It’s been around 10 days since I last wrote to you, and in that time the Federal Reserve has committed to creating a staggering US$3 trillion.

That’s as much money as was created over five years after the GFC ended in 2009!

It really is extraordinary when you think about it…

The US dollar is meant to be the world’s reserve currency. The reliable money of international trade. And yet it seems to be growing on trees!

How long can this situation last?

I don’t think it can last long at all. And the COVID-19 crisis has just fast-tracked a process which was well underway anyway.

Let me explain why the US dollar’s days are numbered…

Here’s How to Survive An Upcoming Currency Crisis. Claim your Free Guide

Abundant money can be a curse

The US has a huge advantage in having the world’s reserve currency.

They can create money at will to buy goods from abroad, to invest in foreign assets, to fund foreign wars…and what’s more, other countries are happy to finance it!

This is the special place of privilege the US has been in for the last five decades. And it’s all because the US dollar is the world’s reserve currency.

A process that was set in motion just after the Second World War, and cemented by President Nixon in 1971 when the US officially came off the gold standard.

But there’s a downside to being a reserve asset too. It artificially inflates the value of the US dollar versus other currencies.

By having a strong dollar this has meant the manufacturing base of the US is pretty uncompetitive in the international arena.

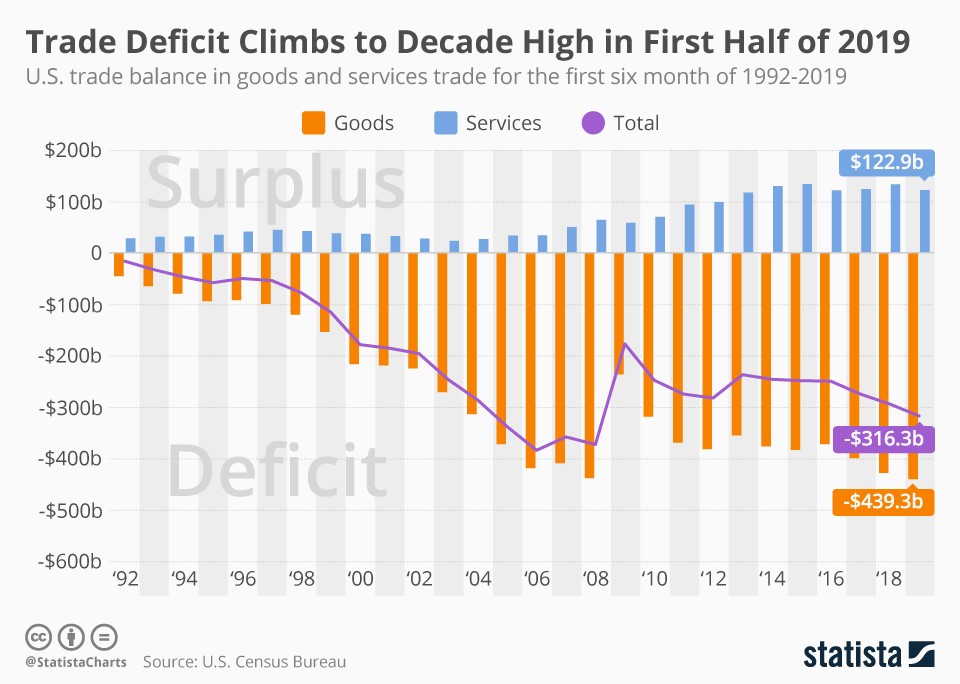

The US import a lot more than they export and have a persistent trade deficit.

|

|

| Source: Statista.com |

Now, normally a currency would weaken over time when this happens and allow the trade imbalance to correct.

That’s the theory of why floating exchange rates work.

But remember, the US dollar is no ordinary currency — it’s a reserve asset held by central banks the world over as part of their own assets. It’s also seen as a safe store of value.

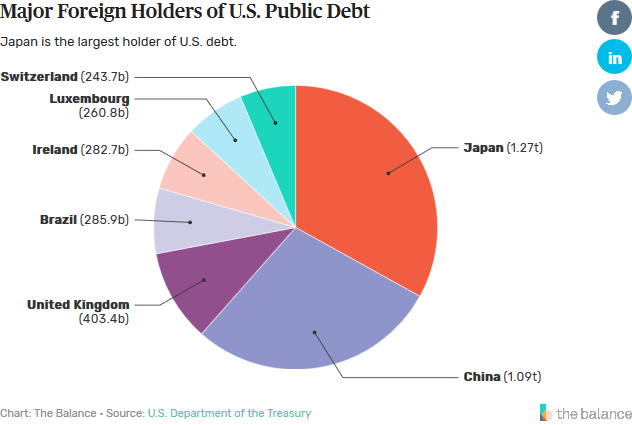

China and Japan, two huge exporters of goods to the US, hold huge amounts of US government debt.

|

|

| Source: The Balance |

Think about how strange this situation is for a moment…

US customers buy Chinese goods because they’re cheap, but they also borrow from the Chinese to pay for it!

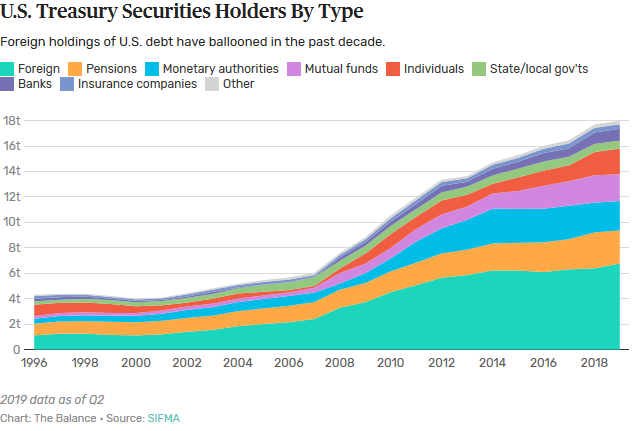

This circular process has led to a huge increase in US government debt since the ’90s. And the US government has a huge budget deficit which no one seems to be willing to address.

|

|

| Source: The Balance |

Here’s the thing…

Having an ongoing trade deficit and an ongoing budget deficit isn’t a sustainable path. And a day of reckoning was always going to come at some point down the line.

But the COVID-19 crisis just brought the end game closer…

[conversion type=”in_post”]

The shadow world needs dollars

To fix these imbalances, the US needs a weaker US currency.

That way they can export more and fix their trade balance. Jobs and employment would rise creating more tax revenue and profits to help fix the budget deficit too.

But as fate would have it, suddenly everyone needs US dollars. Which keeps the value of the dollar high in comparison to competing currencies.

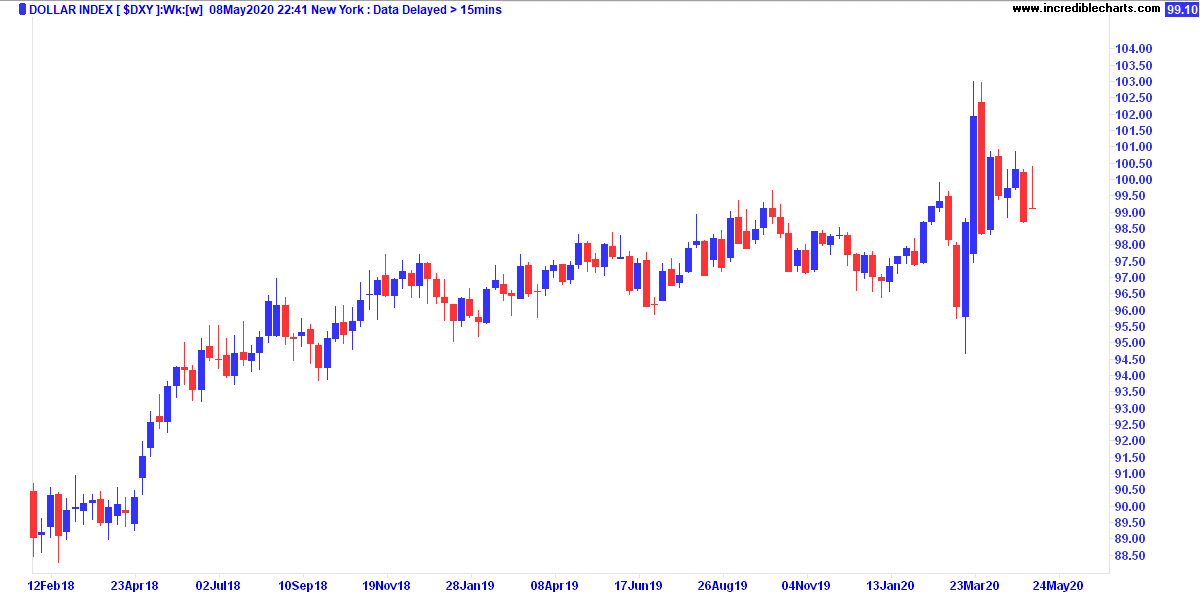

Check out the chart of the US Dollar Index [DXY], which shows the value of the US dollar versus a basket of other currencies.

|

|

| Source: Incredible Charts |

A lot of this demand is due to a shadow US dollar market that’s completely divorced from the US.

That rush for US dollars is what caused that huge spike up back in early March.

You see, a lot of foreign companies and countries prefer to borrow and lend in US dollars, even if no US counterparty is involved.

It’s known, somewhat confusingly, as the Eurodollar bond market.

Now as the virus hit and business ground to a standstill, the flow of US dollars around the world stopped too.

The $12 trillion Eurodollar market suddenly didn’t have enough dollars for borrowers to pay back their loans.

This left the US Federal Reserve in a pickle.

If they didn’t create more US dollars, then a lot of foreigners would end up selling US assets — treasuries, equities, property, and any other US assets they have — in order to get their hands on US dollars to pay their debts.

And that would cause a plunge in financial markets as everyone rushed to sell.

No one wants that.

To stop this, the Fed created swap lines — ways to provide US dollars in return for other assets as security — with other central banks to try and funnel US dollars out the country and alleviate the demand.

They also committed to standing behind US debt markets — including junk bond markets for the first time — to try and stop bond holders panic selling.

What this all means is that they’re creating US dollars at a frightening pace and they’ve committed to printing as much as is needed.

As Fed Reserve member Neel Kashkari put it a few weeks ago:

‘There’s an infinite amount of cash at the Federal Reserve.’

Never has a ‘reserve asset’ been so un-scarce!

An unlikely event I think will happen

The Fed is putting out fires for now, hoping that the money system can resolve itself before it collapses.

But the competing interests of needing a weak dollar for trade, and of being a reserve asset for foreigners, is becoming unsustainable.

The US is in a tug of war against itself. Something has got to give.

I think the unthinkable could happen.

I think there’s a chance the US will gradually let the petrodollar system, that has had the US dollar at the heart of international trade since the ’70s, start to fail.

They’ll allow oil and other commodities to be priced in competing currencies and thus decrease demand for US dollars.

That’s the only way they’ll get a weaker dollar. And it’ll come with a number of benefits for the US too.

With a weaker currency, the US trade deficit should narrow, and more jobs will be created at home. Politically this is clearly a big issue in the US right now.

But that leaves an opening in the financial system.

A space for a new reserve asset.

It could be gold, or it could be something else.

My money is on a cryptocurrency like bitcoin. Though I know many would say that’s an absurd position to hold.

But we live in a digital age and bitcoin is built for such a digital world.

It can settle instantly, it’s provably scarce, it isn’t controlled by any central party, and it doesn’t need vaults and custodians to store it.

No matter what, I think we’re going to see huge changes around the very concept of money over the months and years ahead.

It’s something you should be following very closely…

Good investing,

Ryan Dinse,

Editor, Money Morning

PS: Want to learn how to buy crypto? Download this free report for everything you need to know.

Comments