I just finished a fantastic book called Apple in China…

| |

It charts how Apple came back from the dead in 1996 to becoming the world’s first US$3 trillion company.

It’s also the broader story of US-Chinese relations over the last 30 years.

It’s hard to believe now, but Apple originally manufactured in the US, Ireland and Singapore. They even had a brief foray into Wales, of all places.

Steve Jobs’s original vision was for Apple to manufacture entirely in the USA.

It wasn’t to be. The cost advantage in China was too big to ignore.

China initially offered cheap labour, special economic zones and a compliant workforce. Apple, in return, provided capital investment and expertise.

Nobody knew, even those at Apple, just how gigantic the company would become.

In turn, Apple’s investment in China skyrocketed. Apple’s money and training capitalised China’s entire electronics industry.

But it was never the plan. There was no plan. It just happened that way.

It’s not the same story today, as the book makes clear.

Apple has become so entwined with China’s deep and expert supply chain that the US tech giant can’t leave even if it wanted to.

That poses an existential problem for Apple when the USA and China are pulling further apart at the diplomatic level.

We all hear a lot about the existential threat Beijing holds over Taiwan. The same is true of Apple.

Without China, Apple’s production, margins and shipping don’t exist.

Donald Trump likes to imagine the fantasy that this can all be transplanted back to the USA.

Unfortunately, Apple couldn’t even get one high end factory in Texas to work. The workforce, the speed and tangential industry supply chain just isn’t there.

Apple only tried it for political reasons.

This is why so much of Trump’s bluster over trade and tariffs is bound to lose. Apple’s other problem is even more pressing. Trump can’t do anything about this angle.

It’s that Chinese phones are now better and lower cost than Apple can produce. Apple is losing the Chinese market to domestic brands.

Moving production to America would make Apple even less competitive than they are now.

The same story is playing out in the auto market.

German cars used to dominate China, especially at the high end. But now Chinese brands are soaring in sales and esteem.

No wonder Warren Buffett is selling his Apple stake down. The “golden period” for Apple looks over. AI tools can give the next generation of iPhones a kick, for sure.

But consider the following. Back around 2018, I remember chatting with my colleague Greg Canavan. Apple, at the time, traded on a P/E of about 13.

Yep – one of the greatest businesses of all time was going at the same rate as the general Aussie market.

Today that same P/E for Apple is 32. A big premium is built into the price. But Apple is so large now that revenue and earnings can only increase incrementally.

And now there’s the China bomb right underneath it, at all times.

Xi Jinping could squeeze Apple for more profit share, tech transfers or something, if he really wanted too.

Or he could really go after Taiwan…and blow a multi trillion hole in the US stock market…because Nvidia would go down right alongside Apple too.

The balance of power has swung toward China in a big way, compared to 30 years ago.

That’s all a bit heavy for a Monday.

But the conclusion of the book is clear: Apple is in zugzwang. That’s a chess term where any move you make leaves you in a worse position.

If Apple tries to pull away from China, they risk collapsing the delicate web that’s pulled them to these epic heights.

If they don’t diversify, they’re hostage to a potentially hostile regime and an all in bet on current trends continuing indefinitely.

I’m not sure that’s a bet I want to take.

Best Wishes,

Callum Newman,

Australian Small-Cap Investigator and Small-Cap Systems

***

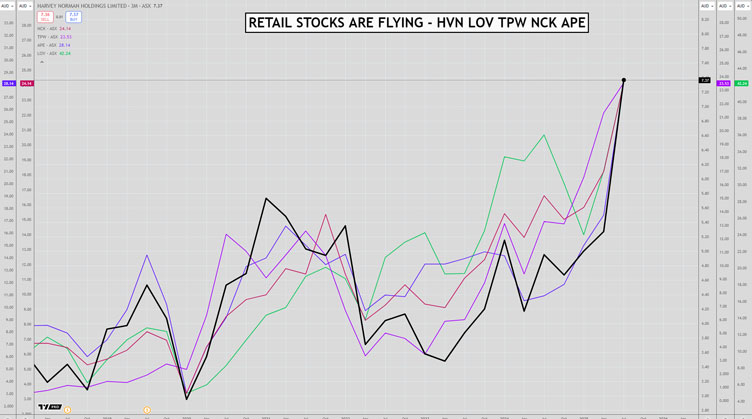

Murray’s Chart of the Day –

Retail Stocks

Source: TradingView

[Click to open in a new window]

The Australian bull market is moving into its next phase with recent earnings results showing that the consumer is finally starting to prise open their wallets.

The share prices of various consumer discretionary retail stocks have taken off like a rocket in the last few months.

In today’s chart I have compared five different retail stocks exposed to the consumer in various ways.

Harvey Norman [ASX:HVN] needs no introduction. They have broken out to a new all-time high after trading poorly since 2016.

Fashion jeweller Lovisa Holdings [ASX:LOV] is up over 100% since April. Furniture retailers Nick Scali [ASX:NCK] and Temple and Webster [ASX:TPW] have been in a strong uptrend for the last couple of years but recent results saw the buying accelerate.

Eagers Automotive [ASX:APE] delivered a 19% jump in revenue to $6.5bn in August which saw the stock up 40% last month.

With more interest rate cuts on the way it looks like the next year could see the bull market go from strength to strength.

Regards,

Murray Dawes,

Retirement Trader and International Stock Trader

Comments