As is tradition, December is filled with predictions for the year ahead, and retrospectives of the year gone by.

It’s passé to say, but Christmas comes around more quickly each year.

Is it our attention sucking, phone-soaked landscape or simply us getting older?

The science remains split. The only agreement we have is that December seems to roll around faster each year.

It’s been an incredibly US-focused year for investors, with the AI-led NASDAQ often setting the tone in Western markets.

Much of this was probably thanks to the ‘entertainer in chief’ and his love for the limelight. But also due to the massive shakeup that tariffs brought to markets.

So, looking back on the year, what predictions did I get right for 2025?

Right and wrong

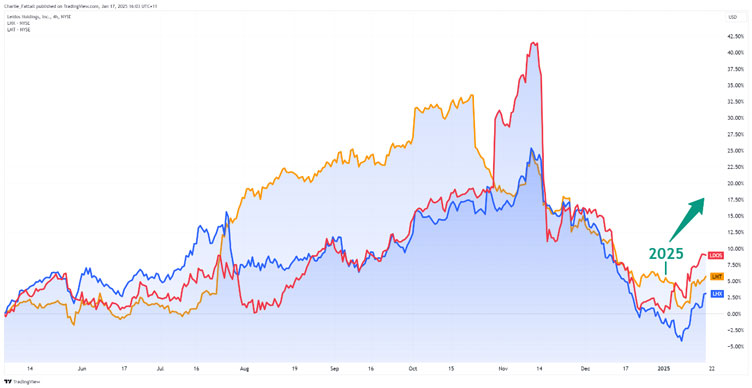

In January, I outlined potential winners in the space and defence sector, highlighting these three defence titans sitting at 52-week lows as a buy with this chart:

Source: TradingView (Jan 17, 2025)

[Click to open in a new window]

How does that chart look now?

Source: TradingView (December 2025)

[Click to open in a new window]

Two out of three with solid gains, one in the dumps.

I also had accurate predictions in ASX critical minerals (both up and down), Australian beef prices, and the most recent crypto drop, to name a few.

All up, it was a fairly prescient year.

But of course, not everything was on the button. I had some misses on the advancement of AI and OpenAI breaking up with Microsoft.

But there is one more I want to spend the rest of today on.

Back in December 2024, I wrote a piece called ‘Trump Trades are Chump Trades’, warning that investing based on expected Trump policy shifts was a dangerous game.

I specifically cautioned investors against Tesla, despite Elon Musk’s cosy relationship with Trump at the time.

The argument here was that in the face of so many other macro factors, this idea looks no better than a gamble. So how did Tesla do this year?

Source: TradingView

[Click to open in a new window]

Tesla has spent much of the year underwater but has picked up its bootstraps in the past few weeks.

While the stock is back in the green, I think it’s time to double-down on my prediction.

Tesla and the speculation gap

At the start of 2025, the prevailing narrative was simple: Elon Musk’s proximity to Trump would translate into favourable policy and easy money.

Tesla bulls pointed to deregulation, autonomous vehicle approvals, and preferential treatment as clear catalysts.

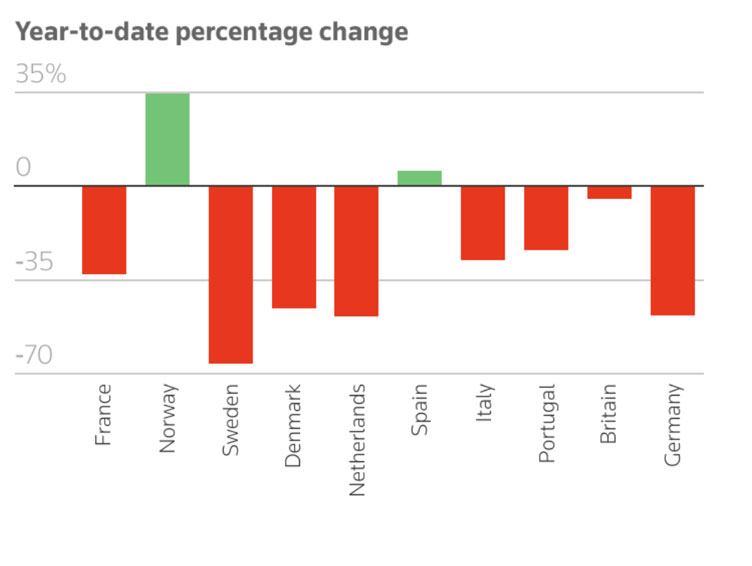

Instead, Tesla’s performance has been marred by declining revenues and margins, intense competition, and political backlash. The worst of which was seen in its European sales.

Source: Reuters

Tesla’s market share in Europe has halved since last October, now sitting at a paltry 3.1% as its older models are overtaken by a wave of newer, cheaper Chinese models.

And yet Tesla has shrugged off its poor sales and rallied in recent weeks. The stock’s resurgence has been driven by renewed speculation on robotaxis and Optimus, Tesla’s humanoid robotics division.

In other words, investors rotated from one speculative narrative to another. From political proximity to AI-adjacent technology bets.

That’s a concern when Elon and Tesla continue to promote their products dubiously.

Just take their robot Optimus. It’s the ‘Mechanical Turk’ of our times, as remote tele-workers quietly piloted their robots at all events this year.

In fact, here’s some footage from their most recent December event called The Future of Autonomy Visualised.’ The robot copies the pilot’s gesture as he removes his VR headset before things go pear-shaped.

Source: Reddit Footage, Miami Tesla Event

In my opinion, Tesla has become a symbol of blind AI optimism for retail investors.

Whether that’s their promised full self-driving (FSD) outside of their heavily tested areas or mass-scale robotics in 2026, investors should be ready for another harsh dose of reality.

The robotics thesis and the autonomous driving thesis both depend on AI systems that can act reliably in the real world. Systems that, I contend, remain delayed.

This is late-cycle behaviour. Conviction running ahead of delivery.

It doesn’t mean Tesla won’t eventually get these technologies right.

However, with a price-to-earnings ratio of 307, your upside here is contingent on this company winning the world.

In the meantime, the stock is likely to continue rising in the short term as Musk promises the moon.

Just be wary when you’re paying moon prices for earthly results.

Regards,

Charlie Ormond,

Small-Cap Systems and Altucher’s Investment Network Australia

Comments