Ever heard the saying, ‘same sh*t different day’?

The drudgery of the daily grind can make people feel like they’re on a hamster wheel. Forever spinning. Never going anywhere.

While our daily life spins, so too do much bigger life changing cycles.

Slowly revolving and evolving into forces that (unknowingly) influence every facet of our ‘hamster wheel’ lives…for better or worse.

Our so-called economic success has been the product of an eight-decade-long cycle…what Ray Dalio — founder of the world’s largest hedge fund, Bridgewater Associates — calls the ‘money-credit-debt-markets-economic dynamic’.

Unless you’re a child of the Great Depression, society knows nothing other than this formula for economic growth. Without historical context, we collectively think this ‘borrow to boost GDP’ model will continue into perpetuity.

But it won’t.

You cannot live on the NEVER-EVER forever

Ray Dalio recently released ‘Part 2 of a Two-Part Look at: 1. Principles for Navigating Big Debt Crises, and 2. How These Principles Apply to What’s Happening Now’.

If you’re familiar with Ray Dalio’s work, you’ll know he’s a deep thinker.

With wealth measured in the billions, Dalio doesn’t need to share his thoughts with anyone.

But he does.

And we, the investing community, are the better for it.

The ‘My Template’ section of ‘Part 2’ should be required reading for anyone interested in understanding the dynamics behind our obsession with never-ending economic expansion.

Here’s an edited extract from ‘My Template’ (emphasis added):

‘I have a template for explaining how “the machine” works that I hope to convey in an easy-to-understand way so you and others can assess it for yourselves.

‘Very simply a) money (i.e., the access to resources) + b) talented people + c) an environment that is conducive to conjuring up and building out developments = d) economic success (and economic success contributes to all sorts of other successes such as health, education, social, and military).

‘I believe that the money-credit-debt-markets-economic dynamic is the most important dynamic to understand and to stay on top of both for investing and for understanding the changing world order, so I will start with that.

‘…it is driven by borrower-debtors, lender-creditors, and central bankers that both produce and respond to incentives to lend and borrow that lead to two interrelated cycles—a short-term one that has averaged about six years in length +/- three years and a long-term one that has averaged about 75 years +/- 25 years—which evolve around an upward trend line in productivity that is due to humanity’s inventiveness.

‘By “short-term debt cycle” I mean the cycle of 1) recessions that lead to 2) central banks providing a lot of credit, which creates a lot of debt that initially leads to 3) market and economic booms that lead to 4) bubbles and inflations, which lead to 5) central bankers tightening credit that leads to 6) market and economic weakening. There have been 12.5 of these since 1945.

‘By “long-term debt cycle,” I mean the cycle of building up debt assets and debt liabilities over long periods of time to amounts that eventually become unmanageable. This leads to a combination of big debt restructurings and big debt monetizations that produce a period of big market and economic turbulence. I believe that we are now roughly about 85% through the one that began in 1945.’

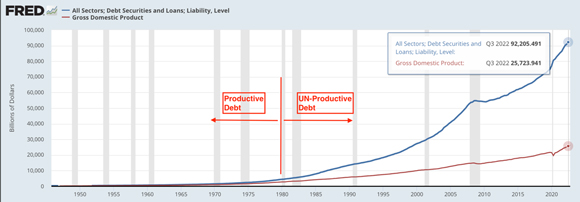

This chart illustrates how the short-term debt cycle operates within the long-term debt cycle:

- Total US Debt (public, private, and corporate borrowers) — blue line

- US GDP — red line

- US recessions — grey shaded areas

|

|

| Source: Federal Reserve Economic Data |

Since 1945, US total debt has ballooned to more than US$90 trillion — that’s Trillion with a ‘T’!

Can this disconnect between debt and economic output (which, it must be noted, has been artificially boosted by excessive levels of borrowing) continue indefinitely?

No, it cannot. We cannot live on the NEVER-EVER forever.

It’s simply NOT possible.

How productive became UNproductive

The debt super cycle that commenced in 1945 has two distinct periods — pre-1980 and post-1980.

Before 1980, the frugal Depression-era generation had a more responsible and respectful attitude towards debt. Debt was used primarily for productive purposes…not wanton spending on the latest consumer fad.

A dollar of debt generated (almost) a dollar of economic output (GDP).

Lending institutions were far more stringent in their loan criteria. Rising interest rates in the 1970s also contributed to keeping a lid on debt accumulation.

After 1980, these dynamics changed. Baby boomer consumers (eager to break free from the shackles of their austere parents) started to outnumber the older generation.

Financial institutions relaxed lending standards. And, as ‘luck’ would have it, interest rates fell…and fell hard — the perfect combination for a society of wide-eyed, debt-fuelled consumers.

Credit creation flowed through to asset price appreciation.

It’s no coincidence the ascendance of share and property markets also commenced after 1980.

Wealth was being generated like never before. Boomers were on a roll. In the midst of becoming wealthier, we rarely questioned why.

The world of prosperity — steadily increasing economic activity, rising share and property values — was taken for granted. This was how our world functioned. It was our norm.

Now, it’s become expected. Any disruption to what we’re entitled to has to be met with vast amounts of stimulus (more debt). Does anyone else see the idiocy in this?

We are living in a world of total make-believe.

But this is what happens when all you’ve ever known is a world where the blue line of Total Debt soars higher and higher with each passing year.

We have lived through an economic and investment purple patch made possible by credit creation and vacuous consumption on a scale never seen before.

The US$26 trillion US economy is supporting a US$92 trillion debt load…it takes (almost) $4 of debt to generate $1 of economic output.

Let’s join some dots here.

With interest rates on the rise, more money goes to servicing debt.

Which means less money to spend in the economy.

Which means more than US$4 needs to be borrowed to push GDP up US$1.

Which means (and this is the last ‘which means’) Total Debt goes exponentially higher.

And, you know what that means?

Yep…an unsustainable and unserviceable debt load that must inevitably collapse.

Unproductive debt is a cancer that’s eating away at the economic body.

How long before it becomes terminal?

Ray Dalio estimates the long-term debt cycle ‘averages about 75 years +/- 25 years’, and we are ‘now roughly about 85% through the one that began in 1945’.

With the average debt cycle being 75 years (plus or minus), we’re literally and figuratively ‘living on borrowed time’.

If Ray Dalio’s estimate of where we might be in this cycle (at 85%) is close to the money, then we have another decade left before this edifice to excess and hubris crumbles under its own weight.

But he could be wrong.

It could happen sooner and far more quickly than any of us expect.

In fact, one of our fellow editors here at The Daily Reckoning Australia, Jim Rickards, believes we’ll see a complete collapse and restructure of the economy as we know it today within just five years. He explains it all in his new book SOLD OUT!, which you’ll hear more about tomorrow. Keep an eye out.

I don’t know when this cycle ends, but history tells us it DOES end.

We are too far down the track to save society from the inevitable; however, at an individual level, we can save ourselves.

How?

By doing the opposite of what the majority are doing.

Reduce debt levels. Build up savings. Live within your means.

When this long-term debt cycle is over, people will, for a period, be living with a ‘different sh*t every day’.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia