The RBA raised interest rates for the first time since 2023, lifting the cash rate by 25 basis points to 3.85%.

It was a unanimous decision by all nine board members. That marks the RBA as the first major central bank to hike rates this year.

And it’s a sharp U-turn from the three rate cuts delivered in 2025.

So what changed?

In short, we kept spending. The government, the people, the lot.

As the Board put it:

‘A wide range of data over recent months has confirmed that inflationary pressures picked up materially in the second half of 2025.’

The problem, they say, is straightforward. Private demand. Capacity is tight, and consumers keep spending while business investment has grown faster than the economy can handle.

The December quarter’s inflation figures showed inflation jumped to 3.8%, up from a 3.4% rise in the 12 months to November 2025.

That figure has now been well above the RBA’s 2–3% target band for years. And while those target bands are an arbitrary line in the sand, they’re still central bank orthodoxy.

As Governor Michele Bullock put it,:

‘As I said in December that the board was alert to signs of a pickup in inflation, and we cannot allow inflation to get away from us again.’

As for the reasons:

‘…It is evident that private demand is growing more quickly than expected and capacity pressures are greater than previously thought…Years of weak to no productivity growth is a big part of that story. ’

So, we’re all spending too much. There aren’t enough workers. Our workers aren’t productive, and prices are rising because of it.

Not ideal.

My view is this…

Australia is looking less like it’s part of the global easing cycle. It’s in an inflation containment regime, driven by supply constraints rather than demand collapse.

That leaves monetary policy doing the heavy lifting for problems it can’t solve.

Tightening financial conditions in an economy already constrained by labour, infrastructure, and productivity.

The Blame Game

Predictably, the government has rejected any suggestion that its own spending is fueling inflation.

Instead, officials point to a surge in holiday spending and the roll-off of energy rebates as the culprits behind the December spike.

It’s a convenient excuse. But the numbers tell a different story.

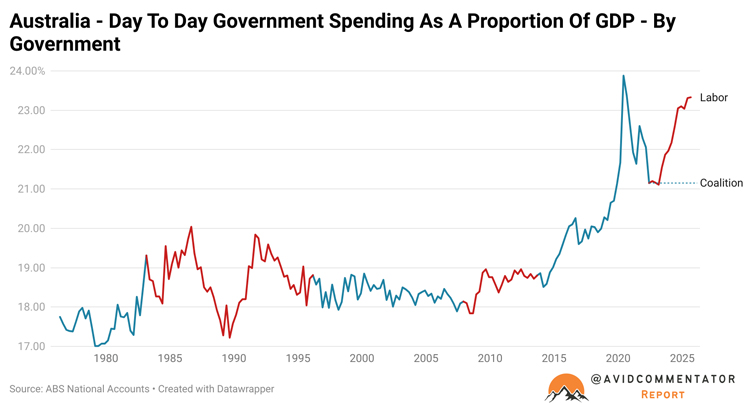

Government spending across local, state, and federal governments accounts for over 23% of GDP. As you can see below, that’s already elevated from the ramp-up seen during COVID lockdowns.

Source: Tarric Brooker

[Click to open in a new window]

That’s not a minor uptick, it’s a structural expansion that shows little sign of slowing.

Between June 2022 and 2024, growth in total government spending accounted for 55% of total GDP growth. This was higher than during any other government on record.

When productivity is stagnant, every dollar of additional spending, public or private, eventually pushes harder on prices.

Inflation in that environment inflation becomes sticky, not cyclical.

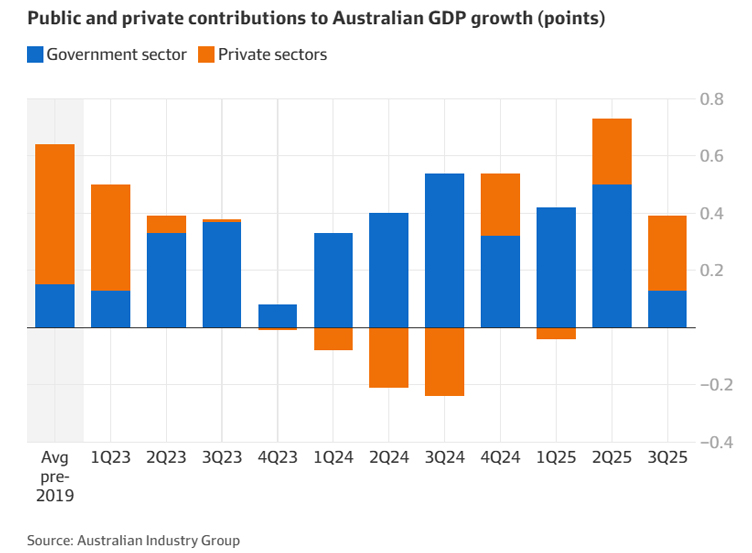

As you can see below, things are beginning to rebalance towards the private sector. But private-sector investment is still historically anemic, and rising cost pressures aren’t helping encourage investment.

Source: Australian Industry Group.

When you’re pumping that much money into an economy already running at capacity, pointing the finger at Christmas shopping seems a bit rich.

Against the Global Tide

What makes this decision remarkable is the timing.

Over in the US, traders are betting on two rate cuts this year. Europe is easing. Yet here’s Australia, swimming upstream.

The divergence has already hit markets. The yield premium that Australian 10-year bonds offer over US Treasuries is now at its widest since mid-2022.

The Australian dollar jumped 1% on the news, breaking above 70 US cents.

That currency strength helps suppress imported inflation. It also tightens financial conditions further, just as domestic demand is being squeezed.

This sends a strong message to households and businesses. Time to temper your spending.

It’s a big move. And it won’t be popular.

More to Come?

The bad news is that we might not be finished here. The board left things hanging saying:

‘There are uncertainties about the outlook for domestic economic activity and inflation and the extent to which monetary policy is restrictive.’

That’s central banker speak for ‘we don’t know if this is enough’.

Rate hikes won’t fix the problem. They’re just the only tool the RBA has.

The RBA upgraded its inflation forecasts to be materially higher for the next two years. Underlying inflation is now expected to peak at 3.7% by mid-year before slowly drifting back toward the target.

Bond traders are already pricing in more pain. Swaps markets now put a two-thirds chance on another rate hike by June. Some economists expect a follow-up hike as early as May.

The housing market certainly isn’t helping. Prices stayed strong through January. Job advertisements just posted their biggest monthly gain since early 2022. The unemployment rate sits at a comfortable low of 4.1%.

In other words, the economy is running hot while the rest of the developed world cools off.

What This Means for You

If you’ve got a mortgage, brace yourself. Variable rates will rise. And with traders pricing in more hikes to come, there’s no relief in sight.

Of the three rate cuts from 2025? Consider one of them erased and possibly two more to be reversed.

The RBA’s forecasts aren’t pretty. Of course, with the caveat that these are projections, not promises. But under the assumption that the cash rate rises to 4.3% by the end of 2026, trimmed mean inflation doesn’t reach the target midpoint until after mid-2028.

If you’re hoping for rate relief, you’re going to be waiting a while.

Australia may have dodged an official recession when others didn’t. But we’re now paying for that resilience with higher rates.

But there are always silver linings…

At least there are some great commodity stocks out there on the ASX to invest in!

If this is something you want to learn more about, be sure to read what our in-house mining expert and geology guru James Cooper has to say about the unfolding commodity boom.

He sees plenty of opportunities, and has some big ideas. Learn more about that here.

Regards,

Charlie Ormond,

Small-Cap Systems and Altucher’s Investment Network Australia

Comments