John Nash was the economist played by Russell Crowe in the film A Beautiful Mind.

A maths genius, his work on game theory — a branch of economics that looks for optimal outcomes in situations when there are many participants with competing goals — is still the standard, many decades on.

What’s less known about Nash, though, is how he applied his work to the concept of money.

He spent his final days in the ‘90s going around the world lecturing on what he called ideal money.

Amazingly, Nash said the following:

‘I think of the possibility that a good sort of international currency might EVOLVE before the time when an official establishment might occur…

‘Here I am thinking of a politically neutral form of a technological utility rather than of a money which might, for example, be used to exert pressures in a conflict situation comparable to “the cold war”.’

It turns out Nash’s prediction was very prescient.

As I’ll show you shortly, money is in the process of evolving right now.

He certainly wasn’t a fan of our current version of money.

He once described Keynesian economists — the people that try to manage the economy through control over money supply — as communists:

‘The Keynesians implicitly always have the argument that some good managers can do things of beneficial value, operating with the treasury and the central bank, and that it is not needed or appropriate for the citizenry or the “customers” of the currency supplied by the state to actually understand, while the managers are managing, what exactly they are doing and how it will affect the “pocketbook” circumstances of these customers.

‘I see this as analogous to how the “Bolshevik communists” were claiming to provide something much better than the “bourgeois democracy” that they could not deny existed in some other countries.

‘But in the end the “dictatorship of the proletariat” seemed to become rather exposed as simply the dictatorship of the regime.’

It’s clearer than ever who the powers that be work for.

Which brings me to a hypothetical bet…

The bet

Let’s say I offered you three choices.

In five years’ time, you could get either:

- $1 million (in Aussie dollars)

- One Bitcoin [BTC] (currently worth AU$42,000 as I type)

- 340 ounces of gold (currently worth about AU$1 million as I type)

But you have to make your choice now.

Which option would you take?

I’d wager, most would people would take option (a), the cold hard cash.

Though a smattering of people might choose option (c), gold, given it’s currently worth $1 million too.

Option (b), bitcoin?

Probably only true believers like me!

I mean, it’d need to go up by 23.8 times just to match the dollar value.

But today, I’m going to argue it’s not as long a shot as most people think.

More than that, I’m going to explain why what you’re betting on here isn’t obvious at first.

This isn’t any old investment. No, what you’re actually betting on here is what money actually is in the future.

Will we still use our current ‘fiat’ money?

Will we transition back to hard money like gold?

Or maybe we will move to technology-based money like bitcoin? Like Nash hinted might happen…

On that note, one famous Silicon Valley tech investor, Balaji Srinivasan, just bet $2 million that bitcoin would hit a price of US$1 million per bitcoin in just 90 days!

I have to say, even I — a raging Bitcoin bull — very much doubt that will happen. But you can read his reasoning here for yourself.

The point is, this is just one small part of a much larger story playing out.

The fact is, we are witnessing huge shifts in the battle for what ‘money’ is.

Personally, I think it’ll look radically different in five years’ time. Maybe a lot sooner if Balaji is even half right.

Either way, you need to start thinking about — and planning for — this possibility now…

End of days for the mighty dollar?

The world runs on the US dollar.

More accurately, it runs on the use of US Government debt as ‘pristine collateral’.

Though, in an ironic twist, the current US banking crisis was brought about from banks having too much exposure to it.

To paraphrase Alanis Morissette, for the banks it was ‘like having ten thousand dollars worth of US treasuries, when all you needed was $10,000 dollars!’.

Regardless, the US dollar has been the dominant form of money for many decades.

The freedom, transparency, and democratic laws of the US offered people protections not found elsewhere.

And in many cases, even foreign countries trusted US dollars more than their own!

But that has changed in recent times…

Consider this recent spate of announcements:

- Saudi Arabia enters trade alliance with China, Russia, India, Pakistan, and four Central Asian nations to step further away from reliance on the US dollar.

- China and France complete first LNG gas trade using Chinese yuan, ending reliance on the US dollar for energy trades.

- China and Brazil to settle trades in their own currencies, ditching the US dollar.

- Brazil, Russia, India, China, and South Africa (BRICS) are developing a new currency, State Duma Deputy Chairman says.

- Kenya signs deal with Saudi Arabia and UAE to buy oil with Kenyan shillings instead of US dollars.

- President of Kenya tells citizens to get rid of US dollars.

- Association of Southeast Asian Nations considers dropping the US dollar, euro, yen, and British pound for local currency financial settlements.

