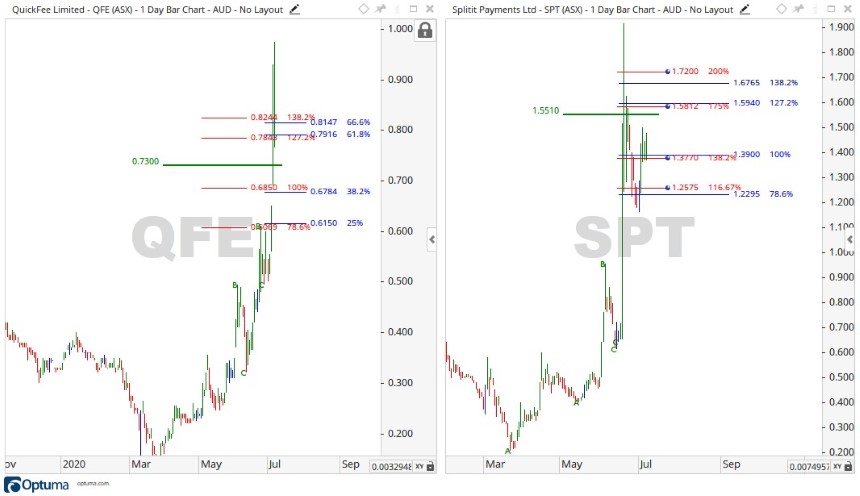

Today we are looking at Splitit Payments Ltd [ASX:SPT] and QuickFee Ltd [ASX:QFE]. Both fintech companies got a major boost in their share price through the COVID-19 pandemic, but can the run up continue?

The SPT share price is trading at $1.55, at the time of writing, and is up 13.92%, whereas Quickfee pulled back 10.37% to trade at 73 cents.

Source: Optuma

What’s happening with Splitit and QuickFee

Looking at the chart above, both stocks look rather similar in their movements, yet the underlying businesses are remarkably different.

Splitit are based in Israel and recently partnered with Mastercard to provide a buy now, pay later solution (BNPL) to customers via their existing credit card.

You can find more on this development here.

Today, Spiltit released some encouraging figures with significant growth in merchant sales volume, gross revenue, and total unique shoppers.

QuickFee on the other hand, differs in that they offer monthly payment plan solutions to white collar industries such as accountants and law firms, i.e. professional services.

Expanding into the US recently, QuickFee recorded strong growth figures, including having a top 10 US accounting firm sign up to use their service.

While both companies surged forward throughout the COVID-19 pandemic, the question now becomes how much further can their share prices go up?

Outlook for SPT and QFE share prices

Source: Optuma

While both stocks moved up strongly in the last month, the SPT share price took a fall at the end of June, but now looks to be powering out of the slump.

Should the uptrend continue, then the levels of $1.59 and $1.70 may provide future resistance.

If another retracement were to take place, then levels such as $1.38 and $1.24 could possibly provide future support.

The QFE share price on the other hand, is currently falling from the all-time high set recently, if this decline is to continue then levels of 68 and 61 cents may provide support to halt the decline.

Should it turn back to the upside, then levels of 79 and 81 cents may provide future resistance.

Regards,

Carl Wittkopp,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments