Here’s Nicole Russell, a columnist for USA Today, weighing in on Trump’s latest trade triumph:

Trump’s EU deal will help blue-collar workers

Critics can hate Trump’s personality all they want, but the president’s ability to forge trade deals that favor American workers shouldn’t be discounted.

The gist of Ms. Russell’s argument is that the deal includes requirements for Europe to buy energy and military equipment from the US. This kind of stuff is made by people wearing hardhats or wielding power tools, that is…by ‘blue collar’ workers.

Ms. Russell, who lives in Texas and has four children, must not have much free time. If she had, she might have thought this through a bit further.

In the first place, why should US government policy favor one group of workers (blue collar) over another group (white collar)?

In the second place, the tariffic negotiations also favor very big businesses — oil and defense. How is that a plus for the guys who mostly work for small businesses?

In the third place, the same policies that will supposedly favor US industry output with a 15% tariff on imports also call for taxes of 50% on steel and aluminum, which must be paid by US automakers…and ultimately by auto buyers. What good does that do the guy who needs wheels to get to work?

In the fourth place, who does she think pays for the tariffs? Tariffs are essentially a tax, paid by American importers, not foreign exporters…and then, inevitably passed along to US consumers. Fox:

July tariff revenues break monthly record, with $150B collected so far in 2025

White collar…blue collar…or no collar at all — they’re all going to pay. Who else would? Dogs don’t pay tariffs. Inanimate objects don’t pay them. In the end, all government revenues must come from The People.

But wait. The only good thing about the tariffs is that they might increase the feds’ income and reduce their need for borrowing. But the geniuses in the US Senate are already finding ways to rip out that silver lining. USA Today:

Josh Hawley Introduces $600 Trump’s Tariff Rebate Bill For Working Americans

You have to wonder…if you’re going to give away money, why give it only to ‘working’ Americans? What have the feds got against retirees?

No matter. None of it makes sense. The US is running a $2 trillion deficit…and heading right for a financial crisis. It can’t afford to give money away.

Still, the trade deals are seen as a political ‘win’ for Mr. Trump. He seems to have been able to apply his tariff taxes without Congressional approval…and without setting off a brutal trade war.

The Wall Street Journal:

President Trump has achieved the remarkable: raising tariffs by more than the notorious Smoot-Hawley Tariff Act of 1930, while—it appears—avoiding the destructive trade war that followed.

Including the deal struck over the weekend with the European Union, the U.S. will impose an effective tariff rate of about 15% on its trading partners, by far the highest since the 1930s, according to JPMorgan Chase.

But will the deals stick? The New Republic:

Trump’s Big Trade Deal With Japan Is Already Falling Apart

…a new report from The Financial Times demonstrates that U.S. and Japanese officials don’t see eye-to-eye on what exactly the countries agreed upon.

Mireya Solís, a senior fellow at The Brookings Institution, told The Financial Times that the deal contains “nothing inspiring,” as “both sides made promises that we can’t be sure will be kept,” and “there are no guarantees on what the actual level of investments from Japan will be.”

It’s not exactly a done deal with Europe either. Energy Intel:

US-EU $750 Billion Energy Deal Faces Major Reality Check

Fred Hutchison, CEO of pro-US LNG export group LNG Allies, said both sides can do a lot to encourage additional commercial deals in the LNG space, but “neither government has any control over what happens commercially.

WSJ continues:

Marine Le Pen, a leader of France’s populist right-wing National Rally, which is slightly favored to win the presidential election in 2027, called the EU deal a “political, economic and moral fiasco.” Alice Weidel, leader of Germany’s far-right Alternative for Germany, wrote on X, “The EU has let itself be brutally ripped off.”

Trump got his deals because of the leverage other countries’ deep economic and security ties gave to the U.S. In coming years, that leverage will wane as those countries cultivate markets elsewhere and build up their own militaries. The resulting international system will be less dependent on the U.S.—and less stable.

The markets are less stable too. Already teetering at the tippy-top of their trading range, stocks have become even more overvalued.

More importantly, Donald Trump has raised the cost of trading with the US. He must also have increased the desire not to trade with it at all.

Regards,

Bill Bonner,

For Fat Tail Daily

P.S. This chart and comment from Investment Director Tom Dyson (who will be publishing the August Monthly Strategy Report later this afternoon):

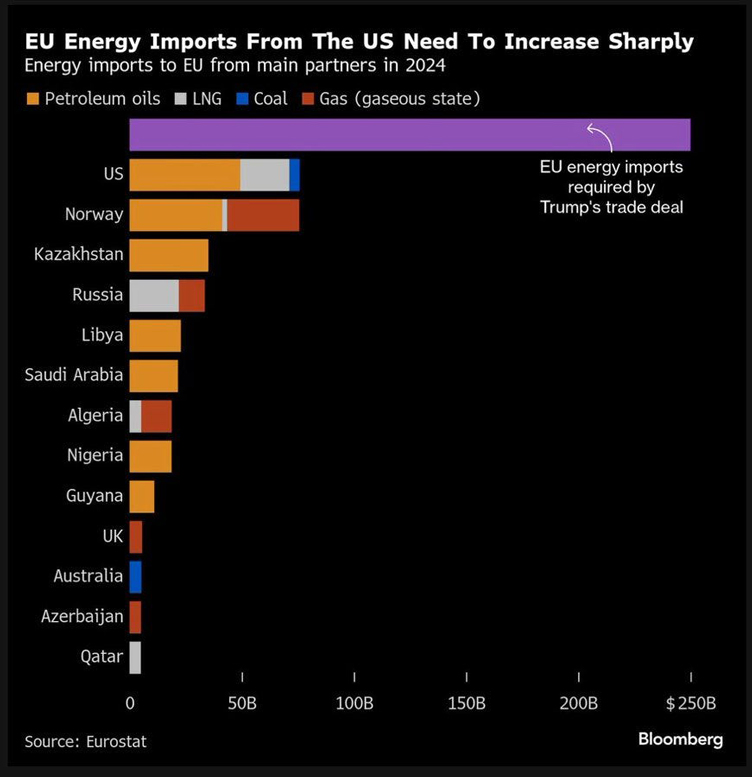

‘The $250 billion purchase of US energy the Europeans just agreed to is pure fantasy. The US is already Europe’s largest supplier. In 2024, Europe spent less than $100 billion on US energy. Where is the additional $150 billion going to come from?

Even if Europe cancelled its purchases of LNG, petroleum, coal etc. from every other supplier, and replaced them with 100% US supplies, it’d still be way short of the $250 billion agreed with Trump.

The only way Europe spends $250 billion a year on US energy is by paying twice the price!

| |

Comments