In the competitive landscape of Singapore’s telecoms sector, Tuas [ASX:TUA] has emerged as a prominent player.

Previously part of TPG Telecom [ASX:TPG], Tuas was the Singapore arm of TPG that spun out after the merger between TPG and Vodafone in 2020.

Since then, the company has been under the capable leadership of David Teoh, Founder of TPG and its CEO until June 2020.

In the years after the demerger, Tuas stormed into the Singapore market with its telco business Simba.

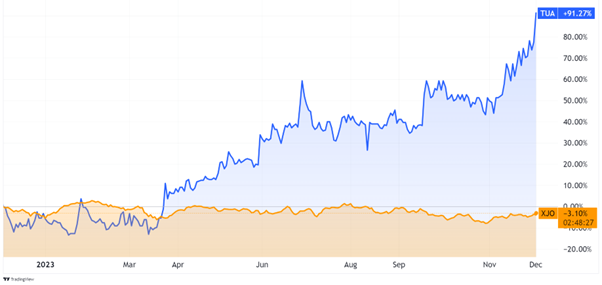

Simba is an aggressively priced and agile consumer mobile business. The company has seen its share price rise by 91.2% in the past 12 months as its customer base grew.

Now, the company is looking to take its success and evolve into a full-service telecommunications company. In its latest AGM, Mr Teoh discussed 5G coverage and the pilot launch of Fibre broadband services.

Investors bought today, impressed by the company’s growth, raising the share price by 7.8%, trading at $2.63 per share.

Source: TradingView

Strategic growth

Tuas’ journey mirrors the success of its predecessor TPG, showing a similar growth pattern. Under Teoh’s leadership, TPG witnessed a remarkable five-fold increase in equity from 2010 to 2020.

Mr Teoh has been key in implementing aggressive pricing strategies, offering 5G mobile services for 4G pricing.

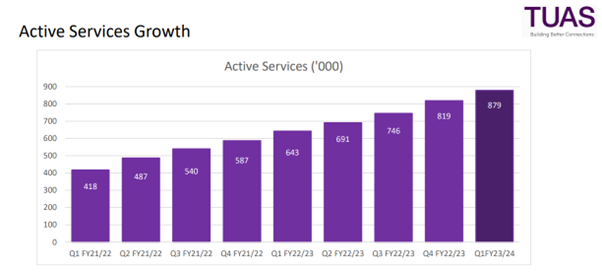

Tuas mobile phone subscriptions rose by 40% to 819,000 by the end of FY23. The company has now secured over 8% of Singapore’s mobile market.

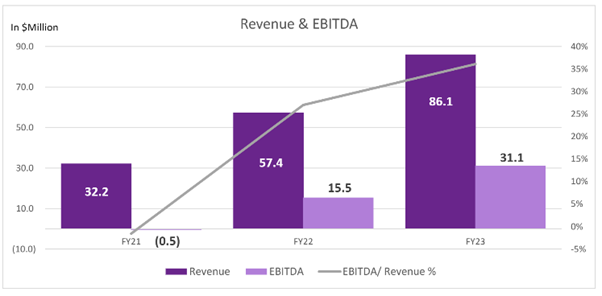

Tuas beat analysts’ expectations and increased its revenue by 50% at the end of FY23.

They also reported a doubling of EBITDA to AU$35 million, showing effective operating leverage and cost controls.

The company ended the year with a robust AU$49.7 million in net cash.

Source: Tuas (Singapore dollars)

As Mr Teoh said succinctly today:

‘FY23 was a very good year for our Company. Our Simba mobile telecommunications business in Singapore continued to gain traction in the market producing solid financial results.’

Tuas is now transitioning from a consumer mobile business to a full telecoms service provider.

This strategic shift includes the planned launch of broadband services in the first half of 2024. Later Tuas will expand into business and enterprise services.

So, can the company maintain its position?

Outlook for Tuas

Despite expectations of a slowdown in subscriber growth, Tuas has defied predictions.

The company’s strategy of minimal marketing and leveraging existing infrastructure has allowed it to maintain low operating costs.

This significantly helped its bottom line and brought the company to profitability far faster than many were expecting.

The company could become a target for acquisition in the coming year as the expansion of the 5G network begins to cost more. The company’s goals are to expand from 60% coverage to 95% coverage by the end of CY26.

This expansion will mean stepping away from piggybacking off existing infrastructure. Now that it will build its own, costs will likely skyrocket.

The company’s guidance for 2024 indicates this higher capex. However, analysts remain optimistic about positive cash flow by 2025.

Singapore was the first nation to have 5G connectivity and has one of the highest internet penetration rates globally.

While it’s a highly competitive market, Tuas’ growth is the envy of competitors.

Source: Tuas

While Tuas looks strong, challenges such as competition, spectrum constraints, and potential delays in its 5G rollout present risks.

If it can continue to ride the wave of users moving onto 5G networks, then it should be worth watching in the years to come. Tuas’ trajectory under David Teoh’s leadership suggests a strong potential for continued growth.

The expansion into broadband and enterprise services positions it well in Singapore’s telcos.

While there are risks, Tuas’ innovative approach makes it a strong case for investors seeking growth.

Is growth the thing to look for?

With the stressful state of the market, growth isn’t many people’s priority.

But despite the ASX 200 benchmark being down -4% for the year, people are still making money.

That income is from dividend companies that don’t require you to speculate on ‘the next big thing’.

Dividend stocks are the ‘Stealth Wealth’ makers of a market going sideways — simple, safer, and stress-free.

But finding the right ones takes more than just finding the best dividend payers.

Editorial Director Greg Canavan has written a simple guide to helping people find the right ones.

Click here to find out how to access the report.

Regards,

Charlie Ormond

For Fat Tail Daily