This week I’m going to begin with some advice from a cartoonist.

I’ll introduce him in a second.

You might be surprised that such a profession could feature in these notes.

You shouldn’t be. A cartoonist must always keep a razor-sharp sense for the absurd, the hubris and the grandstanding.

In other words, they have a red-hot bullshit detector. That’s why they can be so funny.

That’s a very useful skill set in the financial sector, which, year after year, produces a constant stream of useless drivel.

Right now, we have an example of how handy a cartoonist can be.

Read on to find out why…

The cartoonist in question is Scott Adams. He created the famous Dilbert comic strip. He’s also an author. His book, Loserthink, is right next to me as I write this.

Loserthink is about the shoddy way humans tend to think about complicated topics.

For example, we are generally terrible at predicting the future, or even probable outcomes.

We are prone to all sorts of psychological weaknesses and quirks (me included), such as confirmation bias, the endowment effect and the sunk cost fallacy.

Scott Adams also points out another weakness. He calls it the ‘one variable illusion’.

It’s happening in the markets right now.

What is it?

It’s the ‘Trump’ illusion.

What do I mean?

Practically every move happening in the markets right now is attributed to either Trump’s election, proposed policies, personality or appointments.

America’s outlook is bright from his deregulatory agenda.

Bitcoin is going up because Trump is pro-crypto.

US stocks are soaring because Trump can cut taxes.

The Trump tariffs could hit China and commodities hard.

Trump wants to ‘drill, baby, drill’ and return fossil fuels to their former glory.

You’ve heard it all. The rough outline is to go long US stocks, crypto, fossil fuel firms, and short China and US government bureaucrats.

Apparently, the world economy and asset markets can be surmised and exploited all thanks to the Orange Man.

You might as well have him don an orange cape and turn him into a superhero.

Rarely is anything remotely complex decided by one variable. The global economy and its intertwined asset markets are certainly not, or not for long.

I’m wary of doing anything based off one factor.

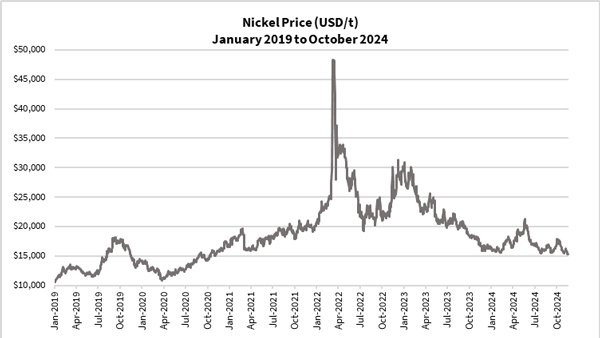

In fact, I’m reminded of how market participants lusted after nickel stocks in the electric car mania a few years ago. Nickel demand would soar from all the batteries, or so the thinking went.

I pointed out that battery demand was only 2% of the nickel market at the time. What about the other 98%? Wasn’t that important too? Nobody cared.

Turns out it was. The Australian nickel industry is now in crisis after its price collapsed.

| |

| Source: Refinitiv Eikon |

That’s the result you can end up with if you chase a one-variable illusion.

Going back to the Trump trade, here’s a quote I saw in The Economist a while back…

‘John Bolton, Donald Trump’s national security adviser in 2018-19, has simple advice for anyone trying to understand his former boss’s philosophy on foreign policy: don’t bother. Mr Bolton, who fell out with Mr Trump, says the former president has no consistent principles, only moods, grudges and an obsession with his image.’

Of course, this could be a cheap shot from a man with his own grudge now.

But the record shows that Trump’s words aren’t exactly famous for their accuracy, dedication to facts or even coherency.

Point being: any supposed Trump trade, as of now, is built on nothing but hot air.

Even if his agenda is implemented, there is still a roll call of other factors in play.

For example, if you’re interested in US stocks, you might like to check in on some of the following:

- traditional valuation metrics,

- expected profit growth,

- historic and current margins,

- business investment,

- unemployment,

- capital spending,

- buybacks,

- consumer demand,

- interest rate policy,

- geopolitical issues,

- Money supply growth

- momentum readings

- …and many more fruitful areas of research.

Or you could just run with the mainstream ‘one variable illusion’: Orange Man good!

After all, why complicate things?

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

PS: If you want to check out something with a whole lot more substance, check out my recent presentation on the ASX resurrection happening now.

Comments