The Pushpay Holdings Ltd’s [ASX:PPH] share price was up 8.7% at 2:00pm on news that the Huljich family sold their stake to US$50 billion investment firm Sixth Street.

Peter Huljich and Christopher Huljich, substantial shareholders in Pushpay, yesterday entered into agreements with Sixth Street to sell 100% of their Pushpay shares to the global investment firm.

Dual-listed Pushpay reported that Sixth Street would now become the company’s largest shareholder.

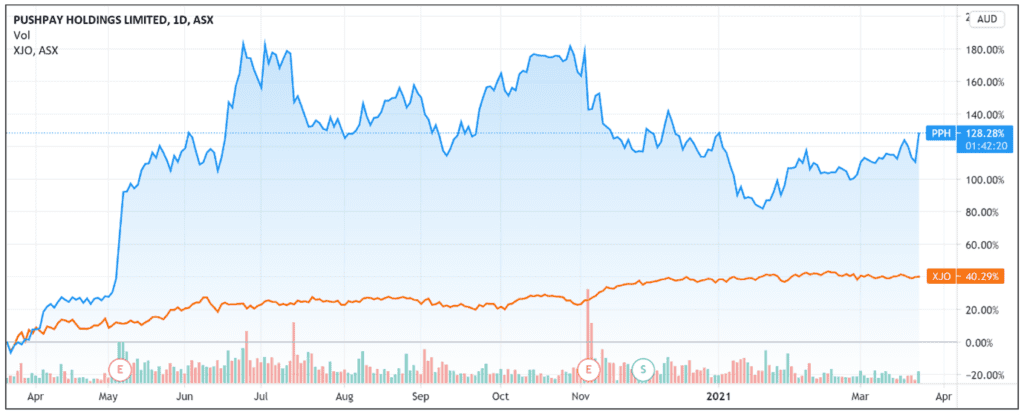

The announcement saw the Pushpay share price continue their rebound from a three-month low in January.

The company’s share price is up 6.8% over the last week and up 10% over one month.

Despite the January trough, Pushpay shares are up 140% over one year.

Pushpay was founded in Auckland by Chris Heaslip and Eliot Crowther when the pair sought to create digital alternatives to the usual cash donation in churches.

It now has a large market presence in the US, with more than half of the top 100 churches counting themselves as Pushpay customers.

Source: Tradingview.com

Source: Tradingview.com

Pushpay farewells early investors

The investment vehicle associated with both Peter and Christopher Huljich — Christopher & Banks V Limited (CBVL) — agreed to sell a total of 172,877,928 shares in Pushpay to Sixth Street for $1.85 per share.

Four Innovative Aussie Small-Cap Stocks That Could Shoot Up

This represents an 11.7% premium on Pushpay’s previous close of $1.655 per share.

The Huljich family were early investors in the digital donation business and were involved in the business for the past seven years.

The Huljich family invested in the company in 2013, ahead of its 2014 listing.

Pushpay and its new cornerstone investor

Pushpay’s release described Sixth Street as a global investment firm with more than US$50 billion in assets under management and committed capital.

Founded in 2009, Sixth Street has more than 320 team members working across nine locations.

The firm’s current and past growth investments include Airbnb, AirTrunk, Spotify, PaySimple, and Paycor, among others.

Pushpay Chairman Graham Shaw commented:

‘As a highly experienced technology and growth investor with a core thematic focus on the convergence of software and payments, Sixth Street’s global scale and partnership-oriented investing approach brings considerable strength to Pushpay’s shareholder register.’

Pushpay share price outlook

An investment firm with US$50 billion in assets under management becoming your largest shareholder is a confidence booster.

Not only will Pushpay feel confident in its direction but so, too, will Pushpay investors.

No doubt that is partly why the PPH share price is up more than 8% today.

By proxy, investors may now think that the involvement of large players like Sixth Street, who tilt towards growth stocks, is a sign Pushpay has recognised growth potential in the burgeoning fintech and digital payments sector.

That said, global behemoths like Sixth Street can take large positions in stocks like Pushpay as a diversified strategy to expose itself to many potential winners.

Smaller retail investors don’t have that luxury and may monitor Pushpay’s next moves to assess its trajectory.

If you’re researching fintech stocks and wish to access extra information in pursuit of fintech investment decisions, then I’d recommend reading our free report on three innovative Aussie fintech stocks with exciting growth potential.

Download the report here.

Regards,

Lachlann Tierney,

For Money Morning

Comments