium explorer says the Upper Rhine Valley Brine Field lithium resource has increased to 26.6Mt LCE (lithium carbonate equivalent), making it the largest lithium resource in Europe.

Dr Francis Wedin, Vulcan CEO, commented:

‘The Phase One DFS, backed up by technical data from our operating commercial geothermal wells and plant, and our operating lithium extraction pilot plants, shows compelling financial results, as well as world-leading target environmental metrics.

‘Simply put, we are showing that with the right engineering, choosing a sustainable lithium production process can be a more profitable route than legacy methods.

‘The work doesn’t stop here, it starts here, as we target start of production by end-2025 and ramp-up thereafter. This is a tight timeframe, and we recognise the significant challenge ahead of us as a growing company. To this end, we are rapidly transforming towards being a project execution and operations company.’

Source: VUL

Australia’s next commodity boom is nearly here

Speaking of lithium production and net-zero carbon emissions targets, our resources expert and geologist James Cooper thinks the Australian resources sector is set to enter a new commodities boom.

This is a boom that is likely to be brought on by the ‘Age of Scarcity’.

James is convinced ‘the gears are in motion for another multi-year boom in commodities’…and the best part is that Australia and its stocks are in prime position to reap great benefits.

You can access a recent report by James on exactly that topic, AND an exclusive video on his personalised ‘attack plan’ right here.

If that isn’t enough to sate your curiosity, you can also check out this recent interview with James and Greg at ausbiz.

Regards,

Mahlia Stewart

For The Daily Reckoning