The US is no longer as trusted as it once one was.

And even Americans are feeling the growing debasement of their currency through sky-high inflation.

Make no mistake about it…

Wrong decisions by central bankers and politicians have contributed to this inflation. And even worse, their next moves might lead to a credit crunch…and even a new financial crisis.

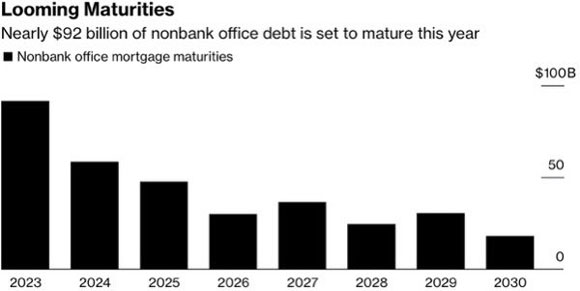

For example, check out this chart of commercial loans due for refinancing this year:

|

|

| Source: MBA |

US$92 billion is due in 2023 and US$58 billion in 2024. This will all be refinanced at much higher interest rates.

And all while 17% of US office space is vacant…

If that sector explodes, then we all know from 2008 what happens next.

More money will be created from nothing by those same decision makers that got us here!

Here’s the thing though…

All fiat currencies, whether it’s the US dollar, our dollar, the Euro, or any other currency, are all programmed to lose value over time.

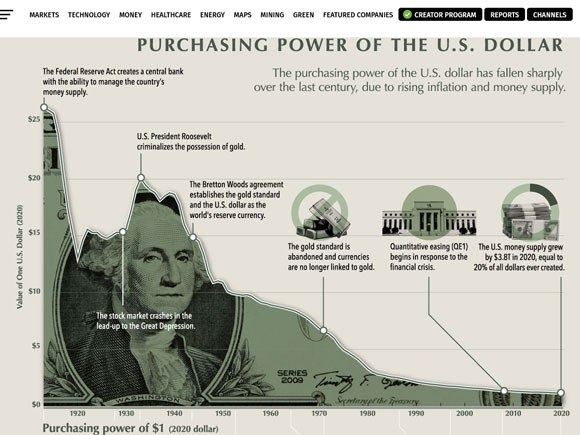

|

|

| Source: Visual Capitalist |

The purchasing power of $1 has fallen by 26 times since 1913. I mean, $1 could buy 10 bottles of beer in 1933.

As CEO of MicroStrategy Michael Saylor put it, fiat is a ‘melting ice cube’.

So, option (a), $1 million cash in five years, will buy a lot less than it does today even in a ‘business-as-usual’ situation.

And it’s far from that right now…

What you’re really betting on

What will money will be in five years’ time?

That’s the real bet here.

While that might sound like an odd question at first, it’s clearly something that is changing.

Could the status quo remain?

It could.

And it definitely won’t go down without a fight.

Just know that betting on the status quo is a bet on the existing political system of money prevailing.

In fact, if they win out, they’ll have even more control over money, probably through central bank digital currencies (CBDCs) that can be programmed at will.

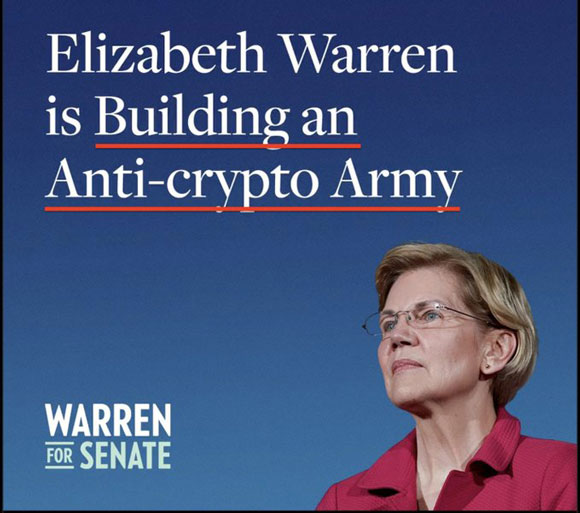

That’s why it’s probably no coincidence that far-left Democrat Elizabeth Warren has launched her re-election campaign with this provocative slogan:

|

|

| Source: Twitter |

You can clearly see what she thinks is the real threat to her ilk’s political control over money.

