Manufacturer and distributer of scooters and electric motorcycles Vmoto’s [ASX:VMT] share price moved slightly down on Friday afternoon.

Vmoto said that it sold 7,771 units in 4Q22, which went up 19% in FY21 and 58% in FY20.

Vmoto’s share price has fallen 8.5% over the last 12 months, and is 2.5% below its sector average in that time.

At time of writing, the VMT share price was at 37 cents.

www.TradingView.com

Vmoto’s fourth quarter 2022 adds up sales

The electric vehicle company reported a total of 7,771 units sold in 4Q22, bringing the total group’s unit sales for FY22 to 37,181 units.

The scooters and bikes manufacturer said sales figures in the fourth quarter were in line with expectations, the company having already taken into account the usual seasonal fluctuations, such as known holidays in China.

VMT noted the company was also able to mitigate against any impacts caused by the prolonged COVID-19 lockdowns in late 2022, despite China being the location the majority of its products are made.

However, VMT did not place much weight on the disruptions caused by both COVID and Russia’s invasion of Ukraine, with the company claiming that its manufacturing facility in Nanjing, China, remains fully operational with no material impact.

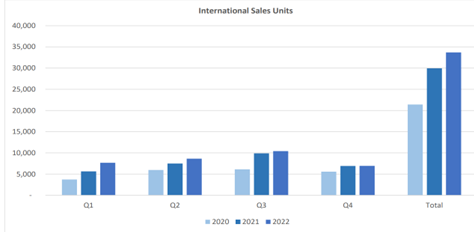

On a global note, the company reported it reached a new record for international unit sales in the full year, with a total of 33,687 units sold — an increase of 13% on FY21, and a further increase of 57% on FY20.

There was continued positive operations cash flow even in the fourth quarter, and VMT now has a fair net cash position of $28 million, with the added benefit of no debt.

As reported by the company, total cash generated from ordinary operations has increased by $9.4 million since the end of the last financial year.

The company said this reflects ‘the continued strong and profitable performance of the business whilst providing the Company with the opportunity to pursue strategic growth initiatives to further consolidate its leading position in the electric motorcycle markets’.

Source: VMT

Vmoto holds strong outlook for FY23

VMT was optimistic about its sales runway for the FY23, noting the current count of international orders had already reached 8,046 units by the end of 2022.

The company formed new international distribution partnerships late in 2022, and ongoing discussions and samples have been flagged with more potential customers.

For example, Vmoto has signed a new technology and investment agreement with Charged Asia, an Indonesian company, hoping to increase opportunities in 2023 with Indonesia being the third-largest in the motorcycle market after China and India.

VMT believes its pipeline of new deals and partnerships will enable it to fast-tack growth and place it on track to deliver a strong full-year result by end of 2023.

Is Australia on the brink of another commodity boom?

On the subject of lithium, our resources expert and trained geologist, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

Similar patterns that occurred 20 years ago are happening again.

James is convinced ‘the gears are in motion for another multi-year boom in commodities’.

A boom where Australia (and ASX stocks) stands to benefit…

The next big mining boom is predicted to happen in the next few years.

The same investors that got rich last time are preparing to make their move. Don’t let them take the monopoly again!

You can learn from James’s experiences AND access an exclusive video on his personalised ‘attack plan’ right here.

If that isn’t enough to sate your curiosity, check out last year’s ausbiz interview with James and Greg for more on the matter.

Regards,

Mahlia Stewart

For The Daily Reckoning