Australia is called the lucky country and for good reason…

The last mining boom was fuelled by enormous demand for iron, and it was Australia’s high-grade ore that commanded a premium over competitors.

I’m sure you’re well aware that the Pilbara gifted our country enormous wealth over those boom years.

With up to 75% iron content, these rocks were said to be of such a high grade that boil makers welded rocks to their steel-cap boots!

China had an insatiable appetite for our Pilbara ore.

As we knock on the door to the next mining boom, Australia sits in an enviable position (yet again).

But this time round, our competitive advantage will look much different.

China will still be an important part of the story but perhaps not in the way you would think.

I’ll have more to say on that further in the piece.

But first…

A fundamental shift in Australian mining

It’s been a long time coming but Australian producers are finally value-adding their product by selling refined metal to the market directly, not raw ore, which was the default approach of the past.

Emerging operators are now regularly designing downstream processing facilities into their feasibility plans. It allows companies to reap a greater share of the gains from the product they extract.

But this change in strategy is not just about company profits.

In September 2021, the federal government announced a $2 billion funding commitment to drive growth in Australia’s efforts to produce critical metals.

While it’s a decent chunk of cash, there’s a deep back story to this announcement that plays into the looming crisis in critical metal supplies.

In March 2022, the government released key details behind its push to drive Australia’s role in meeting the world’s demand for critical metals.

You can read the specific details published by the Department of Industry, Science and Resources here.

But the essence of the report is this: the Australian Government has been put on notice, as the world needs an alternative supply of critical metals.

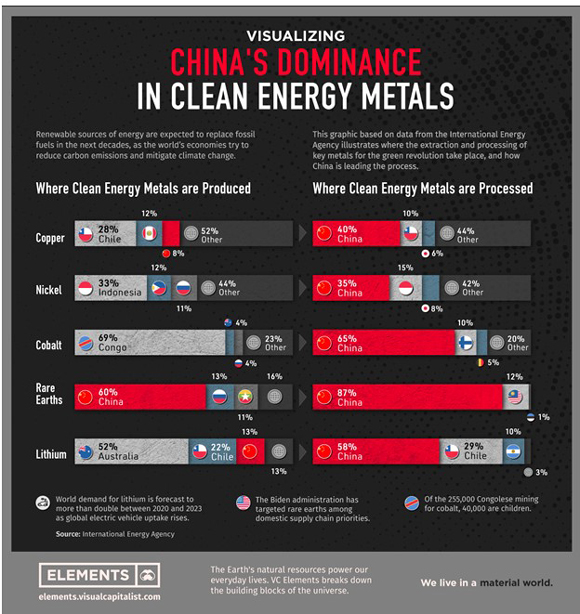

Right now, China dominates extraction and processing of several critical metals including lithium, rare earth elements, and cobalt, plus a whole host of lesser known but vitally important minerals.

The latest USGS’s ‘Mineral Commodity Summaries’ report also adds weight to the global outlook, it found China as the dominant supplier for no less than 16 critical minerals. In addition to being a ‘major’ producer for an additional 20 critical minerals.

Unease is brewing throughout the developed world.

Non-Chinese manufacturing of EVs, solar panels, iPhones, smart TVs, laptops, and defence technology will come to a standstill should China decide to ramp up its pressure against Western powers.

The very threat of cutting off supplies will send shivers down the spine of major manufacturers.

So, what’s the contingency plan for the US or Europe?

Nothing.

China has played a smart long-term move

The West may have an enormous price to pay as it recoils from its blindsided stupidity in ignoring early warning signs.

Toward the end of the last mining boom, the global economy overlooked the importance of raw materials. For a decade now, major manufacturing companies in the US and Europe have taken the steady supply of raw materials for granted.

Meanwhile, as resource companies collapsed during the depths of the last commodity downturn, China stepped in and purchased major deposits for pennies on the dollar.

The downturn gifted China an enormous opportunity to dominate world supplies of critical metals.

Critical metals are China’s greatest weapon in bringing the West to its knees

As a reflection of the growing anxiety, US Republican Congressman Ken Calvert recently communicated his fears by stating:

‘Reliable access to critical minerals is essential to America’s economic and national security, America must be clear-eyed about the Chinese and Russian aggression when it comes to consolidating critical mineral resources.’

While China, and to a lesser degree, Russia, hold the vast supply of critical metals, they have amplified its dominance by securing additional mines in emerging countries such as the Democratic Republic of the Congo (DRC). This war-torn country accounts for approximately 70% of global cobalt, a critical metal used in computer and smartphone devices.

China has bolstered its global dominance while also ensuring the ore processing takes place safely within its borders.

Again, the West has been utterly blindsided and benign on the issue of Chinese dominance throughout the resource rich emerging economies.

Against a backdrop of growing geopolitical tension, it’s no wonder leaders of advanced manufacturing economies are finally scrambling for a reliable alternative. Just take a look at the graphic below, which neatly demonstrates China’s dominance in supplying the world with ‘clean energy metals’:

|

|

| Source: Visual Capitalist |

Tension is brewing and shots are already being fired.

In 2020, China threatened a rare earth embargo against US defence contractor Lockheed Martin as the contractor upgraded Taiwan’s Patriot air defence missiles.

But it was an Australian company that benefited from this political stoush.

Lockheed Martin struck a deal between the US Department of Defense and an Australian producer to construct a rare earth separation facility in Texas.

The Australian company involved was Lynas Rare Earths [ASX:LYC].

And it’s not the only time Lynas benefited from geopolitical tensions with China.

A little over two weeks ago a Tokyo-based company called Sojitz, Japan’s largest metal dealer, signed a $250 million procurement deal with Lynas.

According to Sojitz, China now produces 95% of the world’s rare earths. After the deal was signed, it left a stark warning to global manufacturers:

‘[T]he outlook for stable shipments from the Chinese mainland remain far from certain.’

The comments were made on the back of a Beijing blockade on Japan-bound shipments of the rare earth elements after a dispute over islands controlled by Japan but claimed by China.

This was a stern warning to the world that China was prepared to weaponise its dominance of critical metals.

But there is a silver lining to all of this, and it sits in our very own backyard…

While Australia, alone, won’t be able to meet the enormous supply of critical metals for the future, a handful of local late-stage explorers are set to shift into production just as the issue reaches a tipping point within the next two years.

Companies extracting and processing critical metals outside Chinese borders will have an extremely valuable card to play.

Safe secure supplies will come at a premium.

A massive payout for Australian producers looks imminent on the back of growing tensions.

However, for major manufacturers, the situation will be grim. A matter of life or death.

Tesla, Apple, Toyota, BMW, Hyundai, etc. will put everything on the table as they compete for the raw materials needed to keep their manufacturing plants running.

The question then remains, how much will they pay?

Stay tuned for next week as we uncover the third part of our special series on critical metals.

Regards,

|

|

James Cooper,

Editor, The Daily Reckoning Australia