And it ain’t gold…

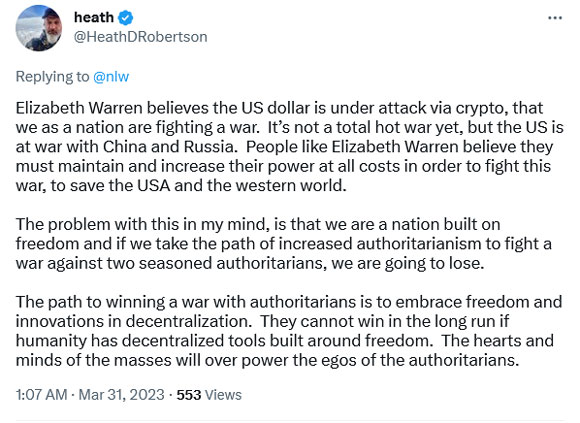

This very good tweet explains her probable reasoning:

|

|

| Source: Twitter |

A bet on gold is a bet that we’ll return to the past.

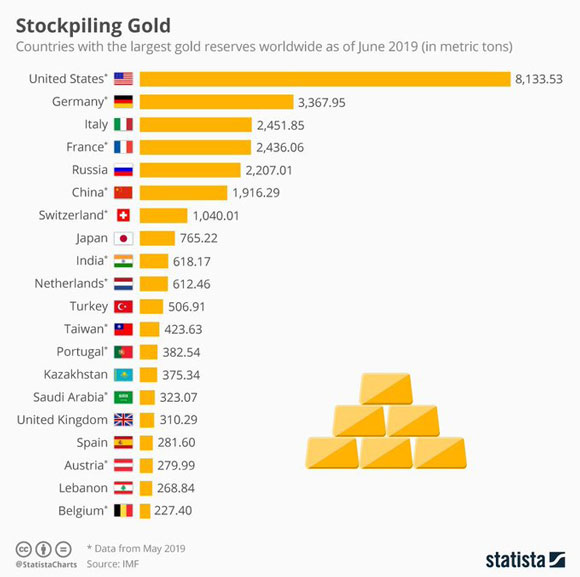

Indeed, central banks already hold a lot of gold and are buying more.

As reported:

‘On the heels of record-setting gold buying by central banks in 2022, they are continuing to stock up in 2023. The World Gold Council reported on Thursday that central banks bought 31 tonnes of gold in January. That represents a monthly increase of 16%.’

I can certainly see the idea of gold as an investment hedge. But philosophically, I can’t get behind it.

It’d still cement control of ‘money’ in the hands of governments and central bankers.

And, as this chart shows, it’d still cement control in the hands of the US:

|

|

| Source: Statista |

Like Nash, I think centralised control over money is the route of the problem. It leads to monetary dictatorships, no matter how benevolent the intentions seem to be.

Bitcoin is the only bet on a decentralised future where money isn’t controlled by anyone.

There will only ever bye 21 million bitcoin compared to a near infinite amount of fiat on offer.

It’s a neutral asset that confers the same rights no matter who you are, or where you are in the world.

Buying and holding bitcoin in your own wallet (self-custody) is not only a bet on that future, but it also helps that future manifest.

And a lot of people around the world are already convinced this is the only way to take back individual financial sovereignty:

|

|

| Source: Glassnode |

This chart shows that 68% of all bitcoin hasn’t moved in over a year — a new all-time high — despite the immense price volatility and public pressure from regulators and politicians like Warren.

The chance for an ordinary person to own one whole bitcoin is fading fast.

The key point to realise is this…

As the holders continue to grow, the price will too.

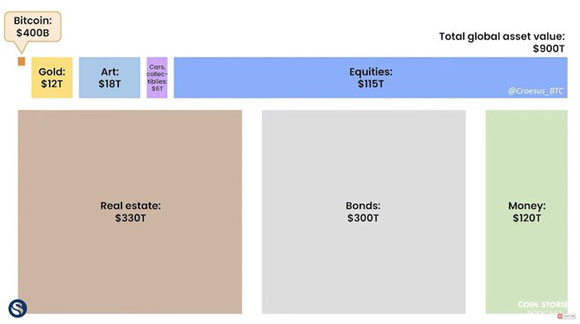

And if they’re right, the below is the potential value on offer relative to other assets:

|

|

| Source: Swan |

The potential value of bitcoin has to rise by 30 times just to match gold!

I’ve said it many times before, but I’ll say it again…

Given all this, NOT having some level of bitcoin as a small part of your overall portfolio is probably the biggest risk you can take.

Not a popular viewpoint yet, but let’s see how this plays out in the next five years…or maybe even 90 days!

Good investing,

|

Ryan Dinse,

Editor, Money Morning