Another day, another story of an apartment building on the verge of collapse.

This time, a 10-storey tower in Canterbury, NSW.

A recent assessment from structural engineers leaked to the Herald Sun says the tower is a ‘major risk’ to occupants.

A collapse would lead to ‘catastrophic damage’ to two other apartment buildings nearby. There are already signs of heavy cracking evident.

The horror story for residents echoes Sydney’s Mascot and Opal Towers back in 2018/19.

Both towers were evacuated for similar reasons. Investors losing everything. Residents left homeless with no support.

One of the biggest beneficiaries of budget spending over COVID — state and federal combined — has been the big construction sector.

Whether house and land packages or off-the-plan apartments — we’ve already seen land values soar in new estates as ‘buyers pounce on HomeBuilder grants.’

But chasing after any newly-built property poses a massive risk for investors.

The grants that bribe home buyers into purchasing dodgy, underperforming long-term investments are just not worth it.

The problems are not limited to Sydney — or apartments.

Last year I had a letter from a reader who had fallen prey to this. He’d purchased a brand-new townhouse.

‘I have a newly built property bought off-the-plan here in Melbourne, covered under 7-year builders-warranty…

‘Yet all year, I have been struggling with extreme challenges to get them to attend to fix maintenance issues like a leaking-roof, clothes rack bedroom fell out, water-tank leaking etc

‘When paying a lot money for new-build over established I want to look after the property and last a long time (I bought new, to avoid maintenance and peace of mind yet I have had nothing but trouble with this and this builder company) etc

‘Not sure how to get them to attend to fix the maintenance-issues once and for all?

‘It is covered under the builders-warranty of off-the-plan- purchases yet they seem to not care at all?’

The truth is, of course, they don’t care.

As with everything else concerning the development sector, the insurance, although mandatory in Victoria, is not worth the paper it is written on.

There are so many loopholes in it. In my experience, getting money for repairs is excessively difficult to completely impossible.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

It is only paid out as a last resort.

When the builder dies, disappears, or is made insolvent.

Then there’s the issue of oversupply — particularly in Melbourne.

After months of draconian lockdowns, oppressive vaccine mandates on the horizon, numerous residents exiting the city, no international students flying in, and an unfolding apartment apocalypse as city vacancy rates hit record levels…it’s hard for anyone to put a date on when things will improve.

Not in the short term, that’s for sure.

Especially for big apartment developers.

This sector is in trouble.

It’s one reason state governments have pushed to get international students back to Australia ahead of the queue.

Who else is going to occupy the high-rise vacant towers and the new ones under construction?

