In a detailed response, Vulcan Energy Resources Ltd [ASX:VUL] sought to refute ‘wrong and misleading’ claims in J Capital’s recent short report on the lithium stock.

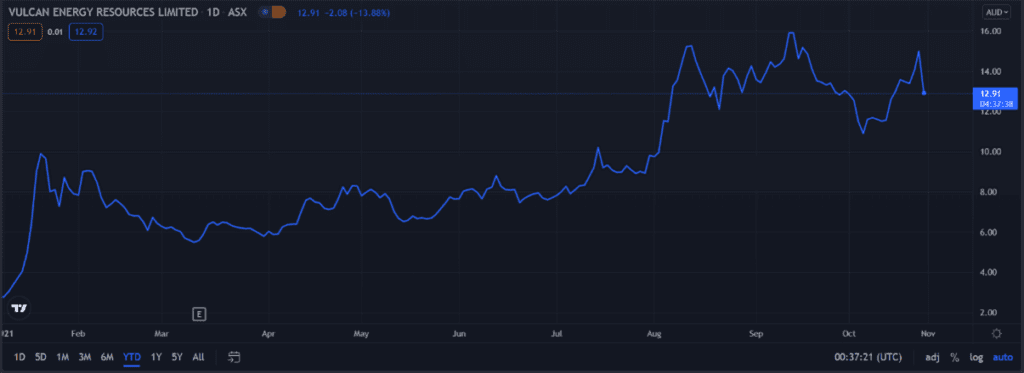

Despite its reply running to nine pages, the VUL share price buckled under selling pressure, currently down 14%.

Vulcan shares were down as much as 19% in early trade.

Today, the ASX lithium high-flyer also released its September quarterly results, posting an operating cash loss of €1.63 million.

VUL ended the quarter with €187.2 million in cash, largely thanks to €123.86 million raised from issuing equity during the quarter.

Vulcan responds to J Capital

As we covered yesterday, short-seller J Capital released a negative report on Vulcan, throwing in doubt the commercial viability of VUL’s Zero Carbon Lithium Project in Germany.

In its report, JCap asserted that VUL’s Upper Rhine Valley project ‘may never actually get under way’, alleging Vulcan’s costs are higher than the company claims, compounded by environmental concerns that may see locals block necessary permits.

Today, Vulcan responded with a ‘detailed rebuttal to the categorically wrong and misinformed claims’.

Regarding cost, Vulcan said it expects cost per tonne to be $2,640.

But even with a cost per tonne of $4,000, Vulcan thinks its project would not be ‘in the highest quartile of cost, but still the lowest quartile of cost for lithium carbonate for current production.’

VUL pointed to a 21 October report on the company from Canaccord Genuity, which it says offers a better grasp of lithium cost curves.

That report from Canaccord initiated a price target of $21 for VUL shares but did not mention lithium cost curves.

Canaccord did disclose that Vulcan currently is, or was in the past year, its client, receiving compensation for investment banking services rendered.

One of J Capital’s biggest claims centred on Vulcan’s projected flow rates.

Faster flow rates are more economical, where more lithium can be produced.

VUL has previously estimated its project’s flow rate to be 100–120 litres per second, an assumption JCap labelled as too optimistic relative to peers.

In response, Vulcan admitted:

‘As Vulcan stated 11 times within its PFS publication, we have not drilled any geothermal wells into our Greenfields development areas, and until we do so, as we have already stated on numerous occasions, risks around flow rate will remain.

‘Vulcan believes it has an appropriate level of confidence around its assumptions surrounding flow rates, based on the experience of its team, and state-of-the-art scientific tools, data and studies as elaborated below.’

But Vulcan further added:

‘Vulcan has, based on its detailed analysis and the various factors mentioned above, used between 100 and 120l/s as assumed flow rates for its projects in its PFS.

‘The Report incorrectly suggests that Vulcan should base its flow rates off some of the first wells drilled in the area, including a well drilled 41 years ago in 1980, without the benefit of 3D seismic data and industry best practice and learnings.’

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Vulcan shifts attention to September quarter results

Vulcan today also released its September activities and cash flow reports, with management labelling it a strong quarter.

The quarter was accentuated by a $200 million capital raising and further offtake agreements.

Vulcan now counts LG Energy Solution, Renault Group, and Umicore as offtake partners.

The lithium developer is targeting first phase production in mid-2024.

Vulcan Managing Director Dr Francis Wedin said:

‘We have expanded our exploration footprint and successfully completed a A$200 million capital raising, as we seek to grow our Project to service the battery and electric vehicle industry and meet increasing customer demand.

‘The recent successful production of the first battery quality lithium hydroxide monohydrate (LHM) sample from Vulcan’s piloting operations, together with securing the site for our planned Central Lithium Plant (CLP) are important milestones.’

The mention of VUL’s offtake partners raises an interesting question.

What will LG Energy, Renault, and Umicore make of J Capital’s report and Vulcan’s response?

They might not be fussed, or they may be going over their due diligence.

At this stage though, it’s an interesting question without an answer.

For some, VUL’s current predicament just highlights the great uncertainty that often prevails in assessing stocks.

But there are ways to curtail this uncertainty.

One such way is through an ingenious algorithmic aid that aims to eliminate the sway of human emotions.

If this sounds interesting, I think you’d love this recent video with our resident algorithm guru Peter Bakker.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here