Last week my colleague Selva Freigedo covered the recent pivot by Volt Resources Ltd [ASX:VRC].

As she explained, this tiny graphite producer has turned its attention to gold. Drumming up a fresh round of capital to acquire Gold Republic. A small gold company based out of Guinea, Africa.

Now, a week after that development, Volt has doubled down.

The miner has announced another gold project acquisition. Leading to a 40% surge in the VRC share price at the open this morning, a sign that investors are clearly keen on Volt’s new direction.

Reviving a forgotten project

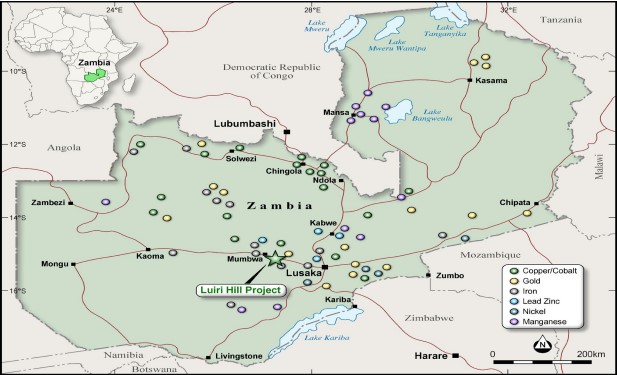

The site that Volt has snapped up is known as Luiri Hills. Which, like their first acquisition, is based in Africa. This time though it’s in central Zambia, further south compared to the Guinea project.

Here is a map of the location and nearby mineralisation:

Source: Volt Resources

Of particular note is the fact that this isn’t the first time this site has appeared on the ASX.

Luiri Gold was one of the previous rights holders to this site. A company that was listed on the ASX up until late-2017. Though they sold the rights to local vendors long before delisting.

Those vendors were Cupriferous Resources Ltd and Bukimo Mining Ltd. Two companies who will now be working in tandem with Volt to develop this project.

However, Volt will retain the bulk interest with an 85% stake.

It’s a fairly established site too.

According to Volt, over US$20 million has been spent scoping it out over the years. Including ‘extensive’ drilling and metallurgical work. Not to mention two feasibility studies as well.

Because of that, Volt’s managing director, Trevor Matthews, will be hoping for a quick turnaround. A goal that will be far more feasible with this site than most. As he comments:

‘The Luiri Hill Gold Project is at an advanced stage supported by a number of studies.

‘The opportunity to realise some cashflow from the sale of the existing on-site stockpiles to provide early funding is unique.

‘Given the substatinal increase in the gold price in the past year combined with the project’s potential supports the ability to debt fund the project development to minimise future equity requirements and can create real long-term value for shareholders.’

On paper it sounds like a great deal. And if all goes to plan, Luiri will play a pivotal role in Volt’s transition into a multi-mineral producer.

What comes next for the VRC share price?

The challenge for Volt will be in trying to take advantage of the strong price of gold right now.

This pivot is timely, but they need to actually start producing to generate cash flow. There is every possibility we could see the price of gold begin to fall if stock markets continue to rally.

All of which is largely hinging on the ongoing pandemic. Namely, how quickly we can beat it.

However, we could also see the price of gold continue to climb. Because even as stock markets surge, the broader uncertainty hasn’t disappeared.

If that were the case, then Volt could be looking at a tidy payday. As long as they can get the mines up and running, as they say. Something that investors will be keenly awaiting updates on.

There’s a reason that gold is popular right now, and Volt’s pivot to it may be a wise one.

For investors, this pivot is something you should consider carefully for yourself. Jim Rickards is one expert who believes now is the perfect time to dive into gold. Because if a bigger crash is coming, it may be your best bet at holding onto your wealth.

You can read all about Jim’s thoughts, and why you should consider gold, in his new report. Get your free copy, right here.

Regards,

Ryan Clarkson-Ledward,

For The Daily Reckoning Australia

Comments