Gold is in a renewed bull market, and the word is spreading around.

Last Friday I was at my son’s school when two other dads came over, asking for my thoughts on gold. And on Sunday afternoon, I received a message from another commenting about how big things are happening with gold.

To many, this is when they may start paying attention. Some may start buying gold and gold mining stocks now.

For those familiar with this market, like yourself, we’ve been doing this for some time.

With the ASX Gold Index [ASX:XGD] now trading over 10,000 points, this could cause a stampede.

In fact, now is a good time to shift our strategy a little. Not to clear out your gold stock holdings. At least not yet.

While it seems like a good time to buy, our attention isn’t on the biggest names in the space that are attracting the headlines.

That’s where the crowd is heading. So what are we going to do from here? Let’s talk about this today!

Stay ahead of the crowd

Remember this: the flow of funds moves market prices. It’s the power of supply and demand.

Many investors follow prices and trade accordingly. This is because they engage in herd mentality. There’s a perceived safety in numbers.

Moving ahead of the crowd is risky. The crowd may not be moving where you’re going, and you could become a forlorn investor holding the bag for a long time.

Gold stock investors felt this way from late-2021 to 2023, in fact. The market focused on lithium, rare earths, oil, nickel and uranium which took turns in being the hot commodities. But these commodities, uranium being the exception, have come back to the ground, some falling even further.

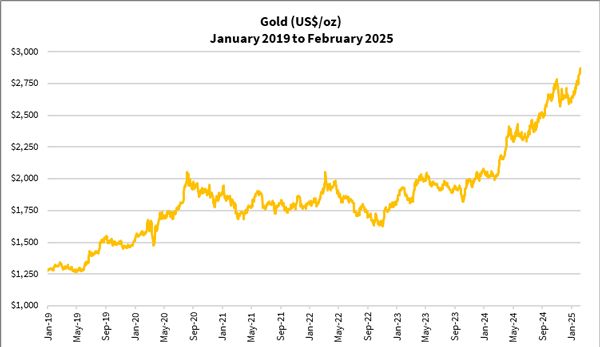

Meanwhile gold held its ground with dignity. It had a great run in 2019–20, stayed put in 2021 and then retreated around 20% in 2022, when central banks worldwide raised rates aggressively to control inflation:

| |

| Source: Refinitiv Eikon |

Gold’s retreat in 2022 didn’t seem severe relative to what a commodity bear market could do to its price. However, that was enough to take gold stocks down to levels that left many sceptical about returning, perhaps until now.

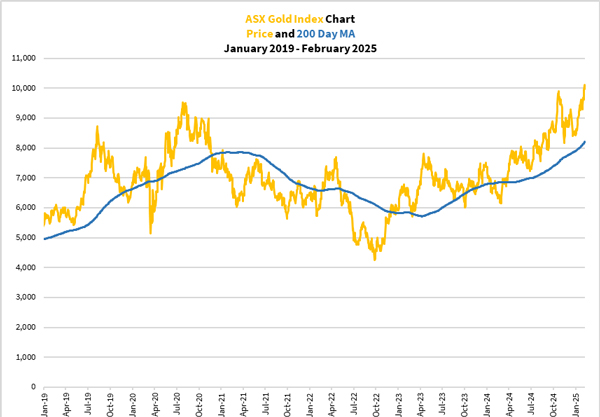

Here’s how the ASX Gold Index [ASX:XGD] performed during this period:

| |

| Source: Refinitiv Eikon |

You can call that a rollercoaster ride. I think there’s nothing better to describe that.

It’s worth noting that the index comprises the more established gold producers and developers. Individual companies, even producers like Northern Star Resources [ASX:NST], Evolution Mining [ASX:EVN] and Regis Resources [ASX:RRL] were all down by more than 50% in 2022 from their record highs in 2020. Smaller companies plunged even more, with many explorers and early-stage developers still finding their lows or trading a little above that today.

Since the outbreak of the Israel-Palestine conflict in October 2023 and the Federal Reserve’s commitment to cutting interest rates in 2024, gold and many gold stocks have taken off. This bull market is well underway, and momentum is strong.

Today, some leading gold stocks are setting new highs, or are close to it, having recovered at least 120% from their lows. Evolution Mining has recovered more than 200% from its lows. For some mid-tiers like Ramelius Resources [ASX:RMS], they’re 300+% higher than their lows in the recent bear cycle. And there are smaller companies like junior producer, Ora Banda Mining [ASX:OBM], that are up by almost 3,000% from their lows!

These companies have delivered solid returns. However, the best time to buy them was in 2022–23. In some cases, we’re taking some profits on these companies already.

And while not every company has performed like these, as you can see, the potential is there if you know where to look.

So where to from here?

Stock selection counts: We’ve found

three choice producers

I know what you’re thinking here.

No you haven’t missed this bull market, just the big names.

To enjoy potentially good gains from this point on, you must bear more risk and put in the extra effort to select the right companies. The crowd has scooped up the bigger names and driven prices up.

The crowd is about to spread out, searching for the better companies down the hierarchy.

Moreover, the larger producers are looking around for smaller companies and mine assets to add to their portfolio. They can readily make an offer as they are trading at generous valuations.

With buying pressure coming from both competitors and the crowd, which are the most desirable companies that could deliver long-term gains?

Well, you could dig around StockHead, Hotcopper and Small Caps and compete with the crowd.

Or you can get ahead of them. I’ve researched deeper to find three gold producers with strong growth potential selling at attractive prices right now.

Tune in tomorrow for further details.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

P.S: Next week, I’ll discuss how to navigate the gold price cycle and show you how to manage your investment strategy when the cycle starts turning.

Comments