The Okapi Resources Ltd [ASX:OKR] has acquired 100% of the past-producing Sunnyside Uranium Mine in Utah, US.

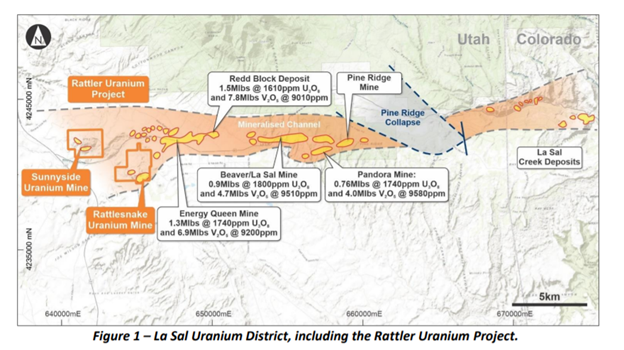

The acquisition complements Okapi’s adjacent Rattler Uranium Project, with the geological setting in both areas being identical to that at Energy Fuels’ La Sal Project.

Okapi Resources Ltd [ASX:OKR] shares, however, are having a difficult time right now, down 4.1% to 70 cents a share.

Despite the slump today, OKR shares have gained 240% over the last 12 months.

OKR acquires Sunnyside Uranium Mine

Okapi acquired a 100% interest in the historical mine by staking mining claims that cover 960 acres adjacent to Okapi’s existing Rattler Uranium Project in Utah, US.

The Sunnyside Uranium Mine consists of various small past-producing pits where uranium was mined in the early 1900s at grades reported to have been 1,500 ppm U3O8 and 1.5% V2O5.

This acquisition complements OKR’s existing Rattler Uranium Project, which happens to be contiguous with Energy Fuels’ La Sal Project.

The La Sal Project is fully permitted for mining and operated from 2006–12.

The acquisition of Sunnyside Uranium Mine increases Okapi’s total landholding in Utah by 90%, jumping from almost 1,020 acres to a total of 1,960 acres.

OKR’s extended project area in the La Sal Uranium District now comprises 98 Bureau of Land Management (BLM) unpatented federal mining claims.

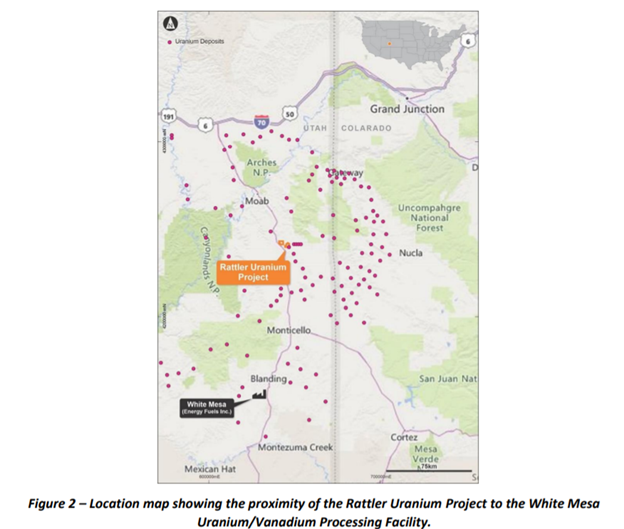

This is located about 85km north of Energy Fuels’ White Mesa Uranium/Vanadium mill in Utah — the only operating conventional uranium mill in the US.

The new claims are located immediately along strike from Okapi’s Rattler Uranium Project, including the historical Rattlesnake Open Pit Mine, discovered around 1948 and was in production until about 1954.

Historic production from the Rattlesnake Open Pit Mine reportedly totaled 3285,000 tonnes of ore at 2,800ppm U3O8 and 1.0% V2O5 for 1.6 million pounds of U3O8 and 4.5 million pounds of V2O5.

OKR share price outlook

Okapi Resources Executive Director David Nour commented:

‘The acquisition of a 100% interest in the past-producing, high-grade Sunnyside Uranium Mine demonstrates the deep in-country knowledge and expertise of Okapi’s team.

‘This acquisition represents yet another highly value-accretive acquisition for Okapi shareholders.

‘The team remains focused on executing its strategy as it becomes a new leader in North American carbon-free nuclear energy.’

Okapi said it seeks to become a ‘new leader in North American carbon-free nuclear energy by assembling a portfolio of high-quality uranium assets through accretive acquisitions and exploration.’

The timing of today’s announcement comes amid a resurgence of uranium.

Ben Cleary, portfolio manager of Tribeca’s global natural resources fund, said this year has been a ‘watershed year for uranium as a baseload power for the green economy and a decarbonising world.’

Now, if you are interested in companies at the forefront of the green economy, then I suggest checking out this report by our market analyst, Murray Dawes.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here