‘Someday we’ll write about this.’

They were the words Dan Denning used to finish an email to me earlier in the week.

The what ‘this’ is exactly, is yet to reveal itself.

Market news has been flooding in thick and fast.

The stock market falls have been even faster.

Normally market news sticks to those who care about it…

…but somehow the despair of stocks is filtering through to everyone.

Petrol is dirt cheap. Supermarket shelves have been stripped bare.

Kids are being pulled out of school. And the headlines coming from the mainstream are making things worse.

Yes. Stocks are down. This is unprecedented. You are living through history.

And any stroll through the supermarket shelves only adds to the feeling of despair.

But let me tell you this now.

Not only will this pass…but it could hand you the most incredible investing opportunity of a lifetime…if you know where to look.

Of course, before we get to that, let’s take a look at the one sector you absolutely do not want to be in a moment longer…

[conversion type=”in_post”]

The news is grim

The markets, for lack of a better word, have been absolutely thumped.

How else do you put it?

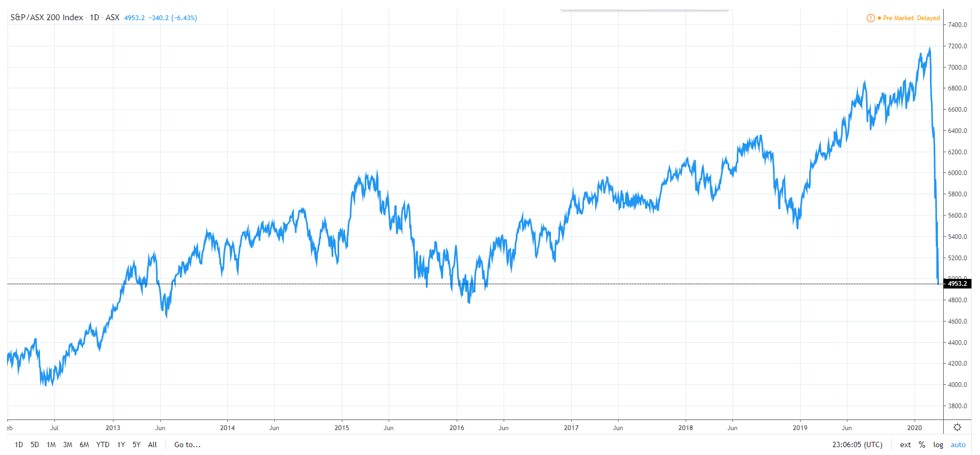

To date the ASX 200 is down more than 30% from the February 2020 peak.

And after the US overnight, the Aussie market has continued its straight line down…

S&P/ASX200 — daily chart

February 2014 to March 2020

|

|

| Source: Trading View |

Never in my lifetime did I think I would see a major index do this for so many days.

Perhaps the real questions for investors is, what the heck do we do next?

Well, at some point, we have to get back to business.

In this case, we need to get up, dust ourselves off, and start moving again.

We can’t control what happened, but we can start making choices about what to do next.

It’s important to note here too, that because of the rapid decline — the fastest in history I might add — that we will be discussing this event for months, and perhaps even years to come.

Right now the market is reacting to two things. What’s happening and what could happen.

While we know we are facing a health crisis, there are still the economic ramifications we aren’t fully aware of.

Just how long the economic impact will be felt for is yet to be known.

We’re starting to see data from China coming through. A recent article by the South China Morning Post noted that there were mostly double-digit declines across China in retail sales, manufacturing, mining, utilities, property sales, machinery, and equipment.

And what was called the great shuttering in one of the newspapers means we still can’t really measure the impact on Australia.

To boot, we don’t have an end date either.

Aussies are packing up and heading indoors. Either because their employers asked them to or because they just don’t want to risk being with gen pop, there are millions of jobs that are becoming vulnerable.

People who work in entertainment, hospitality, and retail are the ones immediately under threat.

That’s before we start looking at the jobs that go during a recession when people cut back on things, like hairdressers, beauty appointments, personal trainers, and other leisure activities.

After that, we’ll need to turn our attention to the construction industry. Here there are a million or so odd people that we pay to plumb, wire, frame or turn poles so we have houses to live in and buildings to work in.

Well, did work in.

Hundreds of thousands of people are now working from home.

In spite of the very big issues facing Australia in the long run, if you were looking for one sector of your portfolio that needs a clean-out, I think I know where to start…

Breaking with tradition

Out of all the sectors of all the markets, there is one I absolutely would not want to be holding right now: commercial property.

Back in January we didn’t know words like self-isolation or social distancing.

Now we find ourselves kilometres apart but connected through fine strings of copper cabling.

Leaving thousands of offices around the country…empty.

Yet — in one of the biggest disruptions to the economy in recent memory — the world seems to be going on as normal.

Why is that?

Because at home, we have the tools to continue with work.

In my house alone is a laptop, desktop PC, and a smartphone all with internet connection.

And here’s the thing…nothing has missed a beat. Work has continued.

From what I hear, many traditional office-bound desk jobs are going just fine from the comforts our own homes.

But with this technology marvel comes the destruction of a sector. And I reckon commercial property is going to be hit hard.

Many of us are now working remotely. We’ve quickly discovered just how many meetings can be emails or group video calls.

But as I and hundreds of thousands of others sit here and tap away, there are huge empty office buildings…just sitting there not being used.

The rent still needs to be paid. As does insurance. And even the utilities.

Then of course there are hundreds of thousands of dollars in computer equipment.

Chances are you work in an office that is bigger than is needed too.

Right now, thousands of Australian businesses have discovered that the work can be done from home.

Just how long until this unique event sees most pen pushers work from home permanently?

I’ll guarantee that the company accounts are watching.

Every day those enormous rented spaces are not being used is costing a company money. Money they perhaps can’t afford to lose in this economic environment.

At some point, the bean counters and management are going to decide that they can reduce costs by ditching the office all together…

Remember when online shopping came out in the early 2000s, and Aussie retailers ignored it and told us people still wanted to come to stores?

Well, commercial property is facing the same reckoning.

The markets are tumbling all around us.

As scary as it is, this presents investors with a unique chance.

Arguably there is some sort of reset coming to the way things are done.

Commercial property is likely the first domino to fall in a complete reshuffle of how we operate…

Nonetheless, the dust will settle on this upheaval.

When that happens the market will start rallying again.

And when that happens, you’ll want to be part of it.

How? Well, I’ll show you what I’m talking about tomorrow.

Stay tuned.

| Until next time, |

| Shae Russell, PS: Learn why a recession in Australia is coming and three steps to ‘recession-proof’ your wealth. Click here to download your free report |

Comments