In a significant development in the ongoing turmoil, Qantas [ASX:QAN] announced today that Chairman Richard Goyder will step down from his position within the next 12 months.

The decision comes as the Qantas board bows to shareholder pressure and attempts to restore the airline’s tarnished reputation in the wake of recent scandals.

Shares in the airline are up by 2%, trading at $5 apiece as shareholders and investors welcome the news, albeit grumbling about the time it took to come to this conclusion and the delays before departure.

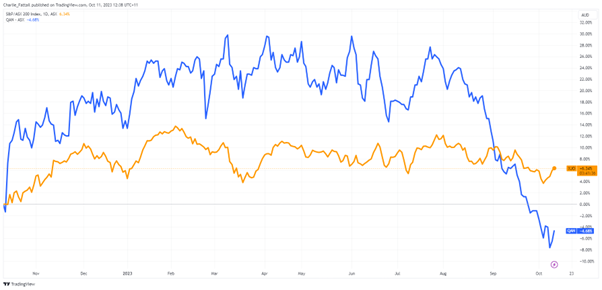

While Richard Goyder and the board failed to act, Qantas has seen its share price decline 26% since late July, dragging its performance for the last 12 months to a -5% share price loss.

Source: TradingView

Qantas chairman and two others out of the board

It has been a turbulent time for Qantas in the past few months. Once the floodgate of bad press, court cases and scandals opened, the company’s skeletons piled up faster than they could manage.

The list of scandals and regulatory gaffs is a long one; some of the highlights include:

- Competition watchdog threatens a record $250 million fine for allegedly selling thousands of ‘ghost flight’ tickets to cancelled flights.

- The High Court last month found Qantas illegally sacked 1,700 workers during the pandemic — they now face a $200 million payout for the workers.

- ACCC is also investigating Qantas for what it calls ‘slot hoarding’ at Sydney airport to block

- Qantas is accused of using the government to run a ‘protection racket’ in blocking of 21 additional Qatar Airways flights into Australia.

- Senate inquiry into the blocked flights came out yesterday with 10 recommendations, including reversing the decision and more regulation for the airline.

- Qantas was forced into a U-turn after customer backlash from customers after threatening to cancel $570 million in flight credits due to expire from the pandemic.

Eventually, the cacophony of public outcry forced Qantas ex-CEO Alan Joyce to step down in September, albeit two months earlier than his intended retirement date.

A move that was met with mixed reactions. Joyce, whose tenure was marked by significant transformations and controversial decisions, left behind a company grappling with the dual challenges of recovering from the pandemic’s impact and restoring public trust.

His eventual exit only sparked further anger as he exited the company with a $24 million remuneration package labelled ‘over the top’ by Labour cabinet minister Bill Shorten.

‘I do think the $24 million package being paid to him for going is so over the top, it’s sort of breathtaking, Mr Shorten said in September after Joyce’s exit.

Pressure then mounted on Chairman Richard Goyder and fellow board members seen as responsible for the golden handshake.

Maxine Brenner and chairwoman of the remuneration committee, Jacqueline Hey, have agreed to leave at the airline’s interim result in February, while Goyder will step down ahead of the 2024 annual general meeting.

Qantas has commenced a search to appoint new directors and says committee roles will be appointed ‘in due course’.

In a statement, Mr. Goyder acknowledged the gravity of the situation, expressing regret for the mistakes made.

‘Qantas has gone through an incredibly difficult period since our operations were grounded during the pandemic. The recovery has not been easy, and mistakes were made. We again apologise for those times where we got it wrong,’ he stated.

Goyder emphasised his commitment to acting in the best interests of Qantas and acknowledged the need for a measured and orderly succession at the board level. He affirmed his confidence in the company’s future, stating, ‘Fundamentally, the group is in a very strong position to overcome its current challenges and deliver for all its stakeholders in the years ahead.’

Outlook for Qantas

For investors and stakeholders, the news of Goyder’s imminent departure raises questions about the airline’s future trajectory.

The chairman’s exit could usher in a new era for Qantas, offering an opportunity for fresh perspectives and strategies to rebuild the company’s standing in the market.

It’s clear that Mr Goyder’s long tail of retirement is in part to maintain some stability in leadership as newly appointed CEO Vanessa Hudson finds her legs. It also appears to allow him plenty of time to pick his successor.

Shareholders will be watching the airline’s decisions regarding Goyder’s successor, anticipating a candidate with a vision to not only navigate the current challenges but also steer Qantas towards sustained growth and profitability.

That will be a challenge for an Airline that was ‘on the brink of insolvency’ after the pandemic, according to Mr Goyder and is now expected to spend large to refurbish its reputation.

The commitments that have been made to-date already signal a costly future for the company. After reporting a $2.47 billion profit in August, the company is now facing short-term costs of:

- $250 million fine for ghost flights

- $200 million penalty for illegal sacking

- $570 million in extended flight credits

- $150 million for improved customer support

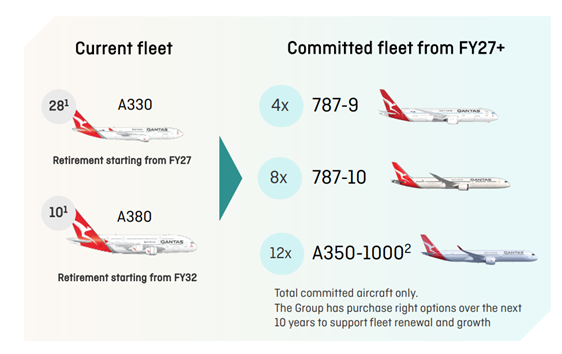

Then, the long-term forecast of $15 billion over the next five years to renew its aging fleet of planes. A significant lift from the $7 billion it spent in the previous five years.

Source: Qantas FY23 Report

The main advantage Qantas holds is market share. The anti-competitive nature of the airline industry has so far propped Qantas up— notwithstanding regulatory tweaks— that is unlikely to shift.

Qantas stands at a pivotal juncture, with the departure of Chairman Richard Goyder signalling a new chapter in the airline’s history. Mr Goyder’s legacy will be tarnished by the scandals seen throughout the year, but Qantas will likely soar again.

Markets are up today but it has been a bumpy ride for many; Australian benchmarks are down this month, and we have seen volatility permeate through oil, gold, and bond markets.

In uncertain times, defensive positions often mean looking for companies that will weather the storm and provide dividends.

Finding dividends that are worth your time

The market has roiled stock investors for the past year — the ASX200 is up a mere 0.49% in 2023.

With things looking uncertain in the stock market, maybe it’s time to change tactics.

Smart investors are focusing on quality stocks that can provide safety and pay dividends.

But blindly buying the ‘best dividend-payers’ could be a fruitless move beyond the short term.

That’s why our investing expert and Editorial Director, Greg Canavan, has spent his time finding the smart move.

He calls it the Royal Dividend Portfolio, and he believes it’s the sweet spot between growth and dividends.

If you think you’re overexposed in uncertain times or simply too defensive with cash and bonds, you may want to consider making a smart play.

Click here to learn more about what that looks like.

Regards,

Charles Ormond

For Money Morning