In today’s Money Morning…utopia or dystopia?…what is the good life?…stablecoin usage has forced central bankers’ hand…and more…

[Editor’s note: In this episode of The Money Morning Podcast, I talk to Andreas Kroell of De.Mem Ltd [ASX:DEM] about decentralised water purification and nanofiltration membranes. I then talk to Selva Freigedo of New Energy Investor about recent action in the renewables space after Scott Morrison indicated Australia will go for net-zero emissions by 2050.]

You can also watch this episode on YouTube here.

Follow The Money Morning Podcast on Spotify here and on Apple Podcasts here.

I finished yesterday’s piece ruminating on the future of money and how central bank-backed digital currencies (CBDCs) could alter political systems.

But I don’t want to be pigeonholed as just another crypto ‘evangelist’.

People like Twitter founder Jack Dorsey, who is the CEO of Square Inc [NASDAQ:SQ], may have ulterior motives for plugging crypto.

Namely, they get richer the more people buy it.

It may be a bit of a similar story with Musk and Dogecoin — you can read an explanation of the phenomenon on Forbes here.

So today, I want to zoom out even further — I want you to be clear-eyed about where things are going.

Bear with me, I think you will get some great insights into the future of money by the end of this editorial. And I’ll finish with a discussion of the CBDC/stablecoin distinction and why this is so important to wrap your head around as an investor.

Utopia or dystopia?

Let’s start with some basic questions.

What’s money for?

What is the good life?

How do we want society set up?

For answers, it may be worth consulting with Thomas More’s Utopia.

As per The British Library:

‘Sir Thomas More (1477-1535) was the first person to write of a ‘utopia’, a word used to describe a perfect imaginary world. More’s book imagines a complex, self-contained community set on an island, in which people share a common culture and way of life. He coined the word ‘utopia’ from the Greek ou-topos meaning ‘no place’ or ‘nowhere’. It was a pun — the almost identical Greek word eu-topos means “a good place”. So at the very heart of the word is a vital question: can a perfect world ever be realised?’

In the society the book describes, ‘On the economic side there is a marketplace where no money is exchanged. There is no private property, nothing is private. No locks are permitted on homes, all things are shared.’

And here’s a good passage from the book describing why this place is apparently so good:

‘Nobody owns anything but everyone is rich — for what greater wealth can there be than cheerfulness, peace of mind, and freedom from anxiety.’

Problem is, as the word implies — utopias are by their very nature, eternally elusive.

Everyone wants them and no one gets them.

They eat themselves.

The desire for utopia so frequently becomes perverted by human nature and results in a dystopia.

Hence why I think you should be wary of people who think crypto will lead to a utopia, but also sceptical of central bankers who say that CBDCs are the solution too.

Put another way, don’t get caught up in the narrative that changing money will change human nature.

Which is why I want to show you something…

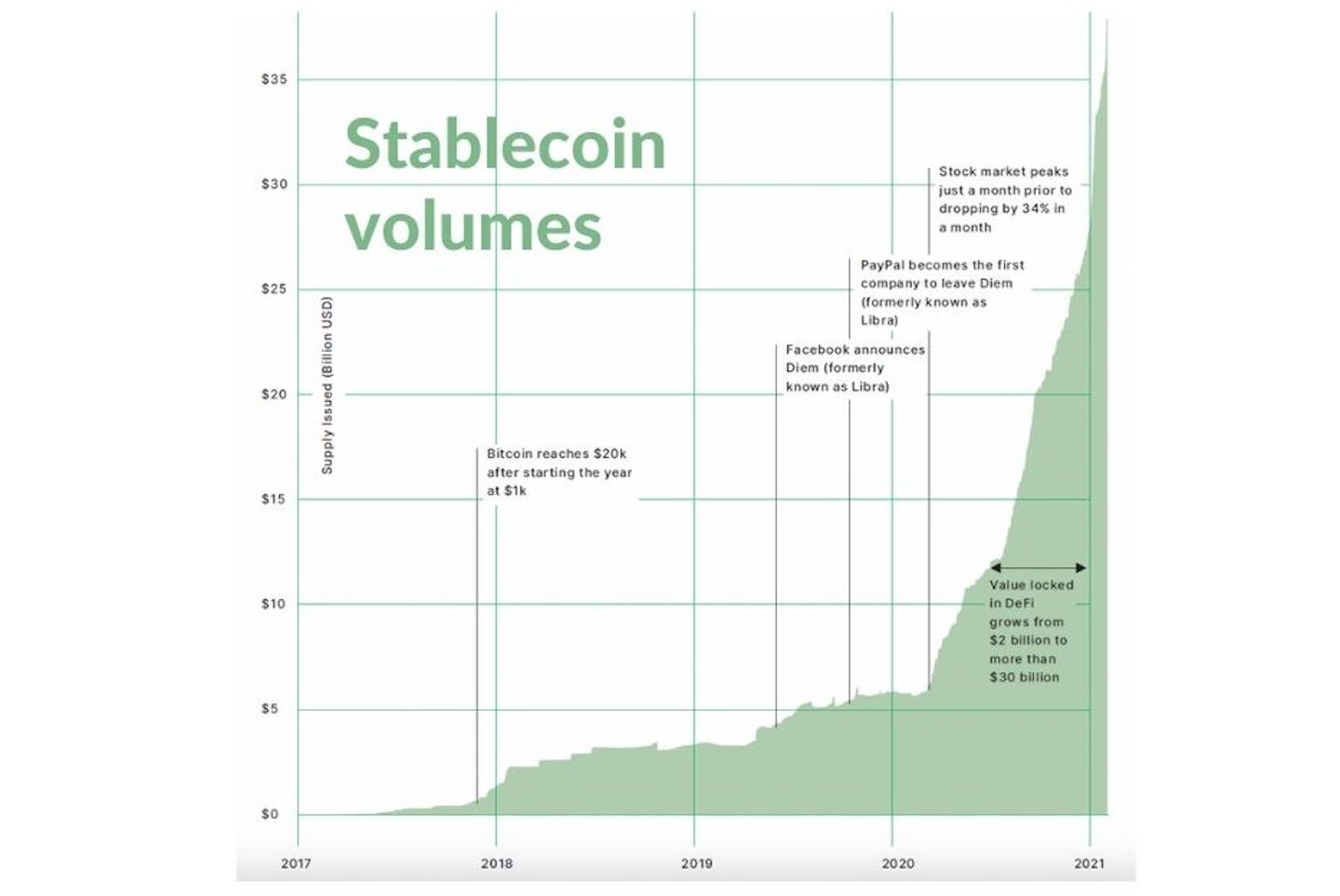

Stablecoin usage has forced central bankers’ hand

Check out the chart below:

|

|

| Source: Digfingroup.com |

This is the decentralised finance exponential (DeFi) explosion encapsulated in a picture.

Back in 2019 the Bank for International Settlements (BIS) released a report on stablecoins.

In it, the report stated that:

‘Stablecoins have many of the features of cryptoassets but seek to stabilise the price of the “coin” by linking its value to that of a pool of assets. Therefore, stablecoins might be more capable of serving as a means of payment and store of value, and they could potentially contribute to the development of global payment arrangements that are faster, cheaper and more inclusive than present arrangements. That said, stablecoins are just one of many initiatives that seek to address existing challenges in the payment system and, being a nascent technology, they are largely untested.’

Ominously concluding that:

‘Central banks, individually and collectively, will assess the relevance of issuing central bank digital currencies (CBDCs) in view of the costs and benefits in their respective jurisdictions.’

They said this in 2019, mind you.

Central bankers have been on the case for a long time — they could see the threat coming from a long way off.

Which leads to an intriguing question:

Did cryptocurrencies like bitcoin force the hand of central bankers?

Or was it actually the co-opting stablecoins that did it?

Either way, the stablecoin/CBDC rift is something that warrants your full attention as an investor.

There will be winners and losers as the concept of money morphs — perfect equality is a myth.

And remember, there is no utopia — ever.

But what you can do as an investor is start wrapping your head around these tectonic shifts in the world of money.

The sooner you do that, the better.

Regards,

|

Lachlann Tierney,

For Money Morning

[PS: Unfortunately, due to a technical error on Monday, we directed you to the wrong place to view Selva Freigedo and James Allen’s (of New Energy Investor) chat on renewables and the investment opportunities they present. We apologise for any inconvenience caused and if you’d like to view that video, please click here.]

Comments