Here’s three things I’m thinking about today…

1. Imagine signing off on an expected expense of nearly $12 billion.

That’s sure more than a long lunch with a cheeky dessert. But that’s what management at Woodside Energy (WDS) just did.

It’s a big move – and a big statement.

What’s the story?

Woodside is going to build a massive US LNG export facility in the Southern state of Louisiana. You know…the one on the “Gulf of America”.

The project is due to be in production in 2029.

Woodside CEO Meg O’Neill says:

“The project benefits from access to abundant low-cost gas resources in the United States and boasts an asset lifespan of more than 40 years. It also has access to well-established interstate and intrastate gas supply networks.”

We can also add WDS is moving in the slipstream of Trump’s presidency.

He wants the world to buy more American products. US natural gas fits the bill for a lot of countries, like Japan, South Korea and even Europe. There’s no doubt about it.

The US is blessed with astonishing energy resources.

The tricky part for Woodside – or any producer in this situation – is they’re dancing with so many variables.

Nobody knows what US and/or world gas prices will be in 2029 and the 7 years after.

That’s Woodside’s project timeline to get its money back before the project becomes profitable for shareholders

That said, this latest move is perfectly in accord with what my colleague Jim Rickard’s is talking about in his latest presentation. Make sure you tune in to see the changes Trump is driving through the American economy like this.

We can also ask…

2. How is the US gas price looking right now?

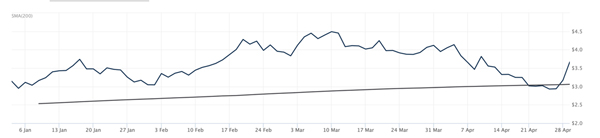

It’s bouncing after the tariff induced sell down in early April, like copper, which you can see here…

US natural gas price

|

Source: Wall Street Journal |

One thing to note here is that the fracking boom from 2014 onwards sent the US natural gas price VERY low through the last decade, under US$2.

It was an extraordinary boon for US industry and consumer. The gas was a side product, mostly, for the oil frackers. But they did so much drilling the gas just kept coming.

Trump might like to wank on about how good he is for the US economy, but he had two massive tailwinds at his back during his first Presidency: cheap energy and the Wall Street tech boom. He had nothing to do with either. His timing was impeccable – I’ll give him that.

That brings us to today…

Here’s a little glitch in the Trump gameplan to turn US energy into a further export powerhouse.

Trump is exporting it AWAY from American users, possibly in the same, arguably dumb, way we do here in Australia.

Instead of using our natural competitive advantage in gas to feed Australian industry, we sell to Asia instead. That brings in export dollars and revenue. But it drives up domestic prices.

This is another reason Trump’s desire to “win” the trade war is not so clear cut.

US natural gas exports might go up, but so do American domestic costs, especially if the US natural gas price keeps drifting higher.

That brings the US oil price into play. Trump says he wants to “drill, baby, drill”. But US oil firms do need an incentive to spend the big dollars to make it happen.

US oil at US$60 per barrel is not a particularly juicy price.

If the current economic uncertainty and Trump’s tariffs drive a global slowdown, there’s no reason to think oil prices are going higher anytime soon, absent some explosive move out of the Middle East. It might even crumble under US$50.

That’s a win for consumers. But the frackers are gonna give a ‘frack you’ to Trump at that price. No “drill, baby, drill” in that scenario.

Trump’s two stated goals: low “gas” (petrol) prices and a booming oil industry don’t square up. You get one or the other.

Plus…

3. Then there’s that thing called AI.

Lost momentarily in the tariff swirl is the unrelenting demand for power from the growth of artificial intelligence.

This is where the Woodside move might turn out to be a turkey.

If more industry is going to the USA to appease Trump, and AI’s exponential growth continues, it could drive US natural gas prices much higher. This would weaken the American consumer and other, unrelated industries.

The gameplan here for energy producers would be to sell INTO the American market. Woodside is doing the opposite. It’s presuming US natural gas prices stay cheap and the world market higher.

Hmm. Your guess is as good as mine as to how this all plays out. But energy is a big space to watch as the world keeps turning.

Regards,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Murray’s Chart of the Day

– Uranium ETF

|

Source: Tradingview |

There are signs of life in uranium stocks, with the Betashares Global Uranium ETF [ASX:URNM], confirming a weekly buy pivot from a major buy zone last week.

Trump has said he will exempt yellow cake from tariffs, which may have sparked some buying, but the uranium spot price has been slowly turning up recently after a year of steady selling pressure.

The blackout in Spain could also see a return of interest in the uranium sector as people question the stability of a grid that relies on renewables.

Many uranium stocks have a high level of short interest which may be starting to cover and some of the smaller uranium stocks are jumping sharply from oversold levels.

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Comments