Fintech company Tyro Payments [ASX:TYR] provided a Q1 update on Monday and raised its FY23 guidance on record transaction value growth and a cost reduction initiative.

For the quarter that ended September 2022, TYR reported $10.4 billion in transaction value, up 59% on the prior corresponding period.

Tyro also launched an $11 million cost reduction program.

TYR expects $5 million in savings to be realised during FY23 via a retrenching headcount and featuring more offshore contractors while stemming ‘discretionary expenditure’.

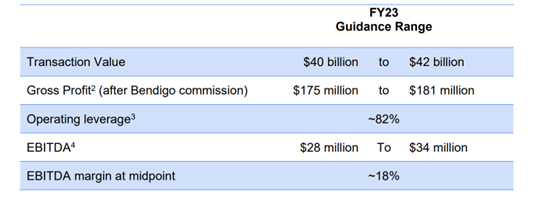

TYR expects the cost reduction program to improve the FY23 EBITDA range to $28–34 million (previously $23–29 million).

Source: Tradingview.com

Tyro’s Q1 update and FY23 guidance

On Monday, Tyro Payments released a first-quarter update and upgraded its FY23 guidance.

Here are the following highlights:

- For the quarter that ended 30 September 2022, TYR reported a 59% increase in transaction value processed by Tyro merchants ($10.367 billion, up from $6.528 billion in the same period last year).

- 4,281 new applications were received by the end of September, up from 3,659 new applications in the previous period.

- Merchant loan originations came to $32.7 million, a significant difference from the $15.2 million reported the same time previously, representing an increase of 116%.

- TYR’s earnings guidance range for FY23 has been updated with a forecasted ‘transaction value retained at between $40 billion to $42 billion, normalised gross profit of between $175 million to $181 million and target operating leverage at ~82%.’

Source: TYR

Tyro also updated on its cost reduction program, which the company brought into effect with the goal of reaching an $11 million decrease in its annualised cost base.

Tyro reported that $5 million in savings should be realised in FY23.

The program involves chasing a ‘lean organisational structure,’ reducing the company’s workforce and contractors. It also includes reductions in operational and discretionary spending.

Jon Davey, Tyro’s new CEO, commented:

‘We’ve delivered strong results in the first quarter of this financial year driven by record transaction value growth, customer applications and loan originations, alongside a clear focus on cost management. All our operating metrics are either in line with, or exceeding, expectations which, together with our new cost reduction program, gives us the confidence to lift guidance for FY23.

‘It is imperative that Tyro continues to invest for growth, but that we do so within an operating approach that reflects long-term sustainability.’

TYR’s outlook

TYR sees FY23 operating leverage moving from the previously guided 85% to the mid-point of 82%.

The company said its key initiatives and digital onboarding platform is to launch in November 2022, with its Tyro Pro next general terminal to launch in December and Tyro Go reader in the new year.

Mr Davey said:

‘Tyro Pro will offer a best-in-class experience for our merchants and, with a growing feature set, will help unlock the potential of in-store digital commerce.

‘Further demonstrating the momentum in our product roadmap, we are bringing forward availability of the Tyro Go reader in our partner channels to January 2023. This new reader provides an alternative solution for our micro merchants. Together with our digital onboarding platform, these products will drive future growth at an improved cost base and operating leverage.’

There has been speculation about Tyro being a potential takeover target. Last month, Tyro rejected an unsolicited bid from Potentia Capital at $1.27 a share.

Will today’s revised earnings guidance see potential suitors up their bids?

Time will tell.

Exciting fintech stocks

The fintech sector has long operated under the ‘growth-over-profits’ model. That worked well when markets paid most of their attention to top-line growth.

These days, however, profitability is back in fashion as businesses batten down the hatches.

With the right choices, some fintechs can grow into very sturdy, lucrative businesses.

Our market expert Ryan Clarkson-Ledward has done the necessary research required for discerning these.

He’s discovered three profitable fintech stocks flying under the radar. One of them, he says, is a start-up ‘wrestling with the big banks — and winning’.

Download Ryan’s free research report on three exciting fintechs here.

Regards,

Kiryll Prakapenka,

For Money Morning