The most consequential cryptocurrency legislation in history is set to pass next week.

After passing the Senate last month, the GENIUS Act is set to become the first major regulation of crypto ever adopted by Congress.

What does it do? It opens the door for cryptocurrencies — through stablecoins — into the very heart of our financial system.

What are stablecoins? A crypto asset whose value is pegged to another asset. Think gold, treasuries, fiat currencies.

The GENIUS Act ensures these pegs are legitimate… and ultimately linked to the US financial system.

But it’s not just America that’s behind this future financial behemoth.

Australia’s own RBA has been testing Stablecoins.

Project Acacia lays the groundwork for revolutionising institutional money movements within Australia.

Together, these developments could transform the US$250 billion stablecoin market into a US$2 trillion juggernaut within years.

This change is going to catch everyone by surprise.

Let’s look a bit deeper into what these changes mean for you and me.

The Quiet Revolution

The US House has dubbed next week ‘Crypto Week’ in honour of President Trump’s pro-crypto agenda.

The bipartisan stablecoin bill they’re pushing isn’t just another regulatory framework — it’s America’s bid to weaponise the dollar through digital means.

The significance runs deeper than regulatory compliance.

Right now, from Buenos Aires to Lagos, millions bypass their volatile local currencies for dollar-backed stablecoins.

My friends in Argentina talk about how many young people keep their entire savings in stablecoins. If they save in local currencies, they watch their value inflate away.

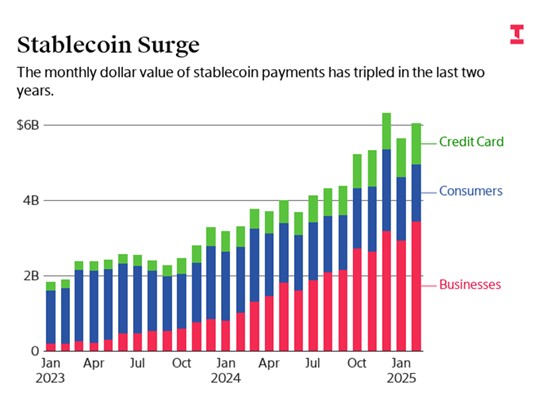

They’re not alone. Monthly stablecoin payment volumes have tripled in two years, reaching US$51 billion for all of 2024. Many of which are from developing nations.

|

|

| Source: The Information |

Stablecoins are on track for around US$80 billion in trade volume this year.

Companies that are issuing these stablecoins are exploding in value.

Circle’s IPO has surged six-fold since its IPO debut in June to a value of US$46 billion.

Tether alone has US$159 billion in tokens outstanding. Last year, with just 100 employees, it earned US$13 billion in profits. That’s not a typo.

But without clear rules, this growth has been occurring in the regulatory shadows.

Now, with the GENIUS Act, stablecoin issuers are forced to back tokens with Treasurys and other safe-dollar assets.

It demands audits and creates oversight…And it completely envelops the next generation of finance within the US system.

Treasury Secretary Scott Bessent calls it a ‘win-win-win’ — and he’s right. The private sector gets clarity. The Treasury gets new buyers for its bonds. Consumers get protection.

Most importantly, it turbocharges dollar dominance globally.

Wholesale Change

While America focuses on maintaining control of world finance, Australia is along for the ride.

The Reserve Bank’s Project Acacia isn’t about letting people buy coffee with crypto. It’s about changing how banks, funds, and institutions move billions.

Working with the Digital Finance Cooperative Research Centre and ASIC, the RBA is testing 24 different use cases for wholesale digital currencies.

They’re exploring everything from tokenised bonds to instant interbank settlements.

Think about what this means. Today, settling complex financial transactions takes days, involves multiple intermediaries, and ties up capital.

Tomorrow, a tokenised bond could instantly be exchanged for stablecoins owned by our biggest banks.

The efficiency gains are staggering. Lower costs. Freed capital. New financial products we haven’t even imagined yet.

Major banks and fintech firms are already participating in the testing here.

Within a few years, I imagine we’ll see our banks trading these internationally.

Here’s what connects these developments: stablecoins are becoming the dollar’s Trojan horse in the global economy.

Nigeria’s stablecoin Juicyway rode this wave from US$6 million to US$64 million in deposits in one year.

Kenya’s Yellow Card is helping write stablecoin legislation. Startups from Southeast Asia to South America are building on dollar-backed rails.

Central banks are terrified. The Bank for International Settlements warns stablecoins could ‘topple certain sovereign currencies.’

They’re right to worry.

When your citizens prefer digital dollars to local currency, the government’s monetary policy becomes meaningless.

Capital controls evaporate. Financial sovereignty disappears.

Investment Opportunities Emerge

This convergence creates multiple investment angles.

It’s not just about owning crypto here — like it or not — this is going mainstream.

First, think about investing in the bridges. Payment processors bridging traditional and crypto finance will thrive.

Companies helping businesses convert between stablecoins and local currencies are seeing huge growth.

Second, watch commodity traders. Tether bought a 70% stake in NYSE-listed agricultural giant Adecoagro.

They’re positioning for stablecoin-powered commodity trading — a multi-trillion-dollar market. This has huge potential to grow in Australia.

Third, don’t ignore the picks and shovels. Cybersecurity firms protecting our digital assets will be long-term winners in this future.

And of course, the obvious plays. Bitcoin and other cryptocurrencies are moving into the limelight yet again.

This week, Bitcoin hit a fresh all-time high of US$116,400, with a daily trade volume of US$50 billion.

The stablecoin revolution isn’t coming — it’s here.

Position accordingly.

Regards,

|

Charlie Ormond,

Editor, Alpha Tech Trader and Altucher’s Early-Stage Crypto Investor

Comments