The way to win a war is in the element of surprise.

And what bigger surprise is there than fooling your enemy into thinking there isn’t a war? Let them suffer losses, but don’t allow them to retaliate by keeping them unaware.

Is there a war happening?

Yes, and it’s not just between Russia and Ukraine. That is a tragic event unfolding.

But another war has been happening for decades.

In case you’re wondering, you’re fighting in this war (or you ought to be)!

I’m not kidding!

The enemy is already banging at your gates!

A fifth-generation information war

The modern-day war isn’t one fought with missiles, bullets, or boots on the ground.

The latest in warfare is information or psychological warfare.

Every day your enemy bombards you with information.

The idea is to change your behaviour slowly without making you realise that you’re working to achieve their ends.

It’s meant to change how you behave in relation to your finances, ideology, and beliefs.

Here are some examples:

Take a loan!

Invest in stocks and bonds that we recommend!

Buy a property, as it’s the easiest way to get rich!

Vote for this party for more goodies and benefits for you!

And in recent times, it’s ‘trust the experts’, as they know much better than you to save the Earth, limit the spread of a virus, and ensure that society is free from those they label as ‘extremists’.

Notice that following this advice without thinking usually leaves you in a world of trouble…but only years after you follow through.

Many households are leveraged to the hilt, and the central banks are now shafting them with rate rises in rapid succession. How many now have to fork out thousands of dollars each month to keep their ‘dream’ alive?

How did those shares and bonds the financial pundits deemed the ‘best buys of the decade’ turn out for them? Many are probably now deeply in the red because the smart money pumped and dumped.

And the ruling party that promised big before the election? They likely raised taxes on you to fund some of their promises, or they did the old ‘bait and switch’, distracting you with something else while not following through.

What has the enemy brought upon our society today as a result of them waging this war against us?

The global economy is severely crippled by lockdowns, government stimulus cheques, vaccine mandates, and draconian regulations.

Everyone can feel it.

But what’s disturbing is that the official statistics on unemployment, inflation, and economic growth would suggest the opposite.

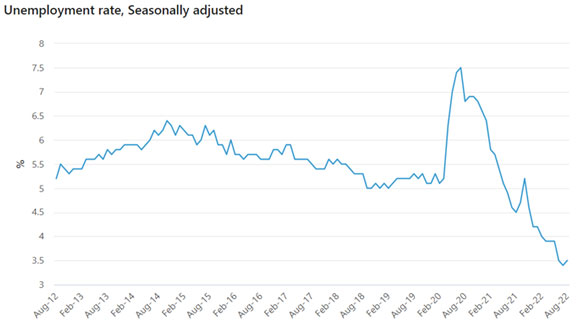

With the unemployment rate at only 3.5% and two-thirds of the working population either employed or seeking a job, statistics suggest that we’re in the best jobs market ever in the past decade (refer to the figure below):

|

|

| Source: Australian Bureau of Statistics |

Experts will have you believe that everything is fine. It’s your perception that is a problem if you believe otherwise because the official figures say so.

Look under the hood and you’ll see how they change the definitions, blatantly fudge numbers, or engage in intentional omission of crucial pieces of information.

I could think of myriad examples where they do the same thing, but you get the idea.

The enemy’s plan exposed

Things might seem desperate for us as we see that the enemy is continually gaining ground.

After all, haven’t we seen how the World Economic Forum, the governments, their media machines, and large corporations surround us?

Many have unwittingly complied with their every whim. Some who have been aware have also unwillingly submitted in order to feed their family.

But there’s hope. The reason why you’re reading this and not dismissing me as some conspiracy theorist who’s off his rockers is because there’s an opposing force working to counter or expose this enemy.

I can see this opposing force is gaining the upper hand.

I warned last year about how the mainstream media has continually spread lies that will eventually catch up with them.

Indeed, you can see it.

The enemy has sustained heavy losses with the resignations and firings of national leaders, business leaders, and media figures alike.

Let me add a note about that list. Not everyone that resigned or were fired are with the enemy.

Make no mistake, there’s anger and dissatisfaction brewing among the people against the ruling class of the elites.

But will they back down?

No. They have only one direction to go…forward.

And they’re now seeking to push their ultimate weapon against us.

It seeks to combine the financial system and our rights to freely express ourselves.

They call it a central bank digital currency (CBDC). It is a programmable system that lives on the blockchain.

The aim is to build into this system the means to track payments with the ability to control accessibility to your funds and even determine what defines an ‘acceptable’ use of your funds.

If this scares you, we are on the same side.

The enemy speaks as if they have it all in the bag. But I believe that they are far from it. They’re burying themselves in the lies that are coming back to haunt them. By then, their system will garner little support that their own forces will turn on them.

You shouldn’t leave it to chance, though.

We can prepare you for what’s to come. Check it out here.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia