The Plenti Group Ltd’s [ASX:PLT] share price shot up by more than 8% this morning on the back of a promising trading update.

The fintech lender quarter’s results for the quarter ending 30 September 2021 (Q2 FY22) were detailed in an ASX release today.

Judging from the positive share price action, investors are feeling encouraged.

Plenti shares have spent much of this year to date tracking a somewhat turbulent uptrend.

At time of writing, Plenti was up 5.80% and changing hands for $1.46 a share.

Today, we’ll go over Plenti’s update and reveal our outlook for the company’s share price in the coming weeks and months…

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Strong growth numbers for Q2 FY22

Plenti’s update revealed several key highlights.

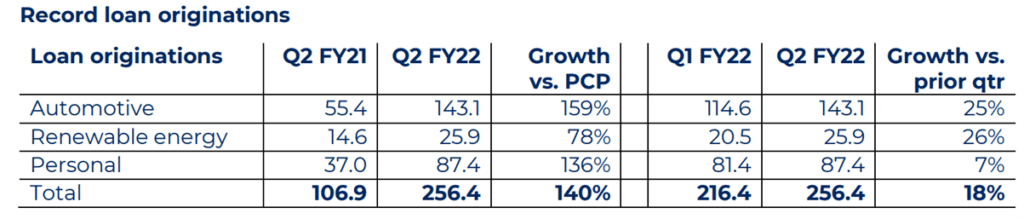

The biggest was record quarterly loan originations of $256.4 million.

That’s a 140% increase from the same quarter last financial year and a 18% increase on the prior quarter.

Record monthly loan originations of $95.5 million were posted for the month of September, which is 159% above September 2020’s figure, a record month at the time.

Plenti’s half-year (H1 FY22) loan originations leapt to $473 million. This marked a 183% gain on the previous corresponding period and 56% above the prior half.

Plenti’s CEO Daniel Foggo commented:

‘I am delighted to report yet another outstanding quarter for Plenti, with record quarterly loan originations across each lending vertical. By continuing to take market share, Plenti has achieved strong growth despite COVID-induced lockdowns.

‘This strong growth along with the high level of operational leverage from our technology-led business model has accelerated our targeted timeframes for achieving a one-billion-dollar loan book and reaching Cash NPAT profitability, now targeted by end December 2021.’

What’s next for the Plenti share price?

Plenti has brought forward the timing for achieving two of its major priorities originally revealed in its FY21 presentation:

- Growth — in particular, a $1 billion loan portfolio by the end of this year (previously it was supposed to be achieved by March 2022).

If Plenti can deliver on its goals, the share price could more buying pressure in the months ahead.

In any case, all the signs of compelling momentum are there. Not only in this company alone but also in the fintech industry Plenti is part of.

But while fintech is a high-potential space right now, it may be hard to wrap your mind around all the fresh start-ups seeking to disrupt established players.

That’s why I think it may be helpful to read Money Morning’s latest report on three fintech stocks with exciting potential.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here