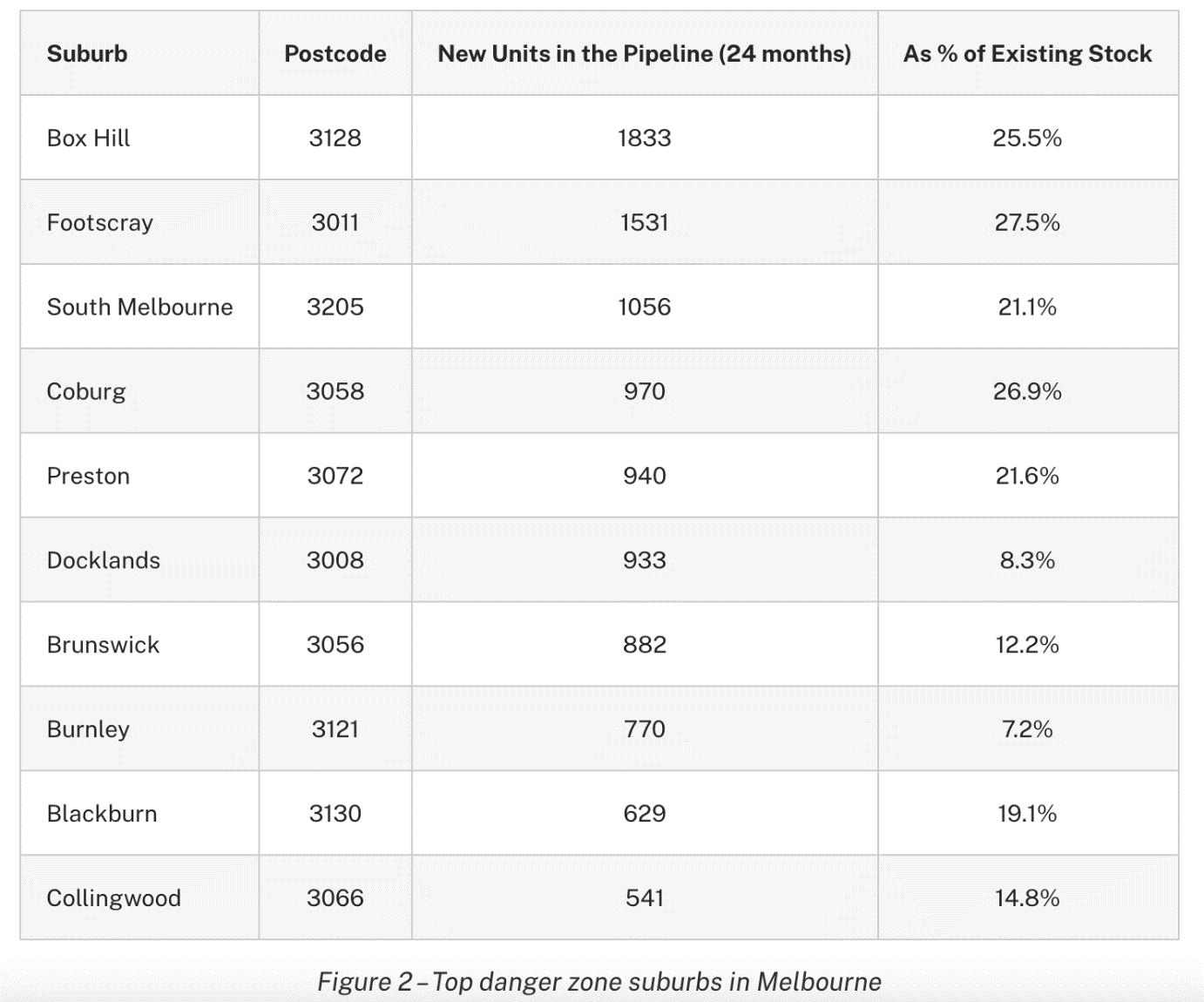

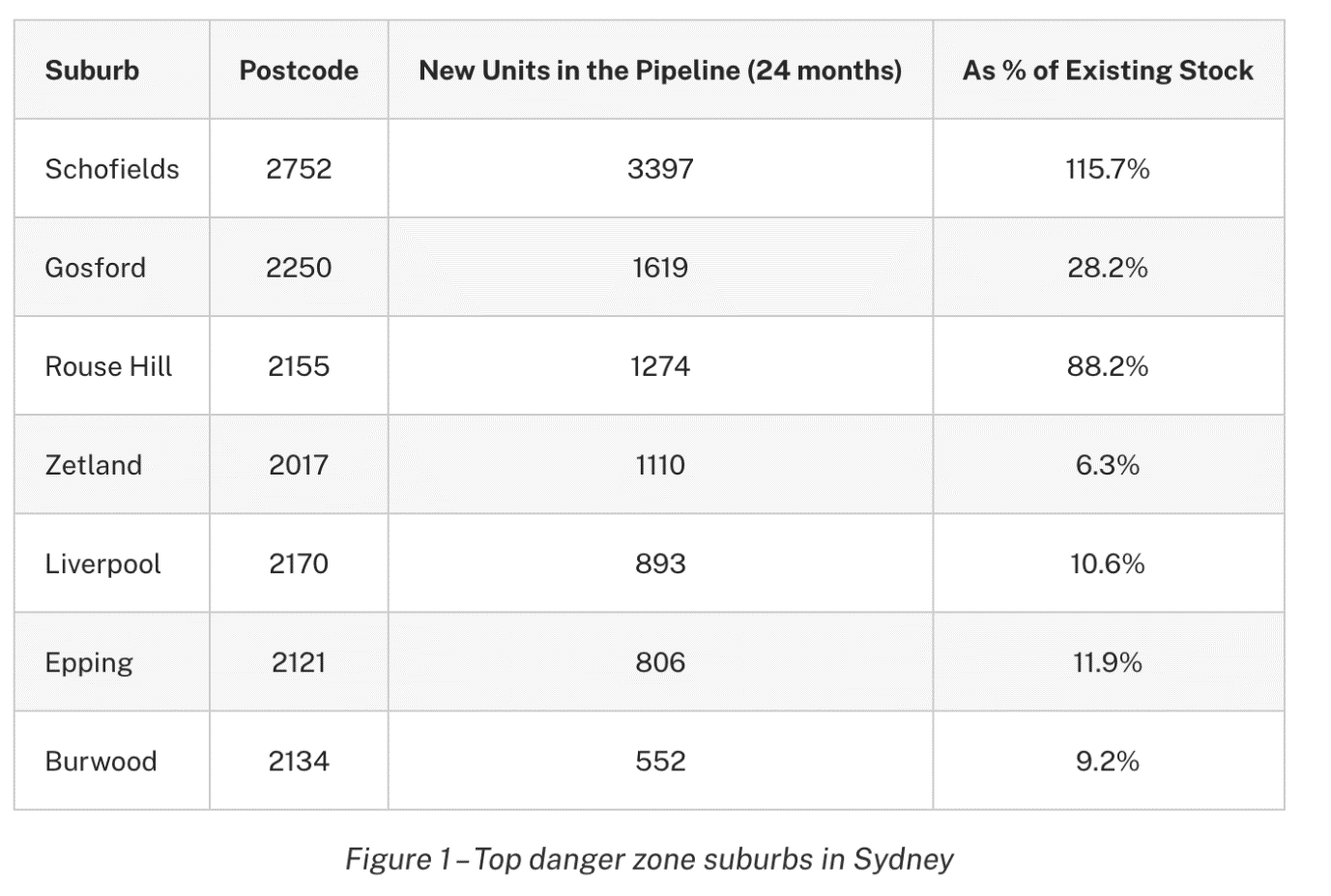

Earlier this month, my good mate Pete Wargent over at BuyersBuyers put together a list of ‘danger zone’ suburbs in Sydney and Melbourne.

The suburbs where apartments risk being massively oversupplied.

A warning for investors to steer clear.

Take a look:

|

|

|

|

| Source: BuyersBuyers |

Don’t get me wrong here.

There’s a lot of wealth to be made from property — especially if you have insider knowledge on how to time the cycle. As well as information on exactly what, where, and when to buy.

We show exactly how you can do this through stocks and property investments at Cycles, Trends & Forecasts.

For now, however, I’ll repeat the lesson again.

If you want to make money from investing in the property market — don’t buy brand-new houses or apartments.

The wealthy don’t get rich from owning buildings.

They get rich from owning land.

Best wishes,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.