In today’s Money Morning…they don’t want to admit they got it wrong…semantics won’t cut it…the viable alternative…and more…

‘In the end the Party would announce that two and two made five, and you would have to believe it. It was inevitable that they should make that claim sooner or later: the logic of their position demanded it…’

The above quote comes from George Orwell’s famous novel Nineteen Eighty-Four. It shows a horrifying imagined future in which the powers that be control everyday people through misinformation and absolute authority.

Well, sadly for the US, they’re now one step closer to living in this exact reality…

Overnight the US GDP data was released, and the result was damning. A 0.9% decline for the second quarter in a row has tipped the US economy into a technical recession.

And this comes literally the day after Jerome Powell insisted that the US would avoid this outcome. The latest gaffe in a series of ignorant or flat-out wrong comments from the Fed Chair in recent times.

It seems clear as day that Powell is unfit to lead the US Federal Reserve.

But, of course, the powers that be won’t abide by that. The US National Bureau of Economic Research (NBER) — which is responsible for officially declaring a recession — has remained silent.

Why?

Because they don’t want to admit they got it wrong.

They don’t want to tell you that the US is already in a recession.

They want you to believe that 2 + 2 = 5…

Semantics won’t cut it

Of course, the argument from Powell and others is that GDP data alone isn’t enough to call a recession.

As The Guardian flimsily reports:

‘Look at the jobs market. The unemployment rate is 3.6%, near a half-century low. Wages are also rising, although not as quickly as inflation, and 2.7 million people were hired in the first half of the year.’

Surely this positive data doesn’t mean the US is in a recession, right?

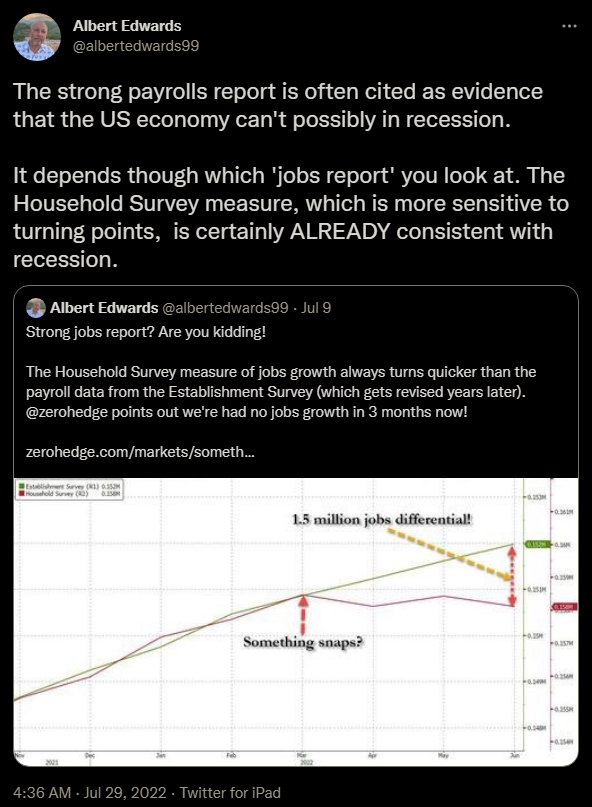

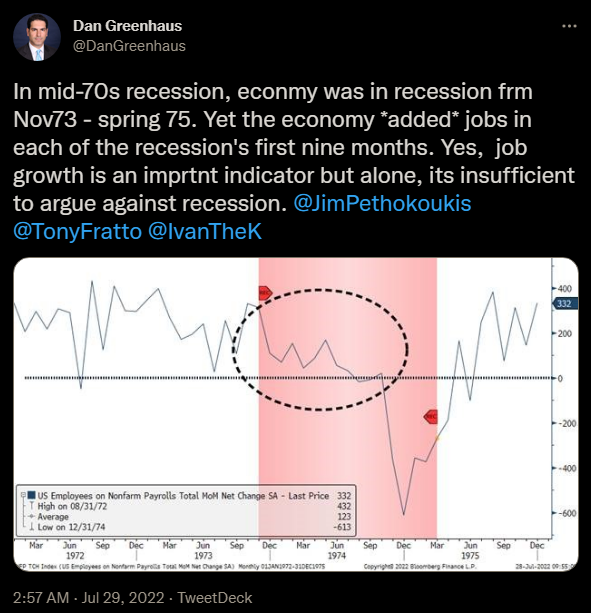

I wouldn’t count on it. Because as others have pointed out, this data doesn’t mean much when you contextualise it. Check out the two following tweets debunking this argument, for instance:

|

|

| Source: Twitter / Albert Edwards |

|

|

| Source: Twitter / Dan Greenhaus |

In the meantime, household budgets are being eviscerated by the rising cost of inflation. Consumer confidence is basically non-existent. And markets have been in a bearish mood for most of the year.

Of course, this last point is a little moot. After all, all three of the major US indices rallied in spite of this technical recession. I’d wager that’s because more and more investors will now expect the Fed to take its foot off the interest rate pedal.

In fact, as I’ve commented before, don’t be surprised if we see interest rate cuts in the near future.

However, while that may provide some reprieve for assets, the real damage is already done. Monetary policy is a farce, and the time to rid ourselves of these centralised shackles is now.

The viable alternative

OK, enough doom and gloom.

The real silver lining in all this is that despite the Orwellian sentiments, we do have an alternative.

Bitcoin [BTC], and cryptocurrency as a whole, gives people the power to take back control. As our resident crypto guru told his subscribers yesterday:

‘In amongst this chaos, bitcoin ticks along block after block, doing what it does without a care in the world.

‘There’s no meddling with its supply (fixed at 21 million and with a preprogrammed release schedule), there’s no special deals to benefit insiders, no one can stop you from transacting on it, no one can stop nodes running it, miners mining it, or developers developing on it.

‘It just works.

‘For anyone who needs it when they need it.

‘This feature of stability and dependability stands in stark contrast to the existing system.

‘And I think as time goes on, more and more people will realise that this alternate system actually has a lot of merit.

‘Indeed, if the sh!t really does hit the fan, it may be the only monetary asset left standing.’

Just keep that in mind as we see how the rest of 2022 unwinds. Because while the madness continues to unfold, the more urgent it is that you consider alternative investments like cryptocurrency.

And most of all, don’t let the powers that be gaslight you into believing that 2 + 2 = 5…

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also co-editor of Exponential Stock Investor, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.