The Melbourne based online retailer is yet another example of a company doing well during the current crisis.

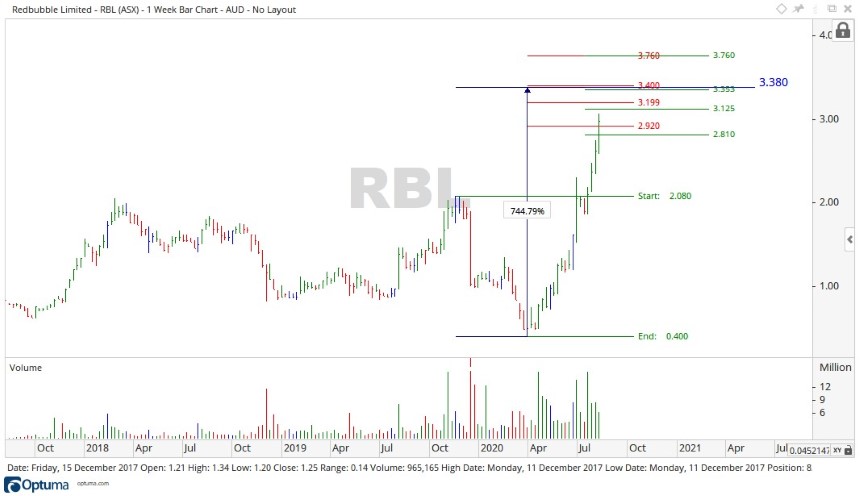

The RBL share price is soaring up to $3.38 at the time of writing, Redbubble Ltd [ASX:RBL] is making gains where others are falling apart.

Source: Optuma

What’s happening at Redbubble?

Redbubble specialise in connecting independent artists with customers through their global website.

Through their website they now have 700,000 artists with millions of customers, making everything from iPhone cases to t-shirts and everything in between.

A quick look at their sleek website shows that there is a near endless array of creative designs, something to please everyone.

In the current climate of COVID-19, with many people being locked at home, it makes sense that they would be looking for things to do, like decorate their homes, and Redbubble is a great place to find art.

Along with this, when on the Redbubble site there is now a section just for masks, of all different colours and patterns.

Obviously, these items are in very high demand right now.

All this combined pushed Redbubble’s share price to a new all-time high and gave the company some fantastic results:

- ‘July Marketplace Revenue of $49 million, up 132% (133% on a constant currency basis)

- ‘4Q2020 Marketplace Revenue of $122 million, up 107% (97% on a constant currency basis)

- ‘Y2020 Marketplace Revenue of $368 million, up 43% (36% on a constant currency basis).’

As global online sales continue to grow, online retailers like Redbubble are perfectly placed to capitalise on current events.

Where to from here for Redbubble?

With no slowdown in sight for the COVID-19 pandemic in the short term, sales should continue to be strong for the company while people are stuck at home.

Source: Optuma

Looking at the chart, we can see that since the low in March 2020, the RBL share price rose over 744% to $3.38 at time of writing.

This move up is still taking place on reasonably strong volume. Should the move up continue, then the level of $3.76 may provide future resistance.

On the downside, Redbubble is currently trading near the resistance level of $3.40.

If this proves strong enough to turn the price around, then the levels of $3.15 and $2.85 may become the future focus.

Regards,

Carl Wittkopp,

For Money Morning

PS: RBL is one of our four well-positioned small-cap stocks: these innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments